GBP/USD Rate Has Further to Fall: Capital Economics

- Written by: Gary Howes

Image © Adobe Images

Independent research company Capital Economics says, "Sterling has further to fall against the U.S. Dollar."

The call comes as the British Pound enjoys a strong start to 2024, vying for the top spot in the G10 complex with the U.S. Dollar.

Both top performers can thank a lowering in expectations for the timing and scale of rate cuts likely to emerge from the Bank of England and the U.S. Federal Reserve over the coming months.

The rerating in expectations has been more powerful regarding the U.S. Dollar and Fed, leaving the Pound to Dollar exchange rate lower by 0.40% for 2024 at 1.2683.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Nevertheless, the Pound has recorded a gain against all its other G10 peers, which speaks of outperformance that has limited Pound-Dollar downside.

"While sterling has outperformed other G10 currencies amid the dollar sell-off over the past couple of months, we expect it to reverse its gains against the greenback as short-term Gilt yields edge lower," says Jonathan Petersen, Senior Markets Economist at Capital Economics.

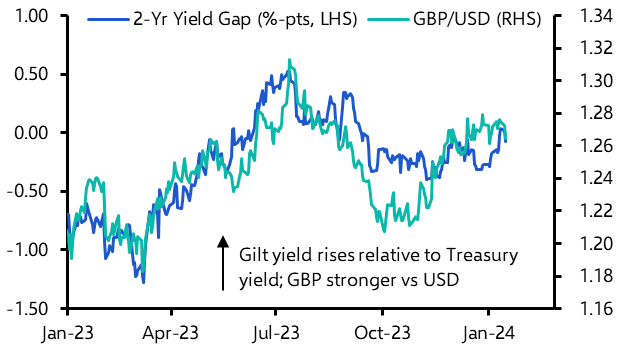

Petersen says much of the Pound's resilience is due to the shift in short-term yields in favour of Sterling; notably, the 2-year yield gap between the U.S. and the UK has risen since the start of the year:

Image courtesy of Capital Economics. Track GBP with your own custom rate alerts. Set Up Here.

But the Pound will ultimately end 2024 at the bottom of the G10 pile, according to Petersen.

"We think sterling’s resilience will prove short-lived and expect the currency to fall against the greenback by more than other G10 currencies over the course of 2024," he says.

The key reason for this is a view about monetary policy in the UK and the U.S.

"We anticipate inflation will reach the central bank's target in the UK before other major developed economies," says Petersen.

Politics Could Finally Give Pound Sterling a Boost: Argentex

2024 has seen a significant reappraisal of UK inflation forecasts, with many now saying UK inflation will fall to the Bank of England's 2.0% target as early as April.

This would put the Bank of England in a position to cut interest rates in June (or even earlier if preceding data points to a sub-2.0% outcome).

"Our revised forecast sees Bank Rate falling to 3% by the end of the easing cycle, about 40bp below what is currently discounted by investors," says Petersen.

If the market comes around to Capital Economics's view, the Pound is due for a sizeable rerating lower alongside interest rate expectations.

"By contrast, market expectations are broadly in line with our forecast for the US policy rate. Taken together, our forecasts imply a shift in the short-term yield gap in favour of the dollar," says Petersen.

Capital Economics also judges that the Pound is overvalued at current levels, leaving "plenty of scope to fall."

"We are sticking with our forecast for the GBP/USD rate to fall to 1.20 by year-end, from ~1.26 now," says Petersen.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks