The Australian Dollar: Iron Ore Price Rally Can't Save it from Further Losses says Westpac

- Written by: James Skinner

© Taras Vyshnya, Adobe Stock

- AUD claims 2nd place in G10 Tuesday after iron ore rises near-5%.

- Commodities support AUD but further losses in pipeline - Westpac.

- RBA to cut rates three times in 2019 as economy falters - Westpac.

The Australian Dollar was buoyant Tuesday after falling stockpiles at Chinese ports drove iron ore prices up almost five percent but analysts at Westpac have cut their forecasts for the Antipodean currency and now project further losses before the year is out.

Prices of iron ore futures traded in China were reported to have risen by 4.2% during the Tuesday session, taking the steel-maker's raw material up to $108 per tonne, which means prices are now up 15% for the month of May.

This helped lift the Aussie close to the top of the G10 league table Tuesday. Iron ore is Australia's largest exports so when prices rise they have a positive impact on the 'fundamental value' of the currency. Resilient iron ore prices are one of the few offsets to an otherwise dire outlook for the Australian Dollar.

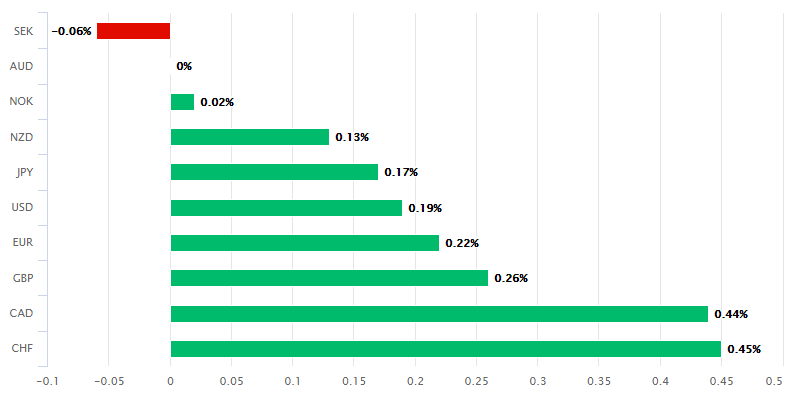

Above: Australian Dollar performance Vs G10 rivals Tuesday.

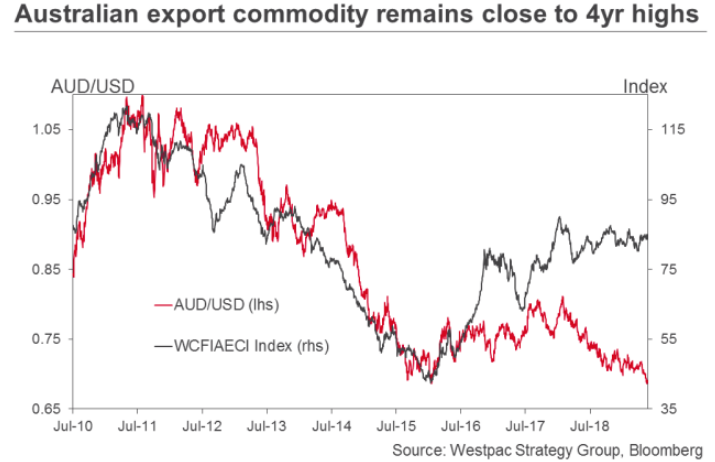

"The potent combination of Vale's mine disaster in Brazil in February and the impact of TC Veronica in March depleted iron ore port inventory in China to 18-month lows. Ongoing weaker shipments from Brazil and the record pace of steel production in China will continue this process through much of this year and we are now forecasting iron ore to finish the year at US$90/t," says Robert Rennie, head of research at Westpac.

China, the world's largest consumer of iron ore, is running down its stockpiles fast at a time when mine closures and dam-decommissioning in Brazil are disrupting supplies on the seaborne market.

This could mean support from commodity prices will help the Australian Dollar get through what otherwise might have been a testing few weeks up ahead of it. However, the Westpac team still forecasts further losses before the year is out.

Above: Westpac graph showing Australian export commodity prices alongside AUD/USD rate.

Housing market figures due out this week could see investors focus again on risks to the domestic economy, while the Reserve Bank of Australia (RBA) is already expected to cut its interest rate in June.

Wednesday's home sales data for April will be important given ongoing declines in home prices and policymaker fears over the damage this could do to consumer confidence, spending and the economy. Thursday's building approvals data will be watched for signs of a rebound in construction activity. After a sharp double-digit decline in March, investors might be alarmed if approvals plummet again in April.

