Pound Uptrend vs. South African Rand Tipped to Extend by the Charts

Image © kasto, Adobe Stock

- Ascending channel continues to provide bullish bias

- Break above highs to confirm continuation

- Q4 GDP data main release for Rand this week

Technical studies suggest the Pound remains favoured over the South African Rand, but expect volatility to be provided by the release of South African GDP data and a decision on Eskon tariffs. The Pound-to-South African Rand exchange rate is trading at 18.85 at the start of the new week, over 2.86% higher than the week before. The Pound's 2019 gain now stands at 2.3%.

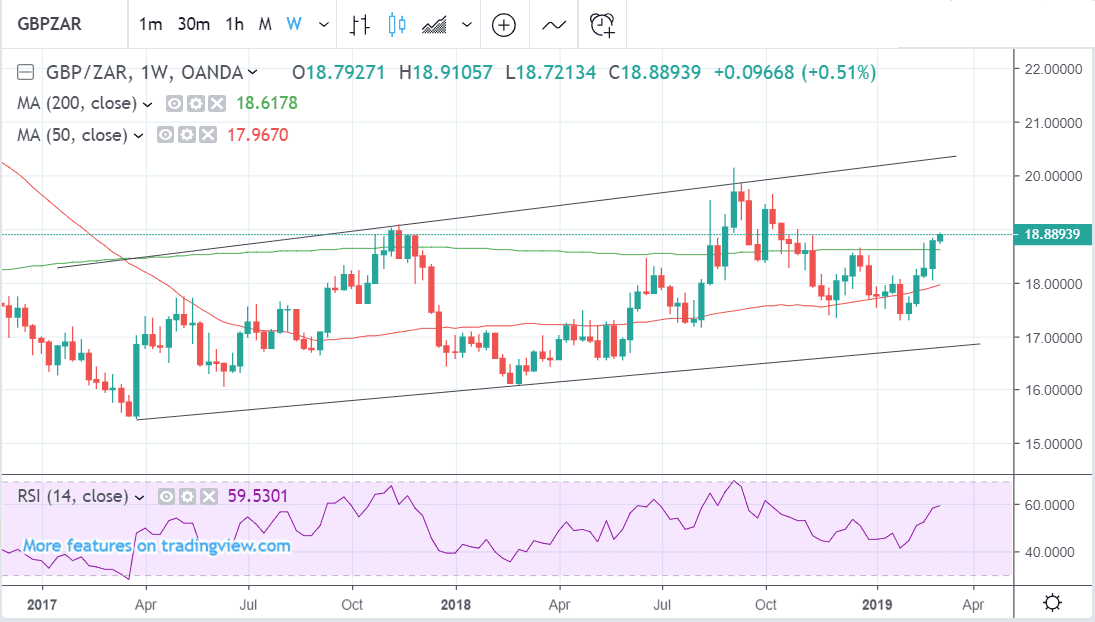

From a technical perspective, the short-term uptrend is tipped to extend as the pair is seen to be dictated by a gently ascending channel which began rising from the early 2017 lows.

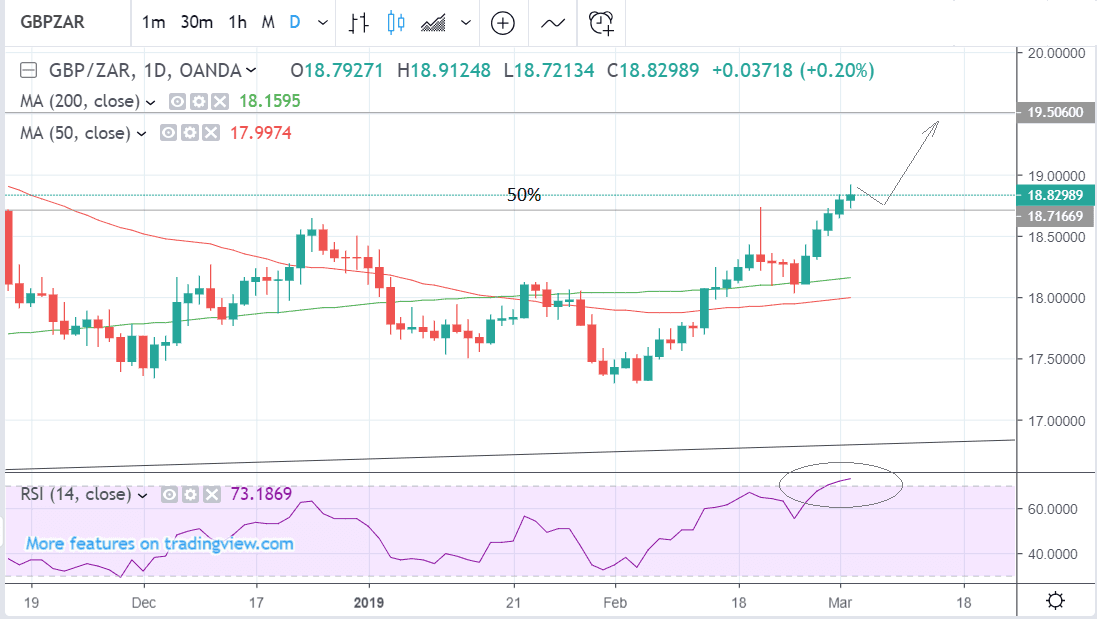

Further bullish technical signs include GBP/ZAR now trading above the 200 and 50-day moving averages (MA) while the pair has also surpassed the midpoint or 50% Fibonacci level of the previous downtrend.

