US Dollar to Rally from Scarcity in Second Half of 2017

The Dollar will join that exclusive club of assets which gain value from their rarity towards the end of 2017, according to Nordea Bank's Chief FX Strategist Martin Enlund.

As far fetched as it may sound Dollar 'scarcity' - or relative scarcity - caused by a variety of factors could be a major source of Dollar strength.

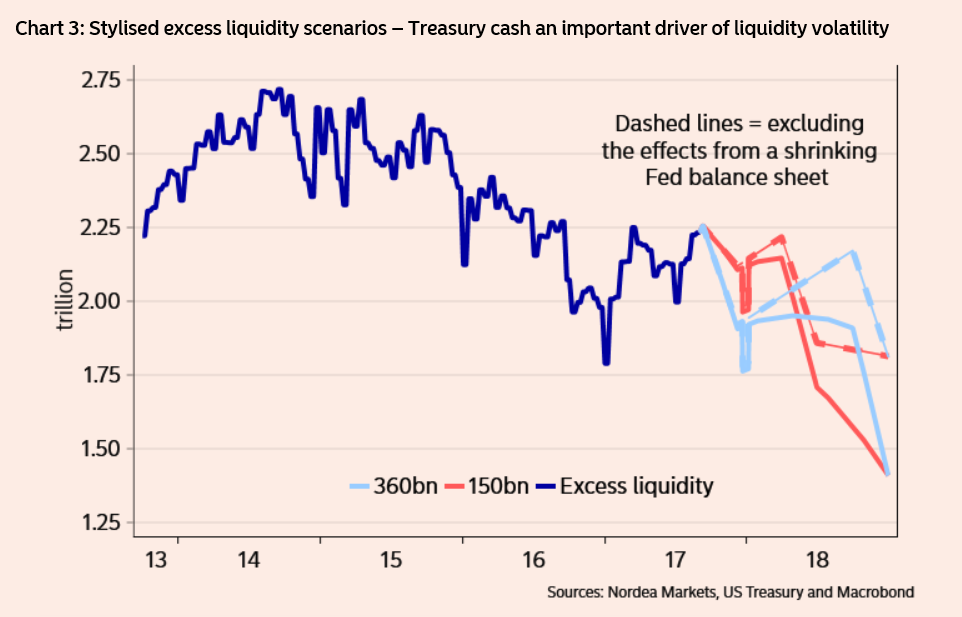

One major factor is the extension of the US debt ceiling which has afforded the US Treasury a 3-6 month window in which to borrow and increase its cash balance, and in doing so effectively drain the system of US Dollars.

The Treasury has set a minimum cash balance of 150bn so as to have enough money in case of national emergencies.

However, Enlund thinks the minimum is likely to be superseded and based on averages over recent years expects the Treasury to borrow enough to bring its balance up to over 300bn - 312 being the average since 2016 - this fresh demand for Dollars will cause a temporary spike in demand, and the resulting 'scarcity'.

"The US Treasury earlier planned for a 501bn issuance surge once the debt ceiling has been lifted, which would have sapped excess reserves in the US banking system by some 300bn. Now, reserves will still be eroded, but probably by around 100bn and with somewhat different timing," says Enlund.

The borrowing bonanza will not last forever: a 'soft' debt ceiling will be reintroduced on December 9 ('hard' in March 2018) but up until then, the Treasury is likely to be issuing Treasury bonds, borrowing liberally, and in the process hoovering up Dollars.

After December 9, the climate will favour the Treasury spending its cash balance rather than issuing new debt, and the supply of currency will start to rise again.

The Dollar is also likely to become more scarce towards the end of 2017 from the actions of the Federal Reserve.

The Federal Reserve holds 4.5 trillion of assets - mainly bonds and mortgage-backed securities - which it bought from struggling financial institutions during the financial crisis to help restore their balance sheets and increase all round liquidity.

When the assets mature, the principle - or the original sum lent - is returned to the owner, which in this case is the Fed.

Previously, the Fed's policy was to reinvest the principle back into buying new assets, but since Septmber it has decided to end this policy due to improving financial conditions.

It will now limit reinvestment to only the principle received over a rising cap.

This will begin at 10bn per month but then rise at 3-monthly intervals, to a maximum pace of 50bn per month in 2018, however, the end result is a withdrawal of Dollars from circulation, effectively in a reverse of QE.

The final source of dollar scarcity is from 'year-end' flows, which are normally caused by portfolio managers hedging their currency exposure.

Enlund sees this temporary factor as leading to a drain of 150bn more units from circulation at the end of 2017.

"In our main scenario, we have pencilled in a USD150bn cash balance in early December (at which point it will likely start to be drawn down heading into the next hard debt ceiling in March - the so-called X-day), a

Federal Reserve letting its balance sheet shrink starting October 1 (at a greater and greater pace in line with its communication, table 1), a temporary year-end effect reducing liquidity by 150bn, and a continued trend rise in cash usage," says Enlund.

Quantifying the Impact on USD

How will the soaking up of Dollars affect the exchange rate?

