HSBC: Pound Sterling "Getting Closer to the End of its Recent Weakening Trend"

- Written by: Gary Howes

Image © Adobe Images

The British Pound is near a long-term base says the UK's largest bank, HSBC.

In a foreign exchange research briefing analysts at HSBC say "after showing signs of vertigo, GBP appears to be finding some balance".

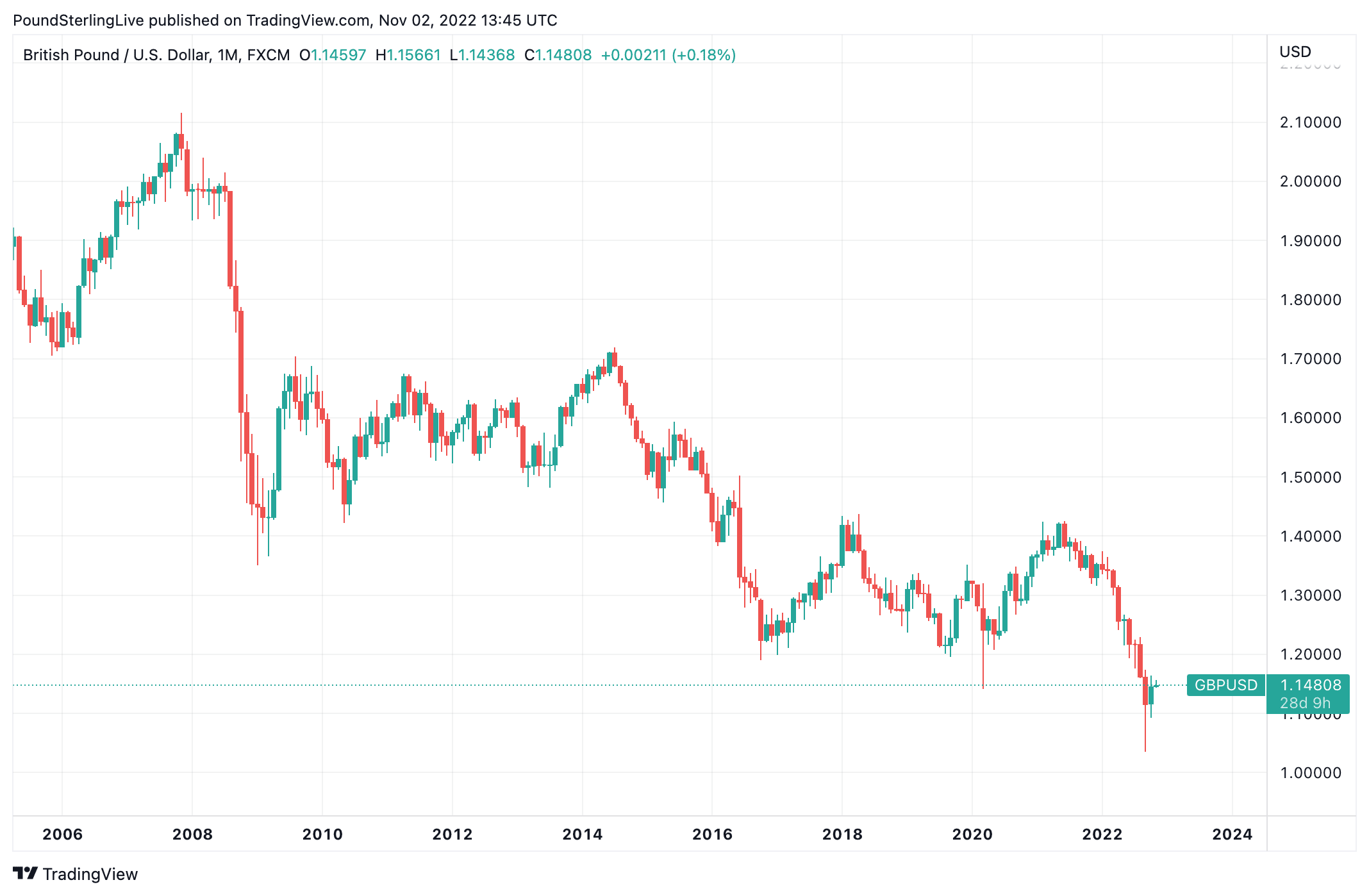

The findings follow an exceptionally volatile period for the UK currency that culminated in a plunge to all-time lows against the Dollar on Monday, September 26.

Declines came after the market reacted to previous Prime Minister Liz Truss' proposed tax cuts which were to be funded by new borrowing, spooking investors who questioned whether the UK's debt position would prove sustainable.

The 'mini budget' debacle came as markets had already been grappling with the UK's long-term and well-known structural issues, namely the budget deficit and the current account deficit.

"These imbalances require the economy, interest rates and the currency to adjust, in order to find some form of equilibrium," explains Dominic Bunning, Head of European FX Research at HSBC.

The Pound has since stabilised against the Dollar, Euro and other major currencies, leading investors to question whether the bottom is now in.

"During previous periods of GBP undervaluation after significant structural, supply-side shocks to the UK economy – in 2008 and 2016 – the currency fell to around 20% below its long-term fair value. With GBP currently around 10% undervalued, a further 10% decline in GBP is plausible," says Bunning.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, such an adjustment lower is not necessarily likely says HSBC's FX research team.

Bunning explains that this time could be different: in 2008 and 2016 UK interest rates were falling, however in 2022 they are rising, explemplified by rising UK bond yields.

"Rates are picking up some of the slack," says Bunning.

Above: Yields paid on UK ten-year bonds. In 2008 and 2016 they were falling, in 2022 they are rising, limiting the scope by which the Pound must adjust lower.

"In 2008 and 2016, UK yields dropped sharply. This meant the currency was doing the heavy lifting to help rebalance the current account deficit and make UK assets more attractive to foreign investors. With UK real rates now at their highest level in over a decade, and the gap versus US rates having narrowed sharply, part of the adjustment in external misalignments will come through this channel," he explains.

Looking ahead, HSBC says the Pound is unlikely to rocket higher and some further downside could be likely from here.

"We still see some modest GBP weakness in the months ahead, but maintain a GBPUSD forecast of 1.10 for the end of 2022 and do not think GBP-USD needs to push towards or below parity," says Bunning.

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Above: GBP/USD at monthly intervals.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks