Bank of Japan Unexpectedly Pulls Yield Curve Back Under Control

Image © Leonid Andronov, Adobe Stock

- Bank of Japan reigns in 10-year bond yields

- Rapid rise in yields may be reason for move suggests BOJ member

- Move suggests ongoing tethering could plant floor below USD/JPY

The Japanese central bank has pulled on the reins of the country's benchmark 10-year bond yields, yanking them back into line, only days after it relaxed its yield curve control (YCC) policy.

The move suggests they remain very involved in targeting the yield curve despite saying they would relax control at their meeting on Tuesday.

The intervention carries bearish connotations for the Yen.

On Thursday, the Bank of Japan (BOJ) conducted an unplanned buying operation of 400bn Yen ($3.6bn) of 5-10 year yields only days after saying it was relaxing control of the yield curve and allowing 10-year Japanese Government Bond (JGB) yields to float more freely.

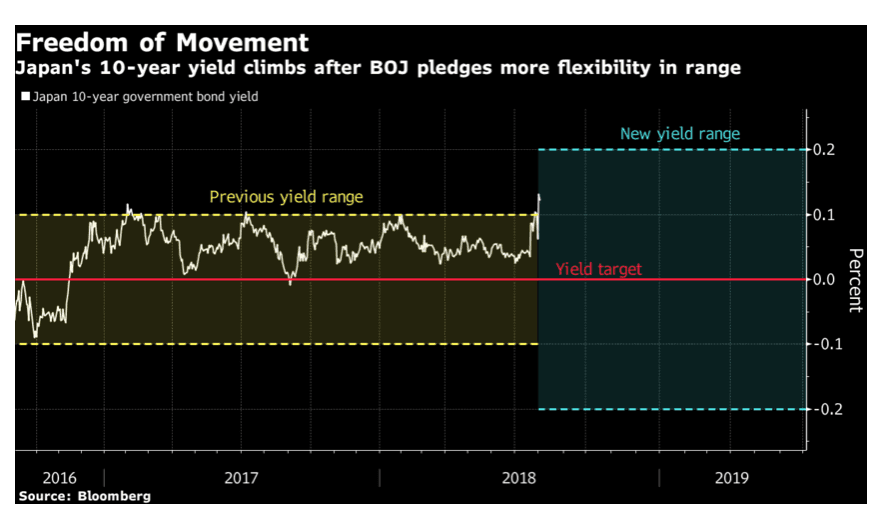

Previously the BOJ had kept yields pegged to 0.0% using targeted purchases in the bond market, but at their meeting on Tuesday, the bank decided to allow movement within a range of +/-0.2% around the zero midpoint.

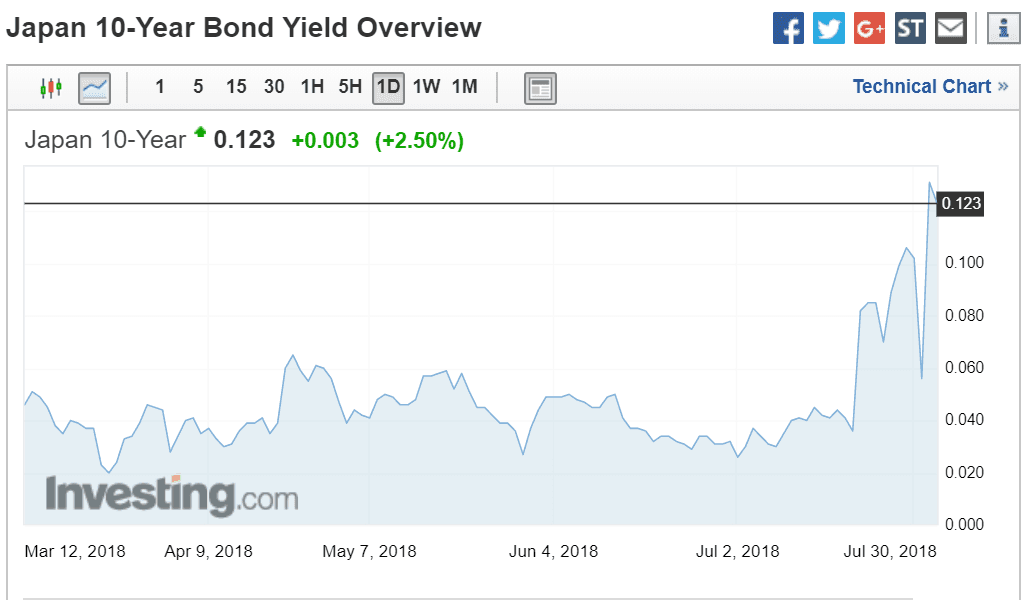

Following the meeting 10-year JGB bond yields rose sharply, reaching an 18-month high of 0.145%, only the day after.

The rise may have been too rapid for the BOJ, however, judging from comments made by BOJ member Masayoshi Amamiya who said the Bank would intervene if yields rose too sharply.

“The BOJ needed to slow the pace of advance in the 10-year yield, but probably wanted to wait until it reached 0.2 percent to step in with a fixed-rate operation,” says Takenobu Nakashima, senior rates strategist at Nomura Securities Co. in Tokyo.

“The move suggests more similar operations may come," added Nakashima, quoted by correspondents at Bloomberg News.

Despite the relaxation of YCC announced by the BOJ, the USD/JPY has reacted in a fairly muted fashion, although it did fall by 0.55% on Wednesday when JGB yields peaked, in a move some say reflected the narrowing yield differential with the US.

The exchange was little changed at 111.60 on Thursday, however, at the time of writing, despite the news about the BOJ's market operation which would have been expected to lead to some upside.

10-year JGB yields, however, had fallen to 0.123% at the time of writing after the BOJ's operations.

Bond Markets in Turmoil

Global bond markets entered something of a spin following the BOJ's announcement that it would be relinquishing YCC in favour of a looser range with wide-ranging implications for the Yen.

The rise in 10-year JGB yields following Tuesday's meeting raised expectations for an increase in yields all the way along the long-end of the Japanese yield curve.

Higher longer-term yields led to speculation that Japanese investors might respond by repatriating the vast sums of money they have invested abroad due to the meagre yield offered in Japan.

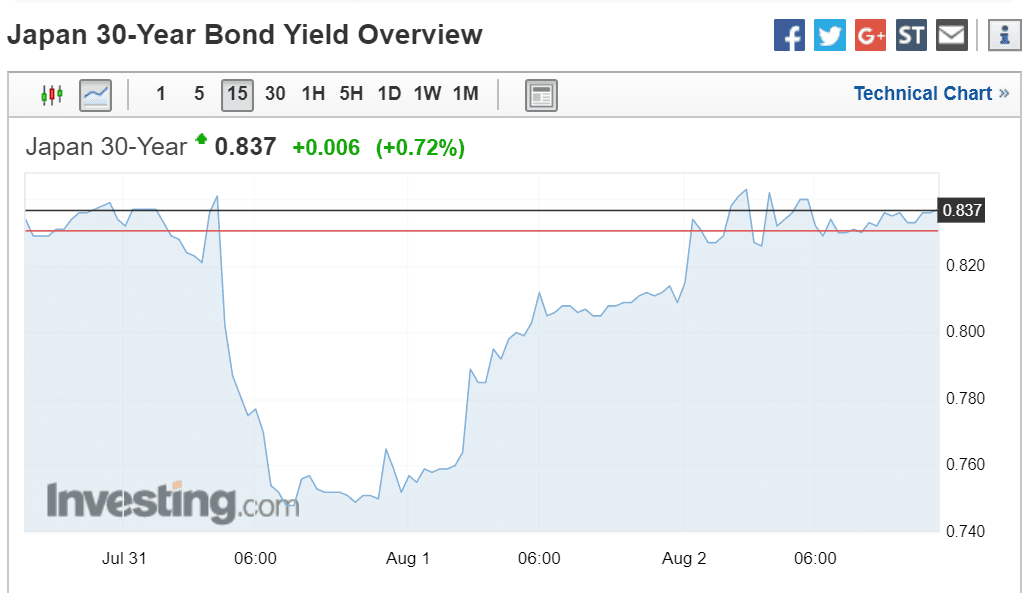

The tipping point, according to bond market experts, lies at the 30-year JGB yield 1.0% level.

"A yield of at least 1 percent on the 30-year JGB is seen as the level that will tempt Japanese investors to shift some of the $2.4 trillion of overseas debt they hold back home," says Chikako Mogi, a reporter at Bloomberg News.

"The Bank of Japan’s new guidance, tolerating a 10-year yield of as high as 0.2 percent, could get longer-term bonds close to that, according to market participants," adds the reporter.

Clearly a repatriation of even a share of the 2.4tr held overseas would have extremely bullish implications for the Yen.

The 30-yr JGB yield stood at 0.837, however, at the time of writing, still well short of the 1.0% level tipping point.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here