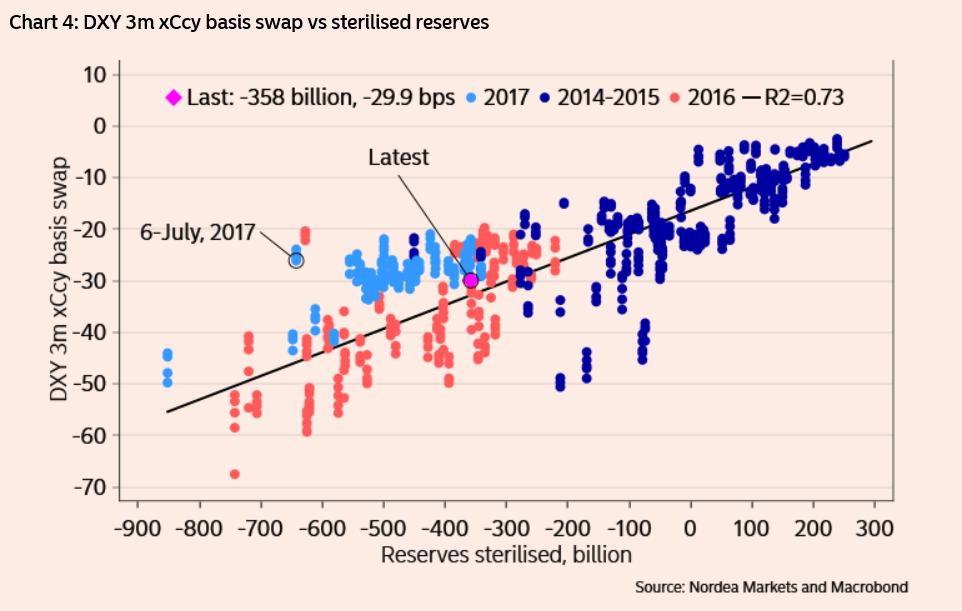

Enlund attempts to quantify the impact by cross-referencing the impact of the drain on liquidity with the cost of currency swaps and then compare the same dates with EUR/USD.

Currency swaps are used by investors who have long-standing debt obligations in one currency, such as for example an American Dollar-denominated mortgage, but who are paid in another currency, such as Euros.

A swap is basically a form of financial alchemy which keeps the payments the same regardless of the fluctuating exchange rate, thereby eradicating currency risk.

The cost of the currency swap is, therefore, a function of the outlook for the exchange rate as well as the scarcity value of the currencies involved.

"US excess liquidity might drop by 200-300bn by year-end, indicating excess liquidity dropping to levels last seen this summer," says Enlund.

The chart below shows the reduction in Dollar reserves or 'sterilization' as it is called, against the cost in basis points of Dollar Index swaps against a basket of counterparts.

When liquidity falls to similar levels as witnessed in July 2016, the cost of Dollar swaps should increase to -40 to -50 basis points according to the correlation line - lower than in 2016 due to one-off factors.

"While the DXY-weighed xCcy basis swap was somewhat tighter in early July this year, the general pattern between sterilization and dollar basis suggests wider readings. Moreover, less excess liquidity by a year-end might have a greater effect on markets than similar liquidity levels around a quarter-end, due to risk-taking and regulatory reasons," says Enlund.

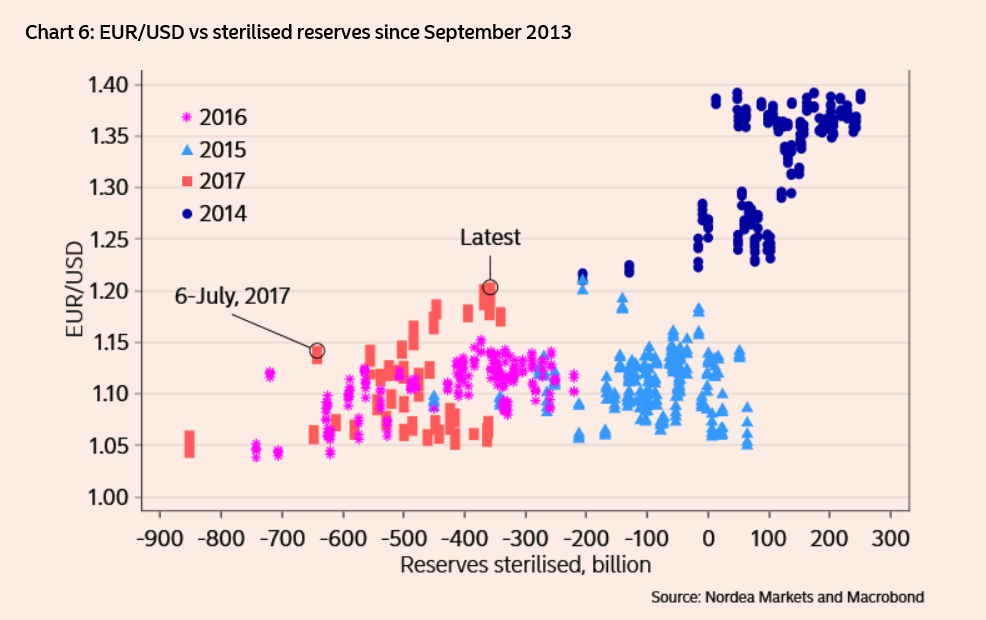

Taking the same data points but applying them to a chart comparing EUR/USD and Dollar liquidity levels Enlund's analysis determines a probable exchange rate of 1.15 which was what the EUR/USD was at in July 2017 when the liquidity draw was at commensurate levels.