Australian Dollar's Chinese Slowdown Adds to Domestic Covid Headwinds

- Written by: Gary Howes

Image © Adobe Images

- GBP/AUD reference rates at publication:

- Spot: 1.8868

- Bank transfer rates (indicative guide): 1.8208-1.8340

- Money transfer specialist rates (indicative): 1.8698-1.8736

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Australian Dollar is said to be one of the most vulnerable of the world's major currencies to a Covid-driven slowdown in Chinese economic growth, a development that comes as the country remains locked in its own protracted battle with the virus.

A slowdown in China's economic expansion is amongst a number of concerns pinging on investors' radars as we move through the third quarter, given authorities have started imposing fresh restrictions on movement in a number of economically significant regions owing to the spread of the Delta variant.

China reported 143 new cases of COVID-19 on the mainland for August 09, up from 125 cases a day earlier, the health authority said on Tuesday.

This is the highest number of cases reported since January 20 and officials say the outbreak is driven by the highly transmissible Delta variant.

China has reimposed travel controls as it tries to stop the outbreaks and data from aviation specialist OAG showed domestic travel to be taking a hit, with seat capacity plunging 32% in one week.

Investor sentiment toward Chinese stocks had already suffered after authorities cracked down on sectors including technology and after-school tutoring.

"There’s no doubt that Australia and New Zealand will be the G10 countries most hurt if China's growth does slow. Those two are extremely dependent on China for their export markets," says Marshall Gittler, Head of Investment Research at BDSwiss Holding Ltd.

"With restrictions in China beginning to bite into activity there, people are worried about the impact on global growth. Several brokerage firms have downgraded their estimates for China growth recently," says Gittler.

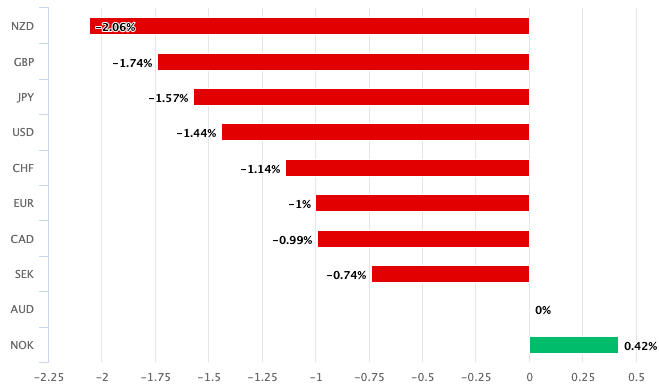

Above: AUD performance over the course of the past month.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Australian Dollar has been one of the laggards of the G10 foreign exchange space over the course of the past month, with analysts blaming the closure of much of the country's economy in an attempt to stem the spread of Covid-19.

But the Australian Dollar is heavily influenced by external factors too, particularly global growth trends associated with the Chinese economy.

"In Asia, the growth downgrades for China in 2H are coming thick and fast as the Delta variant surge and government measures to curb the spread of the virus sap economic optimism," says Kenneth Broux, Senior European Economist at Societe Generale Corporate & Investment Banking.

Australia reported a record trade surplus with China in May, driven by higher iron ore export receipts, confirming the centrality of China's economy to Australia's

foreign exchange earnings.

China accounted for 39% of Australia's total exports of A$42.23bn ($32.77bn) in May, well above Australia's second-largest trading partner Japan that accounted for almost 10%, according to trade data from the Australian Bureau of Statistics.

Any slowdown in China's economic growth would therefore potentially impact demand for Australian exports, diminishing the country's foreign exchange earnings.

"At this stage the downgrades to Chinese growth haven’t been game changing, with our own YoY house forecast coming down to 8.9% from 9.1%, but it certainly feels like a story worth keeping an eye on," says a trader on JP Morgan's currency trading desk in London.

"I have to think that’s at least partially at play in the antipodean underperformance," said the trader in a regular daily note.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Australia meanwhile continues to fight an outbreak of the Delta variant in its two most populous states of New South Wales and Victoria.

New South Wales recorded 356 new cases on Tuesday, up from 283 the day prior, making for the highest count recorded since the start of the Delta Variant wave in June.

Victoria recorded only 20 new cases and it is possible authorities could soon announce the ending of lockdown restrictions, although consumer confidence has been impacted by the State's habit of lifting restrictions to only reimpose them days later.

The Australian Dollar rose sharply against its key rivals last week after the Reserve Bank of Australia (RBA) chose to ignore lockdown measures and continue with a decision to withdraw monetary support to the economy.

The RBA said it would continue to purchase government bonds at the rate of A$5BN a week until early September and then A$4BN a week until at least mid November

The decision to taper quantitative easing in this manner means the RBA is actually reducing the monetary support it offers to the economy, betting that ultimately the lockdowns and resultant economic impact will prove insignificant over a medium-term horizon.

However, those gains experienced by the Australian Dollar in the wake of the RBA decision have proved fleeting, confirming the market is uncomfortable with the domestic Covid situation as well as China's own slowing growth.