GBP/USD Rate: USD Rallies on Retail Sales, Improved Risk Sentiment, Dudley Comments

Moving through the mid-week session the US Dollar is stronger as the stars align to finally allow for a meaningful following months of relentless selling.

The US Dollar index - a measure of the Dollar’s value against a basket of major currencies - is at 93.61 having started the week at 92.85.

Reflecting the Dollar’s strength is the sharp retracement in the Euro / Dollar rate which now trades at 1.1739, down from the week's open at 1.1891.

The Pound to Dollar rate is meanwhile at 1.2863 having started the week at .

There are three reasons to consider on the subject of the Dollar’s surge:

- Fed’s Dudley says interest rate path remains unchanged

- Strong retail sales data

- Improved risk sentiment on Korea-US standoff

- Positioning on the Dollar at negative extremes, short-covering underway

We will run through each of the above.

Dudley Warns Fed will Stick to its Guns

One of the reasons for the Dollar’s recent decline is the market’s expectation that the US Federal Reserve was likely to lower its path of intended interest rate rises.

The July inflation report came in below analyst expectations and appeared to confirm amongst traders the view that the Fed will ease back on raising rates.

The view is misplaced, says William Dudley, CEO of the Federal Reserve Bank of New York who offered reasons on why the Fed would want to stay the course even with inflation below target.

"Now the reason why I think you'd want to continue to gradually remove monetary policy accommodation, even with inflation somewhat below target, is that 1) monetary policy is still accommodative, so the level of short-term rates is pretty low, and 2) and this is probably even more important, financial conditions have been easing rather than tightening. So despite the fact that we've raised short-term interest rates, financial conditions are easier today than they were a year ago.”

If Dudley carries any weight at all in Fed policy then markets have been caught out as being too bearish on rates and the Dollar by proxy.

US Retail Sales Beat Expectations

The Census Bureau reports US Core Retail Sales grew 0.5% in July, well ahead of the 0.3% forecast by economists.

Headline Retail Sales grew by 0.6% in July, ahead of the 0.4% forecast.

The US economy is building up steam again - once more this feeds into the Fed debate as a stronger economy justifies higher rates which creates demand for Dollars.

“Job gains continue lining the pockets of Americans, and they were in the mood to spend over the past couple of months,” says Royce Mendes, an economist with CIBC Capital Markets.

“Today's retail sales report supports our forecast that consumption will remain an important driver of growth in the quarters ahead. The upside surprise has been positive for the dollar and negative for fixed income,” adds the analyst.

Is the fall in value of Sterling impacting your international payments? Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Korea-US Headlines Aid Risk, the Dollar

The US Dollar didn’t like the standoff between Washington and Pyongyang which reached a climax last week with both sides effectively threatening to bomb each other.

While this was always a remote outcome, markets nevertheless took risk off the table with the likes of gold and the Yen coming out as winners.

The “risk relief rally is gathering momentum, as it appears Kim Jong-Un has decided not to launch missiles at Guam,” says Elsa Lignos, Global Head of FX Strategy at RBC Capital Markets.

Traders Overexposed to Dollar Weakness

When too many market participants are betting in the same direction, the trend ultimately loses steam.

And, the prospect of a reversal grows as traders ultimately take profit on that trade.

This appears to be happening to the Dollar which has seen speculators increasingly build up negative bets:

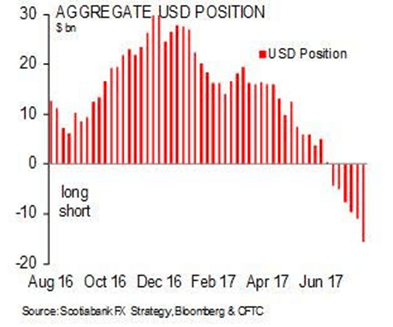

“The latest snapshot of speculative FX positioning shows investors continue to add to USD short positioning in aggregate, with a further build in the overall USD short amounting to some USD4.5bn this week; the aggregate bear bet on the USD extends to USD15.6bn this week, the largest since 2013,” says Shaun Osborne at Scotiabank in Toronto.

The news and data events have combined to expose the excessive positioning against USD, and the strength of the rally is testament to the need for position clearing.

"With markets short dollars, the U.S. currency’s turn triggered a short squeeze, forcing bears to capitulate and run for the exits, exacerbating the buck’s bounce," says Joe Manimbo, Senior Market Analyst with Western Union.