GBP/USD: Analyst Opinion Divided Ahead of BoE Decision

- Written by: James Skinner

- GBP/USD regains 1.31 ahead of BoE

- Analyst opinions divided over impact of BoE decision

- Some see scope for extended recovery in short-term

- Others warn of disappointment & eye slip below 1.30

Image © Adobe Images

The Pound to Dollar exchange rate extended a tentative rebound from some of its lowest levels since November 2020 during the mid-week session although analyst opinion about the outlook for Sterling remained divided ahead of Thursday’s Bank of England (BoE) monetary policy decision.

Pound Sterling traded as low as 1.30 against the Dollar during the opening session of the week before recovering above the 1.31 following Wednesday’s Federal Reserve interest rate decision and ahead of Thursday’s equivalent from the BoE.

While the Fed decision will almost inevitably impact Sterling and U.S. Dollar exchange rates ahead of Thursday’s update from the BoE, it’s the latter over which analyst opinion is most divided; with some seeing scope for the event to bolster the Pound-Dollar rate’s rebound while others beg to differ.

“Many of the policy makers who voted for 50bp last meeting have suggested their call was “finely balanced”, which has softened expectations that we will see the same vote split this time. Meanwhile, GBP is close to its lowest levels since November 2020, suggesting sentiment around the currency is currently quite downbeat,” says Dominic Bunning, European head of FX research at HSBC.

“If we do indeed see some renewed votes for a larger hike this month, then it would likely benefit GBP in the short-term,” Bunning said on Wednesday.

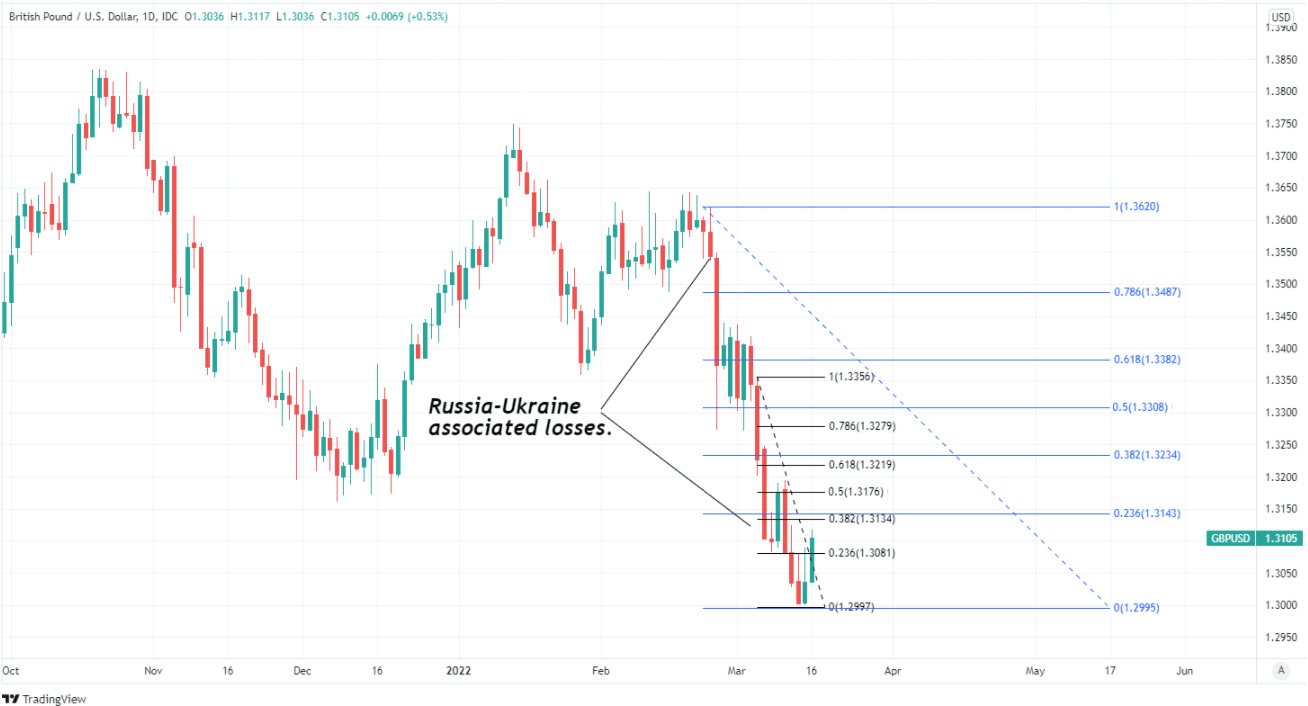

Above: Pound-Dollar rate shown at daily intervals with Fibonacci retracements of late February and early March declines indicating possible areas of short-term resistance for Sterling.

- GBP/USD reference rates at publication:

Spot: 1.3100 - High street bank rates (indicative band): 1.2640-1.2733

- Payment specialist rates (indicative band): 1.2980-1.3040

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The BoE is widely expected to lift Bank Rate for a third consecutive time in a decision that would take the benchmark back to the pre-crisis level of 0.75%, marking a complete withdrawal of the monetary stimulus provided by earlier cuts in the benchmark since the onset of the coronavirus crisis.

But this step has been well priced-in by the market and there’s a chance - if not likelihood - that guidance about future policy decisions will rankle with those parts of the market that have bet heavily on a significant number of further interest rate rises being announced later this year.

