Peak Dollar Might Have Passed Alongside Fading Hike Expectations

- Written by: Gary Howes

Image © Adobe Images

Expectations for the scale of interest rate hikes at the major central banks might have peaked, which might mean financial and foreign exchange markets have witnessed an important turning point.

Most importantly, this has lead some analysts to suggests 'peak dollar' might be near.

A look at money market pricing suggests the peak in expectations for the number and total amount of hikes from the Federal Reserve, European Central Bank and Bank of England might have been reached last week.

Reuters data shows an ongoing retracement in investor expectations for the amount of tightening to come from central banks.

The Federal Reserve's peak Fed Funds rate is now seen at 3.4%, down from 4.1% before the Federal Reserve's policy last week.

This shift was aided by the surprisingly weak PMI data out of the U.S. on Thursday that resulted in lower U.S. bond yields, a weaker Dollar and higher stock markets.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The European Central Bank's peak rate is now seen at 1.8%, down from the 2.6% peak seen last Tuesday, also aided by disappointing Eurozone PMIs out Thursday.

The Bank of England is meanwhile expected to push Bank Rate to a peak at 3.0%, down from 3.6% last Monday.

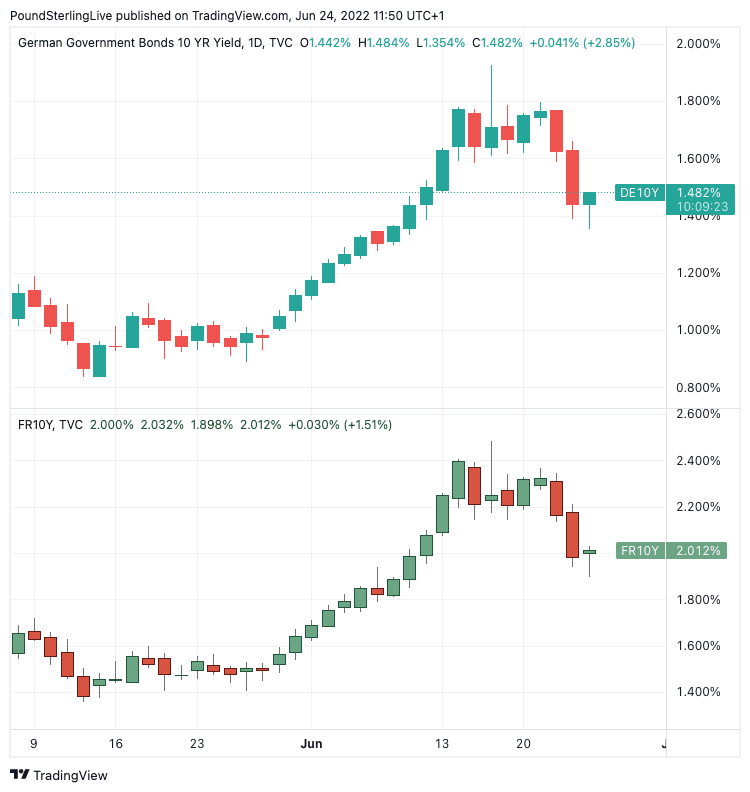

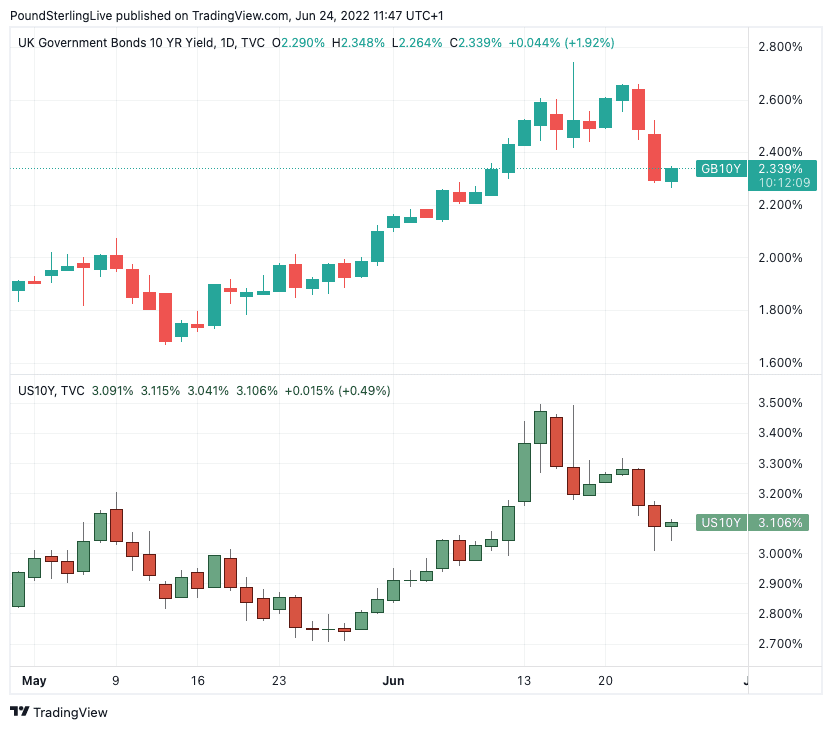

Reflecting this shift in expectation is a fall in the yield paid on government bonds.

French and German 10-year bond yields fell 20bps in the wake of Thursday's disappointing PMI data, the UK's by contrasted fell by a more muted 12bps as UK PMIs defied expectations by coming in stronger than expected.

This provides a compelling explanation for the rise in the Pound-Euro exchange rate in the wake of the PMIs.

Above: German (top) and French (bottom) ten year bond yields.

"Although it's not yet set in stone that a recession is unavoidable, all the doom and gloom has taken the shine off the aggressive tightening expectations that market participants had priced in for the major central banks. Investors have switched from scaling up their rate hike bets to downgrading their predictions of the terminal rates," says Raffi Boyadjian, Lead Investment Analyst at XM.com.

The Dollar has been the major beneficiary of the ramping up in rate expectations as it is the Fed leading the charge in hiking as it grapples with surging U.S. inflation.

But raising interest rates only pushes inflation lower because it slows economic growth.

And it is rising fears of a growth slowdown, one that could result in recession, that has in turn seen investors cool their expectations.

The bet therefore is the Federal Reserve will deliver further aggressive hikes in the near-term and then end its cycle before cutting again.

"A look at the US OIS strip would suggest that it is now pricing in a shallower Fed tightening cycle with the first 'rate cut' almost priced in for H223," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Above: UK ten year bond yields (top) and U.S. ten year bond yields (bottom).

Because the other major central banks can't afford to be left behind by the Fed they will follow a similar path.

Until rate hike expectations turn higher again the Dollar could struggle to build upside traction, allowing the likes of the Pound and Euro to recover.

"The USD has generally struggled to extend its recent gains," says Marinov. "This is partly because the US rates and UST yields have similarly failed to hit new highs."

"It almost looks as if the markets have concluded that the Fed has finally reached peak hawkishness. If this is confirmed in the coming weeks, it will corroborate our belief that a lot of Fed-related positives are in the price of the overbought and overvalued USD," he adds.