New Zealand Dollar Charges On, GBP/NZD Eyes Potential Landing Zones

- Written by: Gary Howes

Image © Adobe Images

The pound to New Zealand dollar exchange rate is expected to remain under pressure against major counterparts shows a new analysis.

The move is driven by sustained New Zealand dollar strength and a widening divergence in interest rate expectations.

GBP/NZD has fallen for four consecutive sessions and appears poised to record a fifth daily decline as selling pressure on the pound persists.

The pair is now down around 2.0 per cent over the past week, marking a sharp reversal from a trend that saw GBP/NZD almost exclusively move higher through much of 2025.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The speed and persistence of the decline risks a material shift in sentiment rather than a routine corrective pullback.

✳️ One key driver is the New Zealand dollar’s apparent immunity to the so-called 'Greenland trade', built around the EU-U.S. spat that has weighed on sterling.

New Zealand’s political and geographical distance from Europe is proving supportive at a time when pound sentiment is being undermined by region-specific trade and geopolitical risks.

✳️ Potentially of more significance to NZD is money market pricing that indicates investors increasingly expect the Reserve Bank of New Zealand to raise interest rates later this year.

That outlook contrasts sharply with expectations for countries such as the UK, where rate cuts remain the dominant scenario, creating a growing policy divergence that favours the New Zealand dollar.

This divergence has become a powerful driver in FX markets, amplifying NZD gains against currencies where easing cycles are either underway or firmly priced.

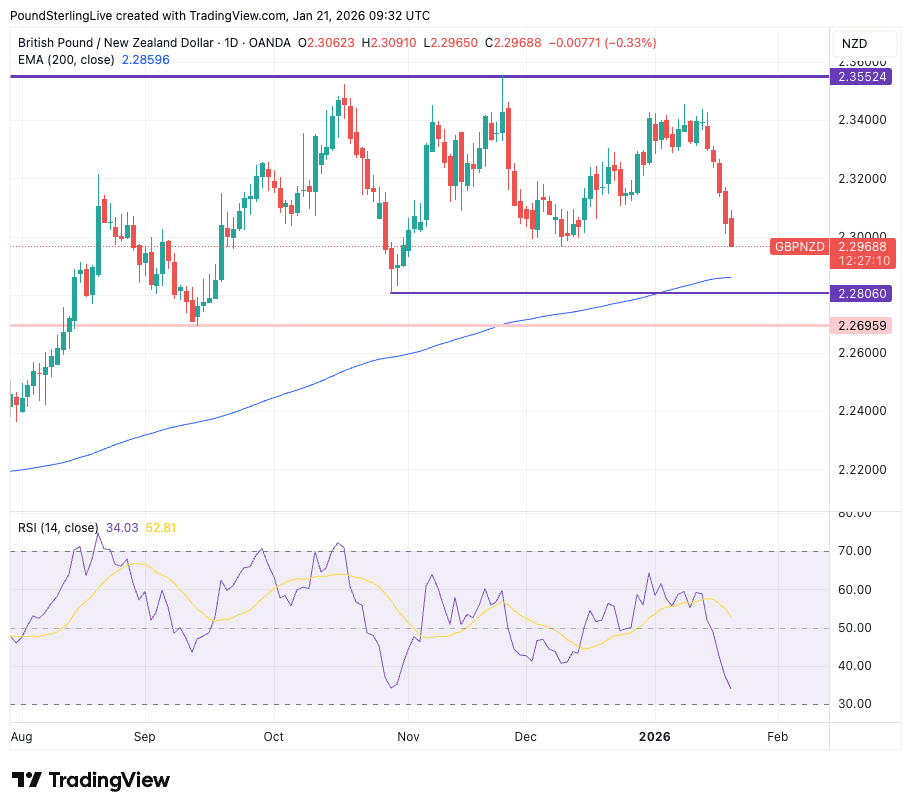

From a technical perspective, traders are now focusing on potential landing zones as GBP/NZD probes deeper into territory not seen for several months.

Initial support is eyed near 2.2972, a horizontal level that has acted as a floor on multiple occasions since August 2025.

✳️ A deeper move would bring the 200-day exponential moving average at 2.2859 into focus, a level the pair has not broken below since 2023.

Technicians warn that a confirmed break beneath the 200-day EMA would mark a significant shift in the long-term outlook, signalling that the tide has turned decisively against the pound.

Below that area, 2.28 is seen as the next downside target before attention turns to the more substantial support zone around 2.2695.

For now, traders say the combination of resilient New Zealand dollar fundamentals, supportive rate expectations, and a softer pound backdrop leaves risks skewed toward further GBP/NZD losses.