U.S. Dollar Rally to Continue a Little Longer before Bear Trend Resumes say Morgan Stanley

- Written by: James Skinner

- USD can go further now yield curve is steepening say Morgan Stanley.

- But, root causes of rally to be the buck's undoing in the longer-term.

- Morgan Stanley correctly predicted the current rally back in March.

© Adobe Stock

The US Dollar rally that has endured from late April through to the end of May has further to run although, according to currency strategists at Morgan Stanley who correctly predicted the current rally back in March.

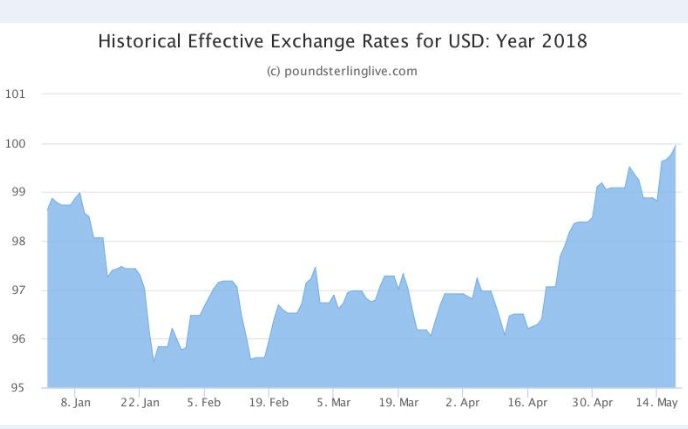

The Dollar is now at the tail-end of a six week period that has seen the currency swing from a 4% year-to-date loss into a 1.7% gain.

The greenback has risen by more than 5% between April 17 and May 23, marking a break in a 12-month rout that had seen the Dollar decline by a double digit number against a basket of other currencies.

The Dollar index is now down by just 3.54% over the last 12 months when not so long ago it had been carrying close to an 11% loss for the same period.

Above: US Dollar index in 2018. Captures April and May rally.

"US bond yields have increased, pushing G10 yield differentials toward near-record levels in favour of USD. However, we put less emphasis on nominal yield differentials. To us, what matters more is the relative slope of the yield curve. The US yield curve has steepened in recent days relative to other DM yield curves, which is a USD-positive development," says Hans Redeker, head of G10 FX strategy at Morgan Stanley.

Driving the move in exchange rates has been a sudden shift in US bond markets, which has seen yields on American bonds of all tenures rise to multi-year highs which, when compared with interest returns offered by bonds denominated in other currencies, has seen interest rate differentials favouring the Dollar move to near record levels.

This means international investors, particularly so called carry traders, have been incentivised to sell other lower yielding currencies and buy the Dollar in order to invest in the US bond market and exploit the improved returns on offer.

Above: 10 Year US Government Bond Yield.

While exchange rates have almost certainly taken their lead from events in the bond market, the recent step up in yields has its roots in a number of areas. First and foremost, the economic slowdown that swept across the developed world during the first three months of the year was much less pronounced in the US than it was in Europe and US economic data has been quick to rebound from its recent soft patch.

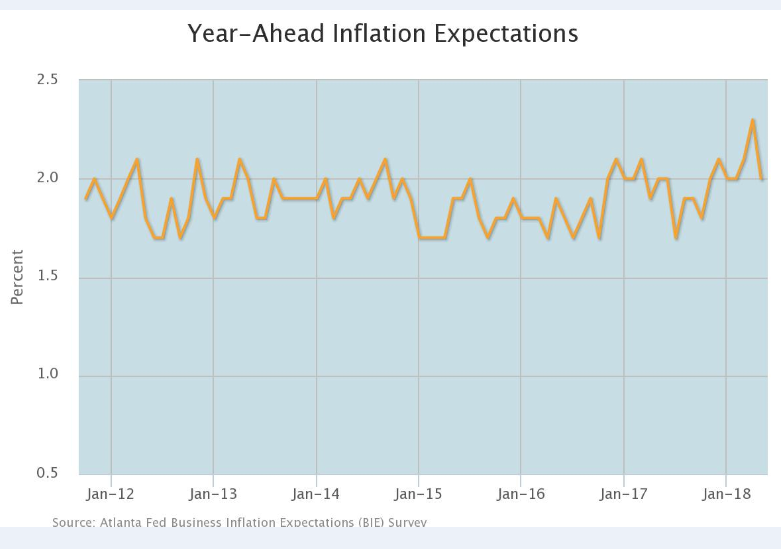

Not only that, the various measures of US inflation are already at or above the Federal Reserve's 2% target and are stable. Whereas, inflation in Europe, the UK and elsewhere has recently gone into retreat. This means that if there is any country that has scope for interest rates to edge higher over the rest of the year it is the US, which is favourable for the Dollar because those higher rates, or even just speculation around them, would typically lead to even higher bond yields.

Above: Atlanta Federal Reserve inflation expectations survey graph.

In addition, US yields have also been pushed higher by President Donald Trump's tax cuts which have raised business and household expectations for inflation and, given their budget-busting size, spurred a sharp increase in the number of new bond the US Treasury is issuing in order to finance the federal budget deficit. This increasing debt supply has naturally seen the price of US bonds fall, which has in turn augured higher yields given the negative correlation between the two.

"The USD upward correction is not yet complete. Over the course of this week, our USD scorecard provided more signs of USD strength. Global growth indications have continued to disappoint, with Korean exports now contracting, leading indicators in the eurozone failing to rebound,and Japan's GDP contracting in the first quarter. US data, in contrast, remain robust, with retail sales and industrial production for April both showing continued strong momentum," Redeker adds.

This call is notable because the Morgan Stanley FX team correctly identified and flagged all of the above trends to clients back in late March, long before the rally occurred, and suggested that Pound Sterling as well as the Australian and New Zealand Dollars would be the currencies that are hit the hardest by a resurgent Dollar.

Above: Euro-to-Dollar rate shown at daily intervals.

The bank's strategists later added the Euro to this basket and recommended clients bet the Euro-to-Dollar rate falls from close to 1.24 to the 1.16 level over subsequent weeks. EUR/USD traded as low as 1.17 Wednesday and has fallen more than 5% since the trade recommendation was issued while Sterling and the Antipodean Dollars have also sank deeply into the red.

"Despite our current USD constructiveness in the short run, we want to make it clear: We believe that USD started a secular bear trend in January 2017,and it could lead USD to historical lows should the current US fiscal and deregulatory policy approach fail to lift the long-term US growth potential and productivity," Redeker notes.

Redeker and the Morgan Stanley team say that, although the steeper US yield curve is a bullish signal for the Dollar in the short term, the root causes of this steepening will undermine the currency over the longer term. This is

"We combine the US twin deficits with G3capital costs. When US twin deficits and global capital costs rise simultaneously, we find a long-term USD downtrend," Redeker warns.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.