GBP/USD Tipped to Fall Further on Brexit & Fed Combo says ACY Securities

Image © Adobe Images

- GBP/USD to fall as Pound weakens and Dollar rises

- Brexit drama to push down Sterling

- Fed recalibration to support U.S. Dollar

The Pound-to-Dollar exchange rate is forecast to extend lower by strategist Russel Sandiford of ACY Securities.

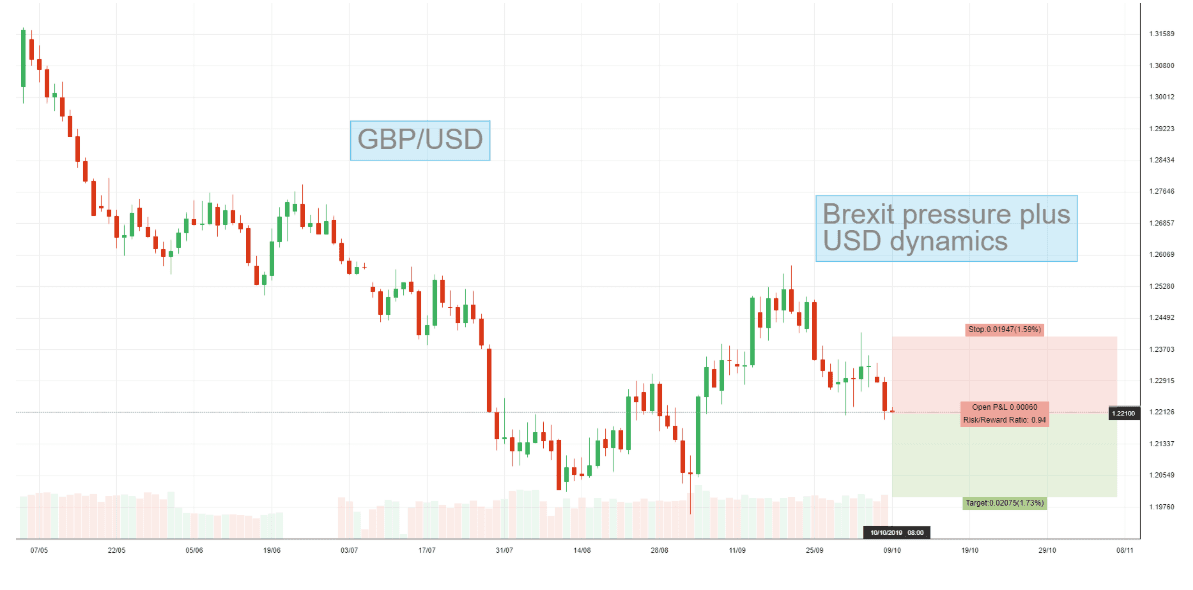

GBP/USD is currently located at 1.2211, having gone as high as 1.2522 in late October, and Brexit headlines will likely extend the Pound's weakness whilst the U.S. Dollar could strengthen from a variety of short-term drivers.

The main reason for expecting the Pound to weaken is that the UK government is taking an increasingly hardline in Brexit negotiations with Brussels and this is raising the probabilities of a 'nob deal' exit.

This is reflected in Downing Street's recent admission following a phone call between Prime Minister Boris Johnson German Chancellor Angela Merkel that a deal was now almost “impossible”.

The previous base-case scenario at ACY Securities was of an extension followed by a general election; both of which were seen as inconclusive but mildly positive for Sterling.

But Johnson’s increasingly trenchant stance suggests a heightened risk of a hard-Brexit, perhaps even on October 31, with a negative outcome for Sterling.

“Bottom line, a UK election is still possible, but a hard exit seems more likely now that we are only (22) days away from the October 31 deadline. This all equals Sell the GBP and play against the USD or Yen,” says Sandiford.

The U.S. Dollar side of the pair, meanwhile, is seen as potentially rising from a combination of three possible sources.

The first is that inflation data out on Thursday at 13.30 BST could be higher than expected, and this could lead to expectations the Federal Reserve might hold off from cutting interest rates as soon as the market is expecting.

Lower interest rates weaken the Dollar as they make the U.S. a less attractive place for investors to park their money, reducing net inflows. So, holding off from making another rate cut would help support the currency.

The second factor is that trade talks between the U.S. and China starting on Thursday might yield a small ‘win’. Although Sandiford does not state what form this might take other analysts have suggested the U.S. may extend the October 15 deadline for the imposition of higher 30% tariffs on $250bn of Chinese imports, currently tariffed at 25%.

The third factor which could boost USD is that the minutes of the September Fed meeting, out on Wednesday at 19.00 BST, may reveal a more optimistic outlook.

This, however, may now be less likely after Fed official Charles Evans said he wouldn't mind another rate cut yesterday, Tuesday 9. Although Evans is a known dove his comments represented a more unequivocally dovish stance than before and come as markets grow more pessimistic about the U.S. economy.

Based on the analysis, Sandiford forecasts GBP/USD to weaken to a target at 1.2000 and advocates the placing of a stop-loss order at 1.2400 in case the rate goes the other way.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement