Buying the Dollar an "Abundantly" Crowded Trade: BMO Capital Markets

- Written by: Gary Howes

The market is heavily positioned for further Dollar upside, to the extent that positioning is now overcrowded heading into the crucial November 03 Federal Reserve meeting policy meeting (FOMC).

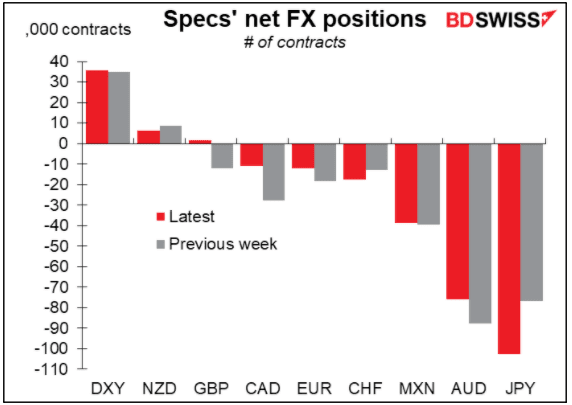

The most recent CFTC Commitments of Traders report shows positioning for Dollar upside remains the most popular bet amongst G10 currencies, to the extent that investors now hold their largest net long U.S. Dollar position since early 2020.

"The bulk of this long-USD position has been built since the August 24 IMM positioning survey conducted by the CFTC," says Stephen Gallo, Head of European FX Strategy at BMO Capital.

Image courtesy of BD Swiss.

"The position hasn't gone against those holding it as the USD is up about 0.3% since late August, but it hasn't exactly been a home run, and now it is abundantly clear that it is a crowded trade," adds Gallo.

Gains for the Dollar come as investors raise bets the Federal Reserve will commence a taper of its asset purchase programme (bringing an end to quantitative easing) in November, while laying the groundwork for a potential interest rate rise in 2022.

The Dollar has also benefited more broadly from an ongoing U.S. economic recovery that has outperformed the global recovery, while intermittent periods of dour investor sentiment also prompted investors to reach for Greenbacks.

BMO Capital says the U.S. Dollar could rally through "roughly the day after the November 3 FOMC and then reverse lower".

"We still think there should be a little bit of a confirmation rally after the Fed lays down its taper timetable on November 3," says Gallo.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Fed is expected by the market to announce it will taper asset purchases on November 03 and offer guidance consistent with a series of interest rate hikes commencing in 2022.

Further potential catalysts to a stronger Dollar include the renomination of Powell as FOMC Chairman, particularly if it occurs between now and November 5 or so says Gallo.

However, BMO Capital views last week's U.S. Dollar decline as a likely sneak preview of what they think will happen between the November FOMC and calendar year-end.

"That is a time period when leveraged investors normally dial back positions and the biggest FX position they've got to unwind is long-USD," says Gallo.