British Pound Hit by Speculative "Fast Money" Sellers, Euro Most Undervalued Currency, US Dollar Still Overvalued: Allianz's Dwane

- Quotes:

- Pound to Euro exchange rate today: 1 GBP = 1.0861 EUR

- Pound to Dollar exchange rate today: 1 GBP = 1.2834 USD

Neil Dwane, global strategist at Allianz Global Investors argues fast money appears to be behind the ongoing decline in Pound Sterling with 'true investors' likely to have already positioned for Brexit worries.

The Pound to Euro exchange rate is under scrutiny at present having recorded fresh eight-month / eight-year lows.

The timeframe chosen depends on whether you want to account for the lows reached during the flash-crash in October 2016 which were fleeting or discount the flash and look at the lows recorded in the wake of the financial crisis.

The latest push lower in Sterling appears to be driven by speculative accounts.

“I would argue most of the corporate and true investors who are worried about Brexit have already take protection on their Sterling assets,” says Dwane in an interview with Bloomberg. “In which case this is noise, speculation, this is fast money.”

Seperately, Allianz have told Pound Sterling Live that the Pound, "has taken the strain for Brexit and will continue to do so, hence may remain weak."

Allianz believe the Pound is undervalued by about 10-12%, "but we do think it can go down on Brexit."

The currency’s undervaluation has come under scrutiny of late with analysts putting the degree of undervaluation in the region of 4-20%.

But, the problem for those looking at this undervaluation and thinking 'surely the Pound must recover to fairer value', is that the Euro is also still heavily discounted.

“We think the most undervalued key currency in the world is the Euro,” says Dwane. “And so the recent strength is not a surprise to us in fundamental terms.”

In fact, “on a strategic, maybe two to three year view, it’s at least another 15% up,” says Dwane noting “international investors are underweight the Euro.”

The Euro has been artificially devalued by the European Central Bank who have pushed basic lending rates in the Eurozone to record lows for a sustained period of time while conducting massive asset purchases currently running to the tune of €60BN / month.

But an improving economy has meant that these actions at the ECB are no longer warranted and investors have started bidding the Euro to fairer levels in anticipation of the ECB ending its programme.

However, the Euro shows us that a currency can stay undervalued for persistent periods, therefore expectations for a recovery in Sterling might be misplaced.

Yet Dwane says that should the Pound weaken further, “we would be looking and telling our clients globally to buy Sterling assets if we saw more weakness.”

The markets is looking relatively neutral in terms of positioning on Sterling and Allianz believe the the currency could therefore absorb further selling pressures.

But the long-term prospects are not all bad.

Allianz note that Sterling been, along with the Swiss franc, a safe haven in Europe for Europeans.

“Many international investors are very comfortable with UK Law and taxation and thus will look to add to UK assets through property and possibly corporate assets,” says Dwane.

Furthermore, Allianz believe London’s financial importance will remain after Brexit to Europe and global markets.

So longer-term, an undervaluation of Sterling will likely be reversed, but patience is required.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

The US Dollar Still Overvalued, Italy a Key Risk to Euro

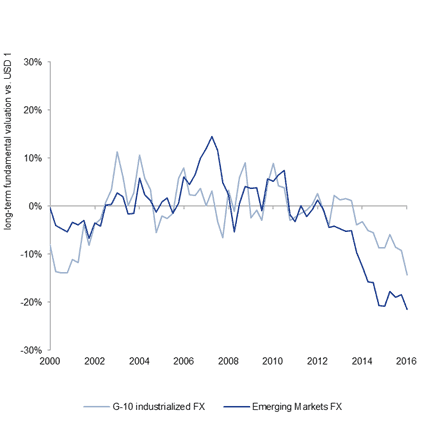

Allianz believe that the Euro and Sterling are undervalued on a longer term basis while the US Dollar is overvalued against almost all currencies, both developed and emerging.

The observations on the Greenback are made even as the currency is seen as being one of the worst-performing majors in 2017.

Further views on the Euro are interesting as Allianz do strive to remind us risks to the outlook.

While the ECB has been responsible for Euro undervaluation in the past, so too have political tensions ahead of the election super-cycle in 2017 and it is seen as constructive that Macron can re-energise France and that “Mercron“ can then re-energise the European project.

But the super-cycle is not yet over as it will climax with the Italian elections in 2018.

“Italy remains very negative on the Euro, the Spain v Catalonia referendum may not help,” says Dwane.

However, Euro strength might be hard to suppress:

“EU current account surpluses are Euro supportive, thus the ECB has had to try harder to get the Euro down Clearly the speed of revaluation needs to be paced from an ECB point of view, but some Euro strength adds some pressure politically for reform and change.”

Johnson's Comments on Brexit Bill Points to More Constructive Position

As ING note - it will take a substantial deterioration in Brexit talks to prompt the Pound / Euro rate down to parity.

It would appear that the UK Government is taking the issue seriously with comments from Foreign Secretary Boris Johnson catching market attention.

Johnson, a pro-Brexit figure in the Government who had earlier dismissed talk of paying a bill, has confirmed the UK will meet its obligations on the matter.

Johnson told BBC Radio 4 that the UK would abide by its financial obligations "as we understand them".

The EU has said it wants to see progress made on the matter of the bill before advancing talks. Recent concessions by the UK make this the more likely.

This is positive for Sterling we believe.