British Pound Off Highs vs Dollar, Euro as Wage Data Disappoints but UK Unemployment Falls Below Key Threshold

- Written by: James Skinner

Labour market data released mid-week has proved to be a mixed bag for Pound Sterling with static wage growth being offset by another fall in UK unemployment.

The UK economy continues to employ more people, but wages are still growing at an uninspiring pace suggest the latest labour market data from the Office for National Statistics.

Pound Sterling eased off recent highs on news that UK wage growth read at 2.1% in July, unchanged on the previous month's figure.

Markets had forecast 2.3% growth, and it is because of this miss on expectations that the Pound has edged lower.

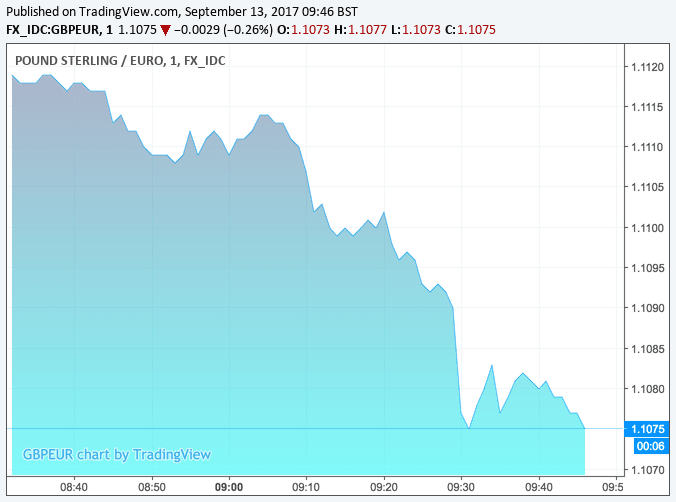

The Pound-to-Euro exchange rate is quoted at 1.1077, having gone as high as 1.1133 earlier in the day. The Pound-to-Dollar exchange rate is quoted at 1.3282, having gone as high as 1.3329.

There was however unequivocal good news in that the unemployment rate had fallen to 4.3% in July, while the claimant count fell by 2.8K.

Make no mistake - this is an economy still adding jobs, but that wages are not finding traction will puzzle many.

Good News! The number of people in work in the UK increased by 181,000 in the 3 months to July 2017 to a new record high of 32.1 million

— Shaun Richards (@notayesmansecon) September 13, 2017

With wage growth at 2.3%, and inflation at 2.9%, it is clear the average citizen is getting poorer.

This will have a knock-on effect on spending elsewhere in the economy and might help explain why the UK's economic growth rate has come off the boil in 2017.

"While the continued strength of employment will be welcomed by the MPC, the continued absence of a pick-up in wage growth is likely to keep the doves in the majority. And with inflation reaching 2.9% in August, the squeeze on households’ real incomes probably intensified. That would make the risk of a sharper downturn in consumer spending the overwhelming concern to the majority of the MPC members," says Andrew Wishart, UK Economist at Capital Economics.

The Bank of England will brief markets with their latest assessment of the economy and ideas on interest rates at mid-day, Thursday September 14.

Above: The Pound had actually been trending lower ahead of the release of UK labour market data out at 09:30, suggesting traders are clearing the decks ahead of the Bank of England policy decision, due Thursday.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

The Pound's Outlook Rests with the Bank of England

The labour market data presents a dilemma for the Bank of England whose Monetary Policy Committee are meeting today.

On one hand wages are not showing signs of lift-off, while on the other employment is growing at a decent clip and underscores the resillience of the economy.

The debate among economists over when the BoE will eventually move rates higher has evolved in recent weeks with the view policy-makers might look to raise rates sooner rather than later gaining in popularity.

Boosting this case is the news that the unemployment rate fell further below the Bank of England’s estimate of the equilibrium rate to 4.3%, down from 4.4% in the three months to June.

The equilibrium rate is the level beyond which further falls generate notable increases in employment, the thinking going that labour becomes increasingly scarce and companies must therefore pay more.

Thus, the story of wage rises could be one that characterises coming months. If the Bank of England shares this view, Sterling should move higher as it suggests the Bank is confident it can start fighting inflation while not jeopardising economic growth.

"With the unemployment rate moving down to 4.3% - much sooner than the Bank of England envisaged - and below the MPC’s estimate of the ‘equilibrium’ unemployment rate (4.5%), the pressure on the BoE to reassess their views on the labour market will continue to build," says Nikesh Sawjani, UK Economist at Lloyds Bank.

As inflation rises further, Sawkani believes workers may yet become more assertive in their wage demands to resist the depletion of their purchasing power.

"A more rapid pace of wage growth would raise concerns for some Bank of England policymakers that higher inflation is becoming embedded in expectations, warranting a tighter policy stance," says the economist.

Expectations of more hawkish rhetoric have mounted since Tuesday’s inflation data showed consumer price growth threatening the 3.0% threshold.

The Pound rose broadly against the G10 basket in response to the news, touching a one-year high against the Dollar, while the Pound-to-Euro rate reached its highest level since the beginning of August.

While the Pound has been enjoying gains of late, there are concerns that the move will be temporary in nature as the ever-present uncertainty generated by Brexit keeps the economy performing below par and leaves the Pound exposed to the UK's unhlepful trading deficit.

“We expect Sterling to resume its decline before long, as the macro data flow show further UK growth deceleration,” says Guy Stear, an economist at Societe Generale. “Sterling is fundamentally affected by the deeply negative combination of a sizeable current account deficit and significantly negative real interest rates.”

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.