JP Morgan: U.S Dollar Could Fall 8.0% Should Fed See Heightened Risk of Recession

The 'recession' word is back when it comes to discussing the prospects of the US economy. JP Morgan tell us how likely they see this scenario occuring and what it means for the USD should it occur.

JP Morgan has released a note hypothetically modelling the potential US dollar exchange rate complex response should the Fed withdraw completely from its tightening programme.

The the prospect of the Fed abandoning its rate raising programme got all the more real on the 3rd of February when the dollar index posted one of its steepest one-day declines in 25 years, driven by US recession fears.

JP Morgan concede that the overall chance of the U.S falling into a recession is modest, although not inconsequential, at 25%.

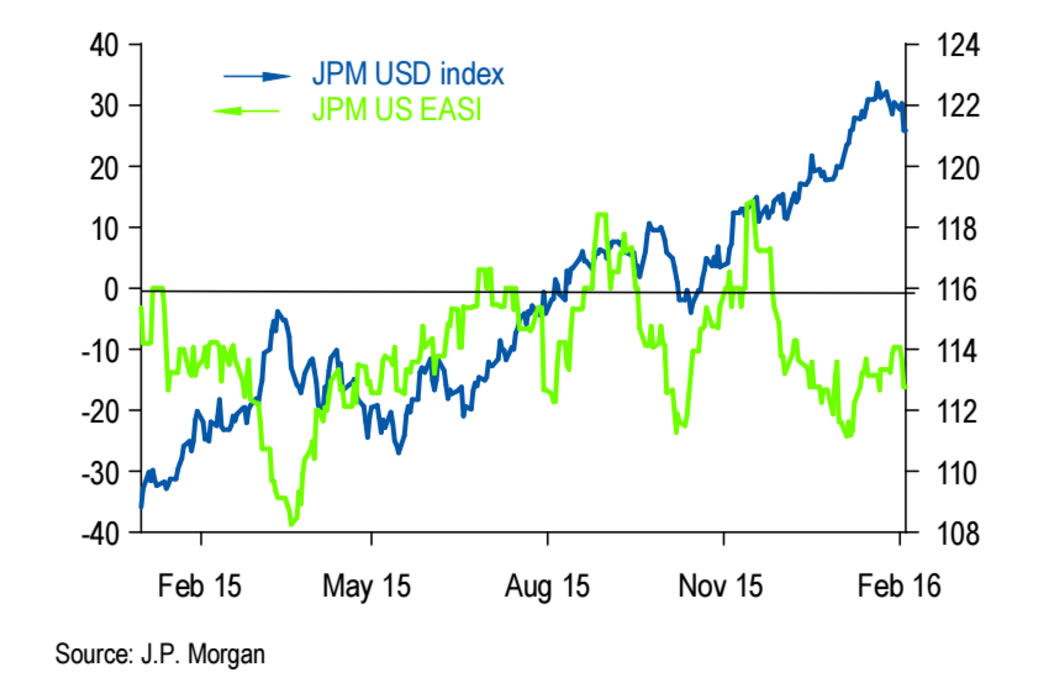

As evidence of this, the bank points out that U.S economic activity data has been falling in every month since January 2015, which if plotted on a graph as an index would show a very wide divergence with the U.S Dollar Index which has been rising in since Jan 2015; and that this wide divergence now appears to be ripe for a ‘snap back’.

The research note goes on to explain in more detail what would happen in an “extreme scenario” where the Fed suddenly stopped rising rates.

Firstly, the JPM Dollar Trade Weighted Index would fall 8% and, “spreads could compress about 65bp”.

Initially dollar weakness would affect all pairs regardless of individual characteristics:

“Over a very short horizon (a month or two), that move would come indiscriminately across all currencies regardless of idiosyncratic issues and offsets, since such a drastic change in Fed policy is so influential systemically,” explains analyst John Normand.

The report points out that the yen and euro would perform best in such a scenario, with a wild-card possibility of increased flows into EM ‘cheap assets’, as well as flows into commodity currencies if oil started a “supply driven” recovery mid-year.

Due to the risk of such an outcome, JPM have changed the forecast for two majors: the EUR/USD (see below) and USD/JPY.

“We expected no or little USD strength versus reserve currencies like JPY and EUR despite the prospect of more BoJ and ECB easing,” says Nomand

For USD/JPY the new forecast is for a recovery to 1.25 midyear – up from 1.23, and to end the year at 1.22.

The note complements our most recent report on forecasts from Danske Bank that suggests the euro should be notably higher againt the US dollar.

JPM’s portfolio holds little “outright USD risk” concentrating instead on cross market themes, such as short USD/JPY to play China-equity stress, short GBP/USD for Brexit and long USD/CAD to play a relapse in oil, however, they have now added short USD/CHF to play a possible slump in U.S activity over coming weeks before the ECB’s March meeting.

The report then goes on to discuss the week ahead, with the comment that:

“Amid fading hopes for Fed tightening with the dovish tone from Fed speakers and soft economic prints, how Fed members see path of rate hike continues to garner attention from the markets.

“Against this backdrop, Fed Chair Yellen’s testimonies before the House on Wednesday and Thursday will be the most important event.”

Euro Dollar Forecast Altered

While a fall into recession is not expected, JP Morgan see it fit to bring forward their year-end target on EUR/USD of 1.13 to Q3, and the interim forecasts are now around the current spot level of 1.11.

Before the Fed’s first hike last December, we thought the dollar's four-year bull market was about 75% complete since a mediocre US expansion and a borderline corporate profits recession would challenge a Fed tightening cycle central to the currency's rise.

But, “with the US economy performing worse than expected and the policy-mistake scenario becoming more relevant, the EUR/USD forecast requires revision higher,” say Normand.

Uncertainty Increasing

Economic uncertainty increased further yesterday after the disappointing German production and external trade figures for December and it is questionable whether today's production figures in France and Italy will lead to a turnaround in sentiment, even if the month-on-month results rise as expected.

Market participants will be focusing on the US over the next two days, as Fed chair Yellen will present her semi-annual testimony to the finance committee of the House of Representatives.

"The mixed data, as well as the stock market turmoil of recent weeks above all, have led to any remaining rate hike expectations for March being priced out and such a move is now considered unlikely for 2016 as a whole," says Ralf Umlauf at Helaba Bank in Frankfurt.