This is all the more likely given that market expectations for Bank Rate have risen substantially since the Russian military crossed into Ukraine in late February.

“We would expect the bank to push back against the notion of a quick move towards the terminal rate, currently around 1.50%. Should the bank prove to moderate what is priced into the strip, we would expect front end US-UK spreads to move further in favour of the USD,” says Jeremy Stretch, head of FX strategy at CIBC Capital Markets.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Such a move would support the prospect of GBP/USD heading back towards 1.2830, this marks the mid-point of the trading range over the last two years (1.1412-1.4248),” Stretch wrote in a note to clients on Wednesday.

For its part in the affair the BoE indicated several times in February that it thought market expectations for Bank Rate were already on the excessive side even before the Russian military first crossed the border into Ukraine on February 24.

However, since then the market-implied level of Bank Rate for year-end has risen further from 1.8% on February 24 to 2.05% on Wednesday, which implies that investors think the conflict in Ukraine is likely to necessitate a steeper upward climb for interest rates.

That’s despite at least one member of the BoE’s Monetary Policy Committee, Michael Saunders, having said since the invasion began that it’s too early for policymakers to determine whether the conflict is something that would necessitate any action from the bank.

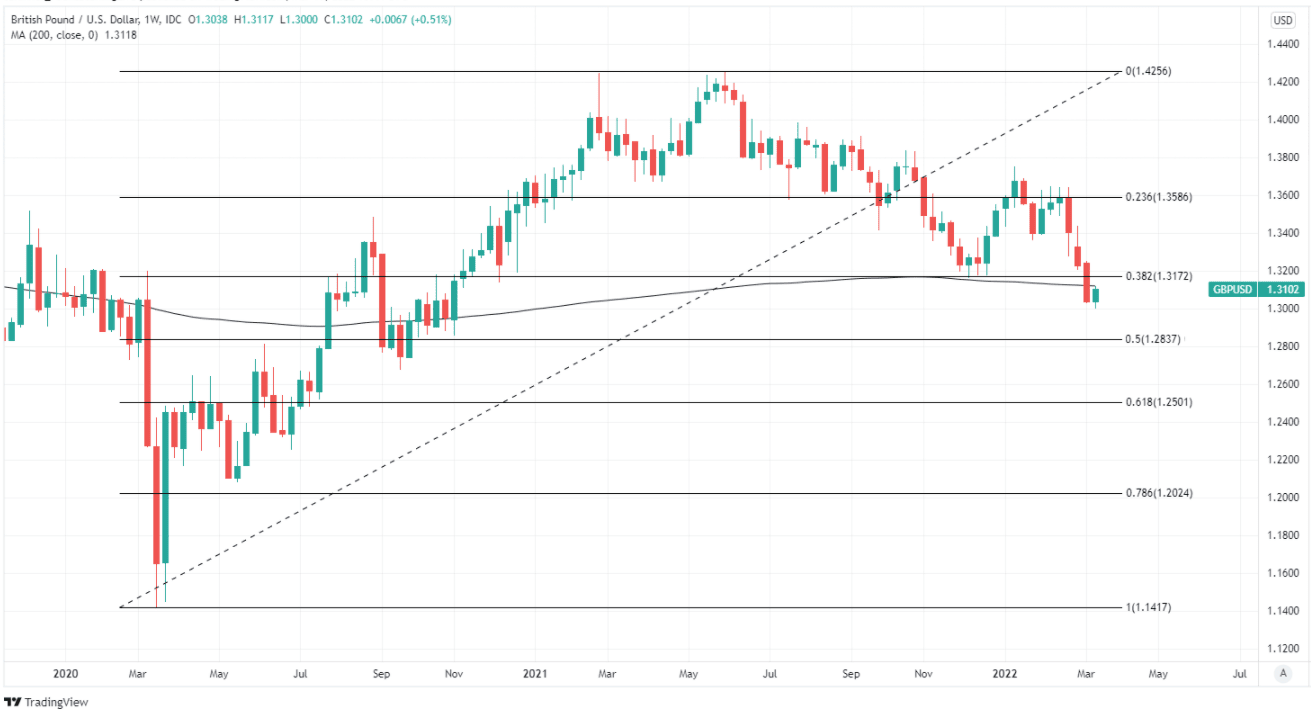

Above: Pound-Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 recovery indicating possible areas of medium-term technical support for Sterling. Also shows 200-week moving-average undermined by early March losses.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“Having been of the view that the BoE could deliver a hawkish surprise in both December and February, we are prepared to take this risk again,” says Shahab Jalinoos, head of FX trading strategy at Credit Suisse.

“If we are wrong, and the BoE chooses to ignore its inflation mandate as many economists are calling for and delivers a “dovish hike” that sees priced-in hikes dissipate, we would expect GBPUSD 1.3000 to break in short order and we would target 1.2870,” Jalinoos said on Wednesday.

Thursday’s policy decision comes after inflation rose to 5.5% in February - more than twice the BoE’s two percent target - and ahead of a Spring period that is expected to see the annual measure of price growth rising even further.

Although many of the factors lifting inflation are beyond the BoE’s control, there are some which it can influence and given that companies, households and financial markets are increasingly anticipating a protracted period of elevated inflation; the BoE could be minded to act further in the months ahead.

The language contained in the looming policy decision and accompanying minutes from the MPC meeting will be scrutinised closely by the market on Thursday for clues about the extent to which the BoE may be likely to meet the high for interest rates set by markets in recent weeks.