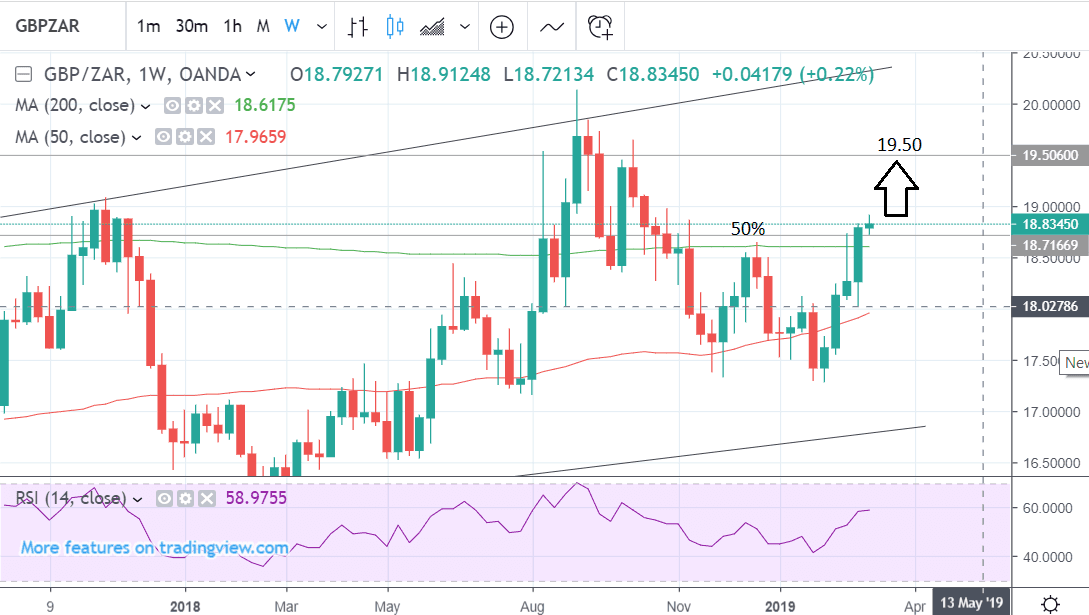

From here there is a possibility of an extension up to the next target at the 19.50 level. A break above the current 18.91 highs would provide confirmation.

GBP/ZAR has rallied higher, breaking above the 50% Fibonacci line, but momentum has entered overbought territory, which is a sign the uptrend could be overextended and due a pull-back.

One possible scenario which fits the current situation, is that the pair will undergo a shallow correction back down to the 50% level at 18.71 as it unwinds from overbought extremes. This will then likely be followed by a bounce higher as the dominant uptrend resumes.

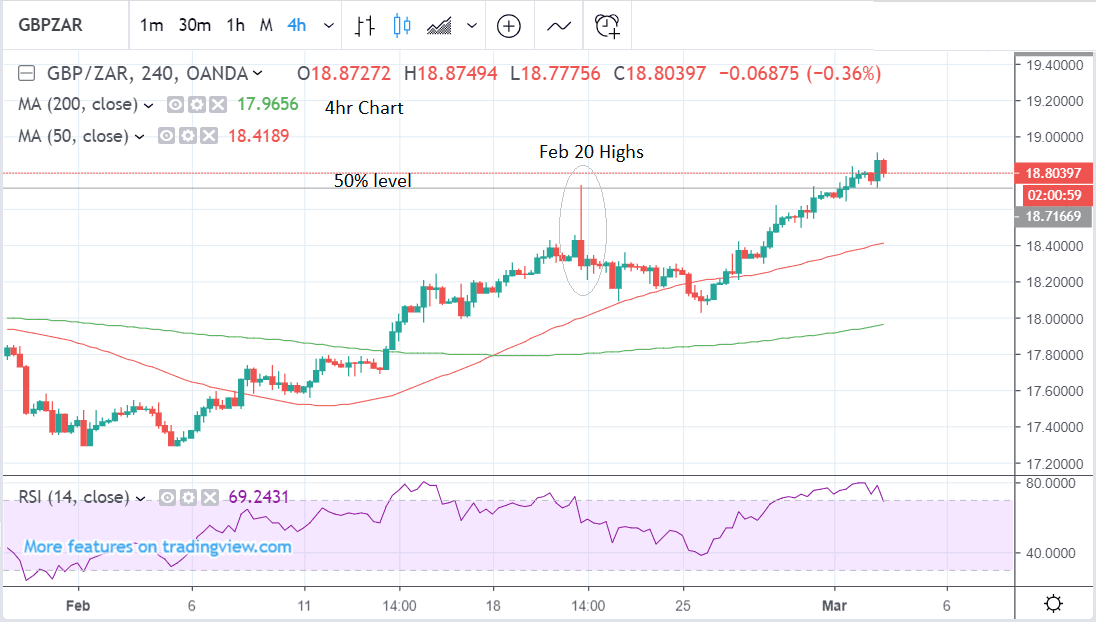

The four-hour time frame chart above shows clearly the development of the short-term uptrend.

The break above the Feb 20 highs was a major turning point for the trend which established a bullish bias.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Rand: Fundamental Outlook this Week Dominated by GDP, Eskom

The Rand is likely to remain broadly range-bound in the near-term until the results of Moody’s credit rating review are known on March 29. There is a fear the agency could downgrade SA debt to ‘junk’ status which would be a significant negative for the Rand.

At the moment Moody's is the only major agency which has not downgraded Rand-denominated sovereign bonds to below investment grade, however, if it did, it would mean many international bond funds would have to sell their holdings.

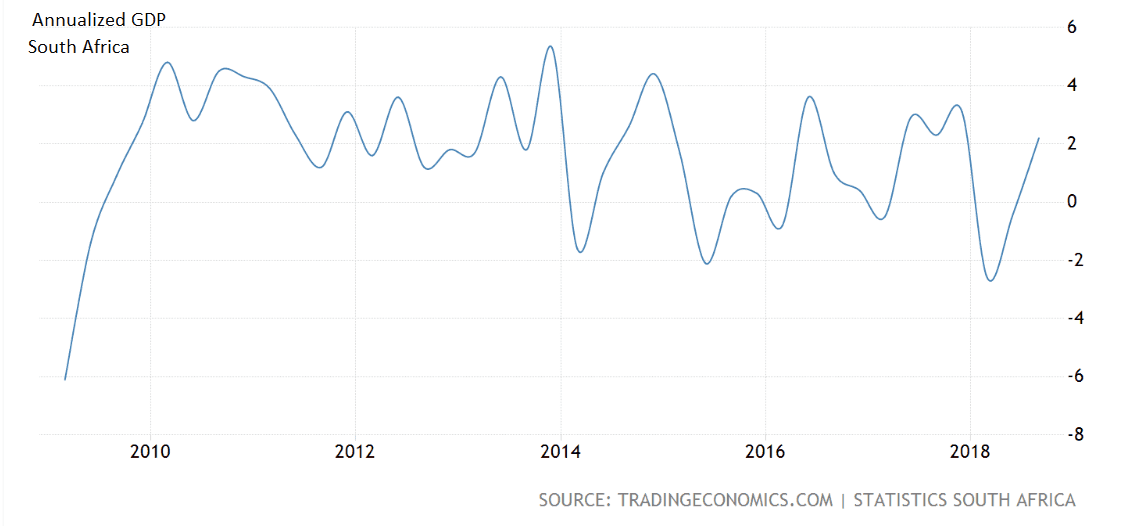

The big domestic economic data release for the SA Rand is Q4 GDP growth data, which is forecast to show a 1.6% annualised rise on a quarterly basis compared to Q3, and a 0.6% rise compared to a year ago. The data is scheduled for release on Tuesday, March 5, at 9.30 GMT.

“We expect GDP growth to have moderated to 1.4% q/q seasonally adjusted and annualised, from 2.2% q/q in 3Q18; we remain cautious about the near-term outlook. We estimate that GDP growth averaged 0.7% in 2018,” says Thanda Sithole, an economist at Standard Bank.

Also keep an eye out trade data and Eskom price tariff announcements.

"The Rand faces event risk stemming from GDP and current account data out on Tuesday and Thursday, as well as Nersa’s electricity tariff announcement on Thursday," says Mpho Tsebe, an analyst with RMB. RMB expect fourth-quarter GDP growth to have moderated to 1.1% quarter-on-quarter, down from 2.2% in the third quarter 2018. The current account deficit is likely to have narrowed to 3.2% in the fourth, from 3.5% in the third quarter, taking the full-year forecast to -3.7% of GDP.

Nersa is meanwhile scheduled to make an announcement on Eskom’s tariff application on 7 March.

"Eskom had originally applied for tariff increases of 15% over the next three years, but later revised its application upwards due to lower sales forecasts. While Nersa is unlikely to award Eskom excessive tariff increase, higher electricity costs would deal a blow to consumers and energy-intensive sectors, which would be negative for the already subdued growth outlook," says Tsebe.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement