Pound to go Sub-1.40 vs. Dollar as Heavy Resistance Layers Loom Warns Commerzbank's Jones

- GBP/USD exchange rate becoming increasingly static

- Technicals suggest next big move would be lower says analyst

- But, we are wary of expecting a major capitulation in Sterling just yet

© Andrey Popov, Adobe Stock

The British Pound is stuck in something of a rut against the Euro and US Dollar at present with very little movement having been witnessed in these two headline pairs over the past 48 hours.

The Pound-to-Dollar exchange rate is quoted at 1.4181 a the time of writing; it closed Wednesday, April 12 at 1.4178 having opened at 1.4173.

The dearth of movement near-term is interesting in that there has been a steady enough flow of news and economic data for market participants to get stuck into over the mid-week session - be it disappointing UK manufacturing data, Sino-US trade war relief, real war angst surrounding Syria, US inflation numbers and briefings from the European Central Bank.

This suggests a market that might be prone to technical direction i.e. traders will be making calls based on chart patterns in the belief that this is what could be dictating moves.

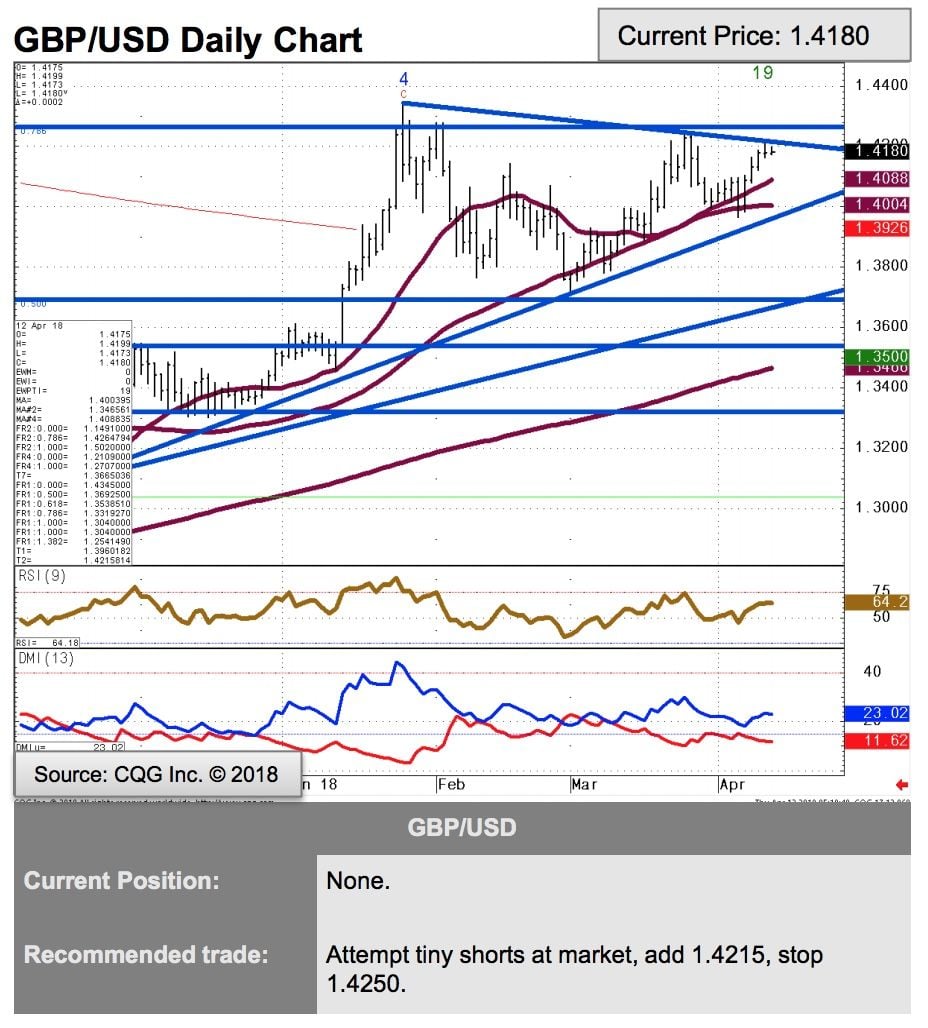

With that in mind, technical analyst Karen Jones at Commerzbank's London offices notes GBP/USD is reaching "the top of its converging range," today located at 1.4216.

"Between here and the 200 week ma at 1.4243 we should see the market struggle," says Jones.

Resistance - a solid set of Pound Sterling sell orders - will be reinforced by the 1.4340/45 recent high and long term Fibonacci retracement.

Image (C) Commerzbank

"Failure here should see a slide back to the five month uptrend line at 1.3960," warns Jones.

The analyst eyes further support levels between the February and the March lows at 1.3765/12 and also at the 1.3658 September peak.

Seeing a similar setup to Jones is Robin Wilkin, an analyst with Lloyds Bank Commercial Banking who has been warning for some time now that Sterling has entered a significant region of supply.

"Prices are in the 1.4185-1.4250 resistance region. We continue to see this area as the ideal topping region as part of a broader range. So, while under there, we look for a return towards the March 1.3712 reaction lows," says Wilkin. Only "a clear break-up through 1.4250" would overturn the bearish scenario, and such a move could "risk a re-test of the 1.4345-1.4550 medium-term resistance region".

Related: Swissquote say the GBP/USD exchange rate is "a sell"

Related: Buy GBP/USD on dips say Maybank

We would however caution readers that the broader trend does look to be higher and the Pound-to-Dollar exchange rate is in fact 1.77% over the course of the month-to-date i.e. the past 20 trading days. This suggests overall the trend is in fact broadly in favour of Sterling.

Furthermore, April tends to be a positive month for the GBP/USD exchange rate on the basis of seasonal trends; it has risen each April for the past decade with analysts suggesting there is an increase in repatriations of external capital by UK nationals at this time of year.

The end of the tax year is said to be one potential driver of this seasonality. In April, the Pound "tends to rally no matter what the political/macro backdrop," says Kamal Sharma, FX Strategist with Bank of America Merrill Lynch Global Research in London.

Earlier this month Deutsche Bank analyst Oliver Harvey told clients he was turning "tactically bullish" on Sterling against the Euro citing - amongst other reasons - that April tends to be a month in which the Pound outperforms its major rivals, and April 2018 should be no different.

So while the technical picture suggests further gains will be hard to come by, we would be wary of expecting a notable decline, certainly a decline of the size that would see GBP/USD going below 1.40.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.