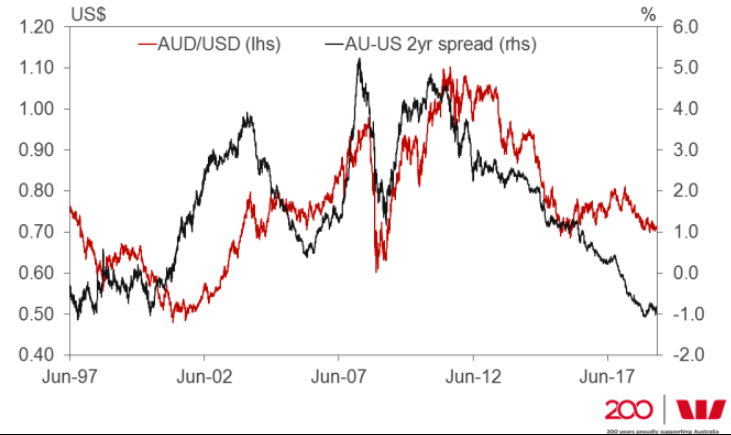

"The A$ should arguably be trading lower than current levels; and if Westpac's forecasts are correct and the RBA does cut 3 times with no change from the Fed, then the 2yr swap spread below could be trading in the -130/-140bps which would be the least supportive for 2yr swap differentials back to mid-1980s taking us into truly uncharted territory for the A$," warns Westpac's Rennie.

Above: Westpac graph showing AU-U.S. interest rate differential alongside AUD/USD rate.

Without support from commodity prices, the housing figures as well as June's RBA decision could easily create the conditions necessary for fresh Australian Dollar losses as they might stoke fears about the outlook for interest rates.

The RBA is already expected to cut its interest rate twice in 2019 but some local analysts are now of the view that the RBA could be forced to go further this year than the already-pessimistic financial markets give it credit for.

Westpac team told clients last week they now anticipate a total of three interest rate cuts from the bank inside of 2019, up from two cuts just a fortnight ago, which has led them to slash their projections for the Australian Dollar.

"Yield differentials are clearly headed in one direction - lower - thus further removing interest rate support for the traditional carry driven Australian dollar. However, a number of idiosyncratic factors are clearly at work in steel-related bulk commodity markets driving prices sharply higher making Australian assets more attractive to global investors and supporting the externally facing sectors of the Australian economy," Rennie says. "On top of this, risk aversion is rising as the US and China challenge each other on trade."

Above: Pound-to-Australian-Dollar rate shown at weekly intervals.

Westpac now forecasts that Australian unemployment will rise from 5.2% in April to 5.4% before year-end, forcing the Reserve Bank of Australia to cut rates more aggressively than the market currently anticipates. The RBA said in February a sustained increase in joblessness would trigger rate cuts and since then, the unemployment rate has risen from 4.9% to 5.2%.

Rennie and the team at Westpac, one of Australia's four largest banks, also forecast GDP growth will fall from 2.3% in 2018 to 2.2% this year rather than picking up as the RBA still projects that it will. The housing market is also set to remain a threat to growth.

All of these projections mean the RBA is even less likely to see the consumer price index rise to within the 2%-to-3% target band this year and there is only one orthodox policy prescription for that, which is interest rate cuts.

Interest rate decisions are normally made in relation to the inflation outlook but impact currencies through the push and pull influence they have over international capital flows. Rising rates normally draw bids for currencies while declining rates drive flows away from them.

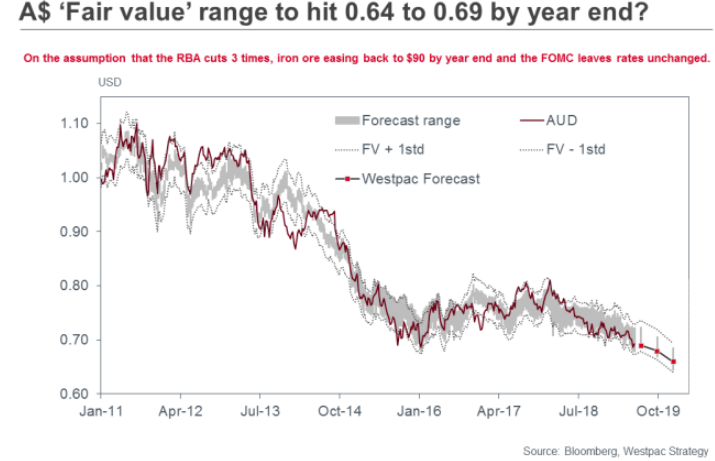

"If we assume that Westpac's forecasts are correct, that the RBA does cut three times by year-end, that iron ore eases back to $90 by the end of the year and the Fed leaves rates unchanged, then we arrive at a fair value range of 0.64 to 0.69 by year-end with a midpoint of 0.6650, pretty much spot on to our year end forecast," Rennie projects.

Above: AUD/USD rate alongside Westpac forecast of 'fair value' range for AUD/USD rate.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement