Traders Flip into Bear Mode on Pound Sterling, but this Could be a Good thing for the Bulls

Image © Rawpixel.com, Adobe Stock

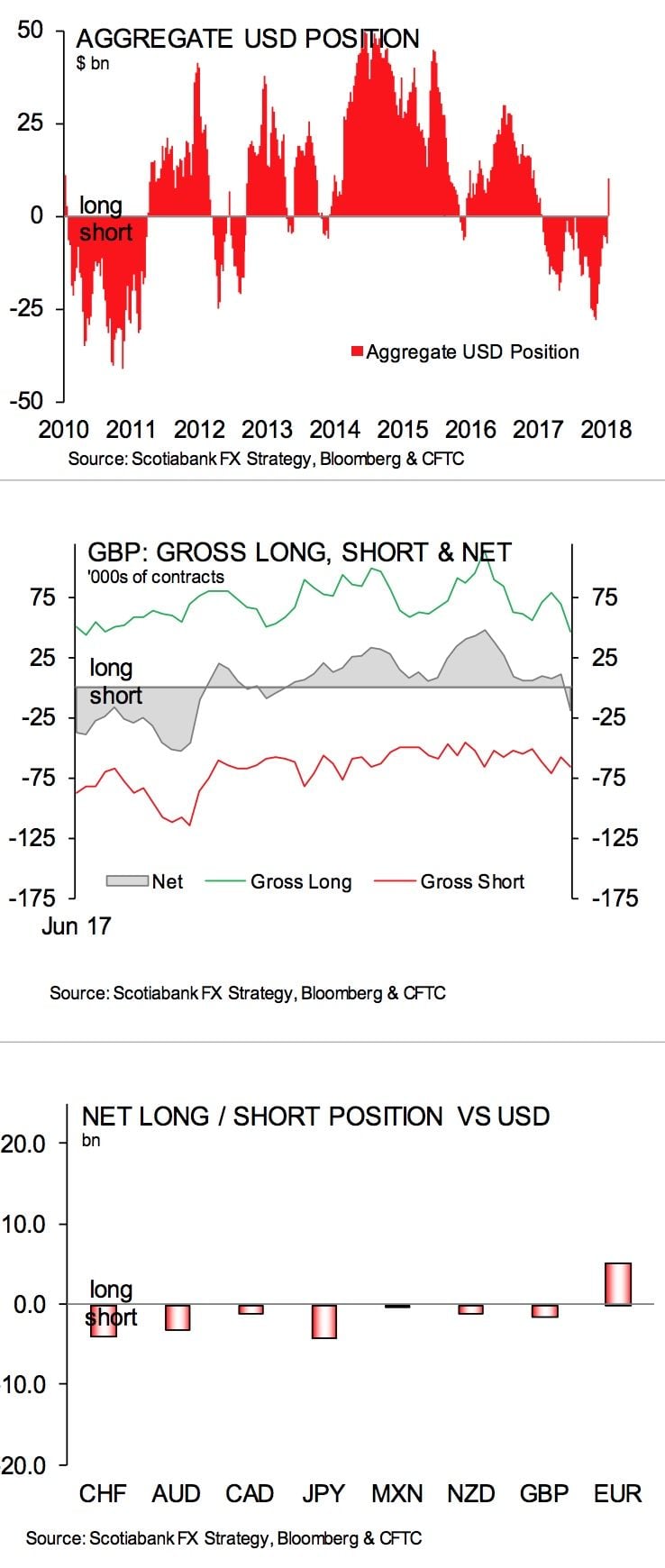

Global foreign exchange markets have just endured a notable flip in trader sentiment according to the latest and most expansive data available on the matter provided by the US Commodity Futures Trading Commission.

The CFTC's latest International Money Market (IMM) report providing data for the week through June 15th shows some significant positioning changes among speculative and leveraged traders who have cut bullish bets on the Euro, British Pound and Japanese Yen.

In the process, traders have turned a previously held aggregate short USD position of around USD7bn into a net long USD position of just a shade of USD10bn — "the first sniff of bullish sentiment on the USD in a year," says Shaun Osborne at Scotiabank in Toronto.

IMM speculators are now on aggregate betting on declines in the British Pound for the first time in seven months.

Shifts in sentiment can often signal the start of an enduring trend, but for Sterling it could also be suggestive of the potential for a reversal higher following weeks of losses agains the Dollar, but only should data or events go in favour of the currency.

"This is due to the lower risk of GBP long liquidation exerting a material influence over price action if fundamental factors negatively impact the Pound, given that gross GBP longs were slashed by a third to 46,892 contracts in the week to June 19," says Robert Howard on the Thomson Reuters currency desk saying the potential for a snowball-type sell-off created by traders liquidating bets is now reduced.

Gross GBP shorts were simultaneously upped by 13% to 66,098 contracts.

"This could work in the Pound's favour if events are positive for sterling, as some of those recently instigated GBP shorts might then get squeezed out," adds Howard.

The British Pound has struggled against the US Dollar since mid-April after a regime shift in global markets saw the US currency embark on a strong and sustained rally against its peers.

This rally could be questioned if the market has finally flushed out its long bets on the Euro, Yen and Pound.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.