South African Rand Liable to Push Sterling Lower this Week

Image © Comugnero Silvana, Adobe Stock

- GBP/ZAR in short-term down-trend which could extend

- Major support from large MAs is preventing an extension lower

- The main even for on the economic calendar for the pair is the Bank of England meeting on Thursday

GBP/ZAR is in a downtrend on the longer-term charts although medium-term it is in a sideways range with no strong directional bias.

if volatility emerges this week it is likely to come from the Pound as there are no major releases for the Rand, whereas Sterling has a 'Super Thursday' when the Bank of England is set to meet and raise interest rates.

Higher interest rates would be positive for the Pound as they attract greater inflows of capital from foreign investors seeking higher returns.

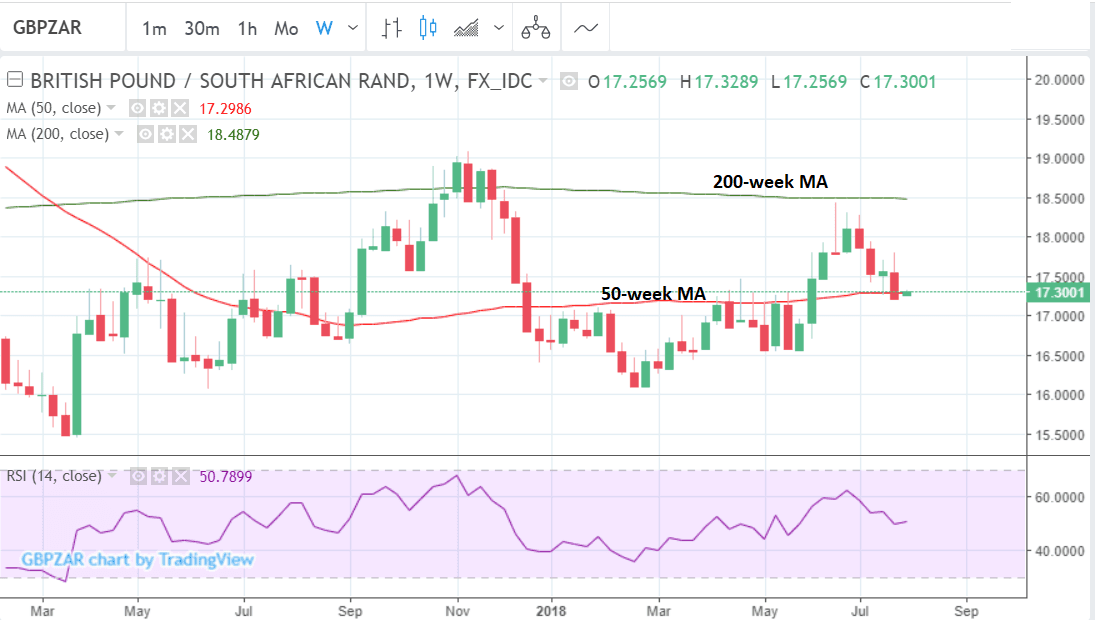

The medium-term chart below shows GBP/ZAR falling and touching the 50-week moving average (MA), which is likely to act as an obstacle to further downside.

The exchange rate may stall in the middle of its downtrend and possibly even start rising from this point. There is a higher chance of a reversal from the level of the 50-week MA.

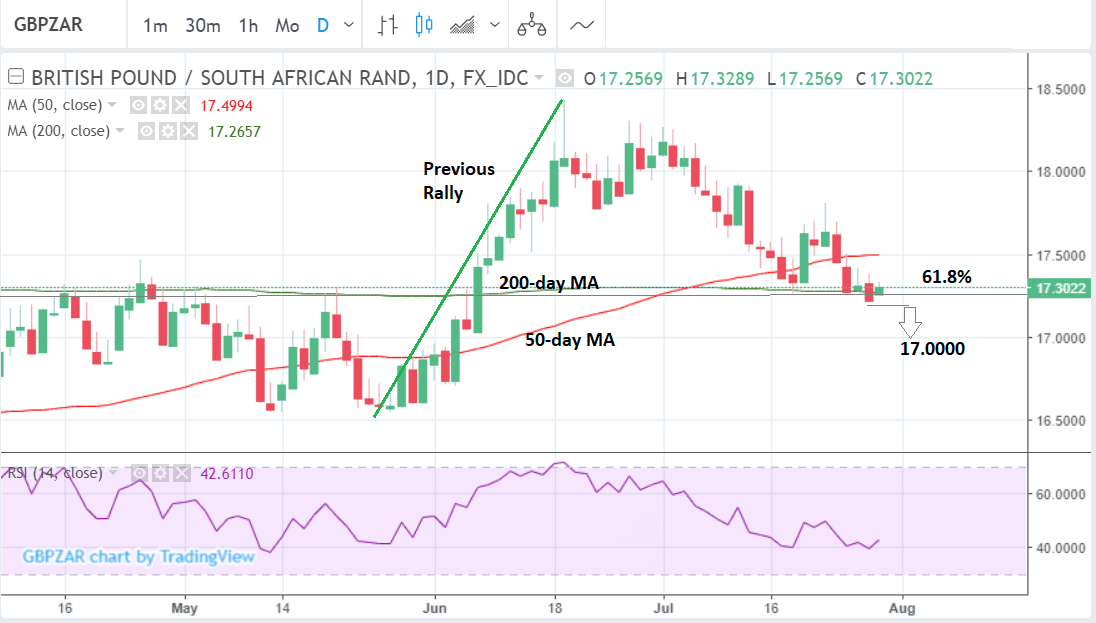

The daily chart is marginally more bearish, as it is showing the pair attempting to break below the 200-day MA and the 61.8% retracement of the previous rally. These are two formidable levels which prices will find it difficult to break below and there is an increased chance of a reversal higher happening here.

Nevertheless, the trend remains down and likely to extend. A clear break below the support levels will probably see an bearish extension to the next target at the major round-number 17.0000.

A break below the 17.2000, for example, would confirm such a move.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The South African Rand this Week

In the absence of any market-moving hard data on the economic calendar for South Africa (SA), the Rand is likely to take its cue from news regarding President Cyril Ramaphosa's drive to attract more credit to South African shores.

Recently the Rand rose after he persuaded China to invest $14.7bn and Saudi Arabia and the UAE $10bn each in the South African economy.

These gains have seen interest in SA's bonds surge as investors see them as a good high risk play given SA has a credit rating a notch above junk but a risk premium equal to other high-yield earners such as Brazil and turkey which are now sub-investment grade.

The Rand is also likely to be impacted by Dollar fundamentals since the currency is highly negatively correlated to the US Dollar.

One major event for the US Dollar is the meeting of the Federal Reserve (Fed) on Wednesday at 19.00 B.S.T, although, no-change in policy is expected and a muted reaction from USD.

Expectations for a September meeting hike are high, however, so analysts and traders will be parsing comments regarding that - or the December hike.

A September hike is expected with a 90% certainty and a December hike with 70% at the moment but Wednesday's meeting could change that.

"On the central-bank front, the FOMC meeting on 1 August will be probably a non-event for the USD, although being the first since President Trump criticised the Fed’s tightening strategy. Rates are expected to remain unchanged this time with no major deviation in the statement from the bank’s recent rhetoric in favour of continued gradual tightening," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.

The other big event for the US Dollar is the release of Non-Farm Paryrolls at 13.30 B.S.T. on Friday.

Despite record high employment in the US, Non-Farm payrolls still has the power to move markets - although now more due to the average earnings component than the headline jobs figure.

A rise in average earnings would provide a sign of real growth in the US's consumer led economy and could keep interest rate expectations on the up, further boosting the Dollar.

Economists are forecasting wages to rise by 0.3% in July from 0.2% in June and to show an unchanged 2.7% rise compared to July last year.

Non-Farm Payrolls, meanwhile, is forecast to come out at 195k from 213k previously - anything around the 200k is very good considering the pool of labour is shrinking all the time.

Another highlight of the coming week for the Dollar is Personal Consumption Expenditure (PCE), on Tuesday at 12.30.

PCE is the favoured gauge of inflation for the Fed, and since interest rates are a major driver of the Dollar, a higher inflation rate tends to drive up the currency.

Current market expectations are for a 0.1% rise in PCE in June compared to May and 2.0% for Core PCE, compared to June last year. Any rise above the expected might well send the Dollar higher.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here