Rand Tipped to Go Higher as Banks Eye Inflation-busting South African Government Bond Yields

- Written by: James Skinner

Image © Adobe Images

- ZAR wins emerging market race higher says Bank of America.

- Adds, "real yields" in South Africa are the highest since 2011.

- Even SARB rate cuts seen having little effect on "real" yields.

- Credit Suisse goes looking for more upside, sells USD/ZAR.

The Rand could benefit disproportionately from a continued rally in emerging market because "real yields" on government bonds are at their highest in years, according to analysts at Bank of America, who're eyeing South Africa's inflation-busting returns while Credit Suisse is tipping the currency as a buy.

South Africa's has demolished a number of 'resistance' levels on the charts in the last six weeks as investors have become more convinced the Federal Reserve (Fed) will begin cutting its interest rate this month, which has seen international capital abandon the Dollar and flood toward emerging markets.

Many are betting the U.S. Fed Funds rate will be cut from 2.5% to 1.75% by early 2020, which is partly why the market is sanguine about the idea of the South African Reserve Bank (SARB) also reducing its cash rate Thursday.

The SARB is widely expected to cut its interest rate from 6.75% to 6.5% on Thursday and to reduce it further to 6.25% in September as part of an effort to support the economy after GDP growth contracted sharply in the first-quarter.

"We are pencilling in a 25bp cut in July, followed by two cuts in Sep-19 and Jan-20. This suggests a total of 75bp cuts by January. The global backdrop helps EM risk and FX. The market is pricing about 50bp easing in the fed funds rate over the next two meetings, which should offer comfort to the SARB," says Ferhan Salman at Bank of America.

Above: USD/ZAR rate at 4-hour intervals alongside Pound-to-Rand rate (orange line, left axis).

Normally a reduction in interest rates would reduce the attractiveness of South African financial assets to investors, leading to outflows from the country and pressure on the Rand but the currency has put in a strong performance in the multi-week run-up to Thursday's decision.

One possible reason for this apparent immunity from is that inflation in 2019 has returned toward the lower end of its range since 2012, which is boosting the 'real' value of already-high bond yields that are further enhanced by the recent strength in the Rand.

The stronger Rand has improved the value of South African returns when measured in foreign currency and with many analysts anticipating that the U.S. Dollar will soon suffer sweeping declines as the Fed ends its four-year rate-hiking cycle, that trend toward improving value could continue for a while yet.

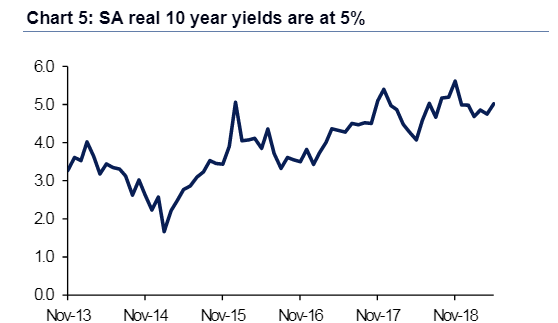

"Real 10-year yields based on core inflation are 5%, the highest since 2011 and substantially higher than at many of the major EM peers," Salman says. "The trade truce and beginning of the Fed easing cycle should help EM FX and hence the South African rand...The current ZAR rally should also offer some relief to the SARB."

Salman and the Bank of America team have tipped an ongoing positive performance for the Rand in the short-term but are looking for the USD/ZAR rate to recover some lost ground before year-end, closing 2019 at 14.2. Although they also forecast a return back down to 13.9 by the end of 2020.

Above: Bank of America graph showing real yield of South African government bond.

Bank of America is not alone in its bullish outlook for the Rand as Credit Suisse also tipped the currency for more gains this week. The Swiss banking giant upgraded its short-term targets for the Rand this week and advocated "fading spikes" in the USD/ZAR rate, which means buying dips in the Rand.

"Given that markets are pricing for a cut of 18bps-20bps, a 25bps rate cut should have little impact on South African assets. We are biased in favor of fading spikes in USDZAR which could be triggered if a surprising 50bps rate cut is delivered," says Nimrod Mevorach at Credit Suisse, referring to the SARB.

Mevorach is unfazed by the prospect of even a large 50 basis point cut to the SARB's cash rate on Thursday. He says the SARB would be very unlikely to cut rates aggressively after that and notes the Fed is also expected slash its own rate by a similar amount in the coming months.

"We now find it likely that USDZAR will drop to the 13.50-13.55 area in case the broader bid for the dollar remains subdued. In such an environment the underlying downside pressures on USDZAR will likely persist, assuming that South Africa does not deliver adverse news locally.," Mevorach writes, in a note to clients. "We think it makes sense to fade spikes in USDZAR as long as this picture does not change materially."

Above: USD/ZAR rate shown at daily intervals.

It's not only expectations around interest rates that have helped the Rand in recent weeks because domestic news-flow has also been positive. Last Thursday saw speculation of an imminent easing in funding pressures for state power utility Eskom lift the currency.

Public Investment Corporation, South Africa's government pension fund and Eskom's largest bondholder, was said to be mulling over a debt-for-equity swap that would improve the condition of the ailing utility's balance sheet and reduce risks to the nation's top credit rating in the process.

Eskom is threatening South Africa's crucial 'investment grade' credit rating assigned by Moody's because the taxpayer is on the hook for R350bn of its debt that is guaranteed by the government. The cash-strapped utility is at risk of failing after years of mismanagement and underinvestment in its asset base.

South Africa's government is under pressure from Moody's to reduce both its budget deficit as well as national debt pile, or face losing its 'investment grade' credit rating. Losing the Moody's rating would mean many international investors, particular those that benchmark to the Citi World Government Bond index, are automatically forced into selling their government bonds. This would risk driving the Rand into the ground as investors seek to swap capital back into their domestic currencies.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement