New Zealand Dollar Outperforms as RBNZ's Negative Rate Rethink Reinforces Uptrend

- Written by: James Skinner

-NZD outperforms as RBNZ begins rethink of negative rate bid.

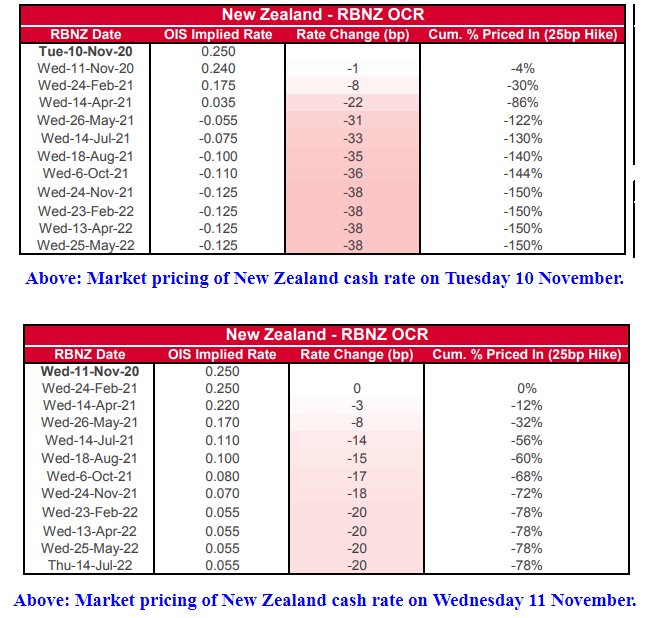

-Market prices out subzero rates, sees 0.10% cash rate in 2021.

-NZD/USD eyes 0.70 after breakout, GBP/NZD under pressure.

Above: RBNZ Governor Adrian Orr. File Image © Pound Sterling, Still Courtesy of Financial Services Council NZ

- GBP/NZD spot rate at time of writing: 1.9320

- Bank transfer rate (indicative guide): 1.8725-1.8861

- FX specialist providers (indicative guide): 1.9113-1.9229

- More information on FX specialist rates here

New Zealand's Dollar swept higher on Wednesday after the Reserve Bank of New Zealand (RBNZ) indicated that it may no longer cut its cash rate below zero next year, prompting a sharp repricing of market expectations for the cash rate while bolstering the outlook for the currency.

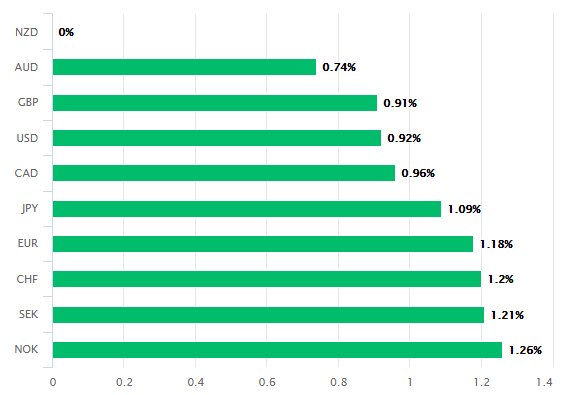

The New Zealand Dollar topped the board among major currencies after the RBNZ said in its November monetary policy statement that Kiwi interest rates could be higher next year than it had guided for at the time of its August update.

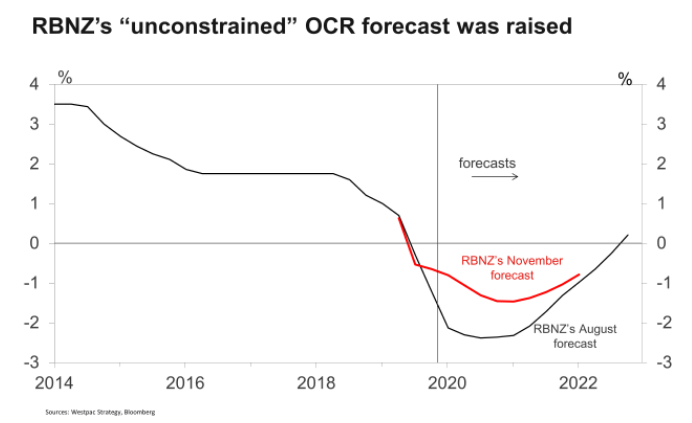

RBNZ policymakers still sought to convince markets that New Zealand's cash rate will fall below zero next year but lifted their 'unconstrained OCR forecast" by around 130 basis points for September 2021, suggesting they think the likely bottom for interest rates is much higher than it was back in summer.

"New Zealand’s success in containing the pandemic combined with optimism about a vaccine meant that the central bank’s warning about a negative interest rate and the potential purchase of overseas asset fell on deaf ears and NZD/USD pushed higher," says Michael Every, a global strategist at Rabobank.

Above: New Zealand Dollar performance against major currencies on Wednesday. Source: Pound Sterling Live.

The bank left its actual cash rate unchanged at 0.25% and did not alter its commitment to buy up to NZ$100bn of Kiwi government bonds over the coming months under the quantitative easing programme that's designed to reduce borrowing costs for government, companies and households.

It also announced a new programme called 'funding for lending' that will provide commercial lenders with cheap cash that is priced at the level of the official cash rate, enabling them to offer even lower cost loans to customers, with the programme set to open in December.

But it was guidance on the cash rate that caught the attention of the New Zealand Dollar, analysts and economists, who've all since rethought expectations for a 2021 shift to a negative interest rate policy.

"The “unconstrained OCR forecast” trough was raised by 90bp, with the Sep 2021 point 130bp higher, The RBNZ appears to have recognised the positive developments in the NZ economy since August," says Dominick Stephens, chief economist for New Zealand at Westpac. "One possible explanation for these positive market responses is that today’s fresh stimulus may be seen as potentially fuelling the economy (especially housing) further, lessening the need for additional stimulus in future."

Above: Westpac graph showing RBNZ's unconstrained OCR forecasts from August and November.

The RBNZ has warned for months that it will likely cut the cash rate below zero in April 2021 and has also said that it could consider foreign asset purchases - involving large sales of Kiwi Dollars - as part of an effort to keep the currency in check. But superior Kiwi virus containment and a faster than anticipated recovery of activity have increasingly underpinned expectations of a robust rebound of late, which the RBNZ acknowledged on Wednesday.

Economic recovery expectations were bolstered further this week when Pfizer and its partners said their coronavirus vaccine candidate had demonstrated a high level of effectiveness, raising hope that an immunisation product could soon further reduce the need for so-called lockdowns of economies.

Vaccine progress came as a likely election victory of opposition challenger Joe Biden of the Democratic Party in last week's U.S. election, reducing the threat to China's economy from U.S. trade policy.

This is all a boon for Kiwi economy and Dollar given China is NZ's largest trade partner and the Kiwi is sensitive to expectations for global growth.

Above: Westpac graphs showing RBNZ's unconstrained OCR forecasts from August and November.

"The evolving balance of risks suggests less justification for rushing into a negative OCR. We are now forecasting an RBA-style 15bp cut to 0.10% at the May MPS, with a highly conditional further 35bp cut in August taking the OCR to -0.25%," says Sharon Zollner, chief economist at ANZ. "The odds we’ll see a negative OCR have fallen – on balance we still see it as more likely than not, but it’s no longer a high conviction call."

The RBNZ's changes to its unconstrained OCR forecasts combined with this week's vaccine progress and the outcome of the U.S. election have each helped to encourage a sharp shift in investor expectations for benchmark interest rates in New Zealand, which by this Wednesday, were expected to bottom out at 0.055% in early 2022.

On Tuesday, markets saw the cash rate bottoming out at -0.11% in August whereas the previous week it was seen falling as low as -0.5% in 2021.

"We have changed our outlook for the OCR. We no longer expect further OCR cuts in the new year, but that’s conditional on the Funding for Lending Programme (FLP) being effective in lowering interest rates in the economy. The economy still needs stimulus, but the FLP may now be enough. Our previous forecast of a 75bp OCR cut in April to -0.5% looks too big and too soon," says Nick Tuffley, chief economist at ASB Bank.

Above: NZD/USD shown at weekly intervals, overcoming the 61.8% Fibonacci retracement of the multi-year downtrend.

"The risks are still skewed towards a lower OCR than the current 0.25%. If the FLP turns out to be a damp squib, then the RBNZ may need to resort to cutting the OCR to get the desired impact on bank lending rates. Furthermore, there is still a lot that can go wrong yet, such as a serious community outbreak in NZ or risk of more marked global economic impacts from the current renewed wave of COVID infections in Europe and the US. And, vaccine hopes could end up being dashed. But for now, we expect the RBNZ will implement the FLP, and reassess developments next year," Tuffley adds.

This week's shift in financial market pricing of the RBNZ cash rate has lifted the New Zealand Dollar sharply, taking NZD/USD convincingly above the 61.8% Fibonacci retracement of a multi-year downtrend that began in early 2017 and placing it on course for a return to 0.70 and above.

Meanwhile, Kiwi strength has pushed the Pound-to-New Zealand Dollar rate back toward the bottom of 2020's range, where it enjoys the support of a major Fibonacci retracement from its post-referendum recovery peak as well as its 200-week moving-average.

Sterling has attempted but failed to break below this level repeatedly in 2020.

The Pound's performance will be determined in substantial part over the coming weeks by progress in the Brexit trade negotiations, or a lack of it, although the British currency was resilient on Wednesday in the face of reports suggesting that the two sides will miss a mid-November deadline for a deal to be done.

Above: Pound-to-New Zealand Dollar rate, at weekly intervals, approaches 50% Fibonacci retracement of post-referendum trend and 200-week moving average (black line.