Soft Retail Sales Curb Pound Sterling Rebound against Euro and Dollar

- Written by: Gary Howes

- Retail sales decline in May

- But monthly read beats consensus expectations

- GBP looks to hold post-PMI gains

- GfK consumer confidence plunges to all-time low

Image © Adobe Stock

UK retail sales fell in May as consumers felt the strain of rising prices, denying the British Pound another much needed boost ahead of the weekend.

The Pound strengthened through Thursday but traded mixed against its main peers on Friday after UK retail sales, including fuel sales, read at -0.5% month-on-month in May said the ONS, which is better than the -0.7% expected.

The figure nevertheless confirms a sharp slowdown when contrasted to the 1.4% growth recorded in April.

UK Retail Sales, with fuel sales included, read at -4.7% year-on-year in May, worse than the -4.5% the market expected and the previous month's reading of -4.9%.

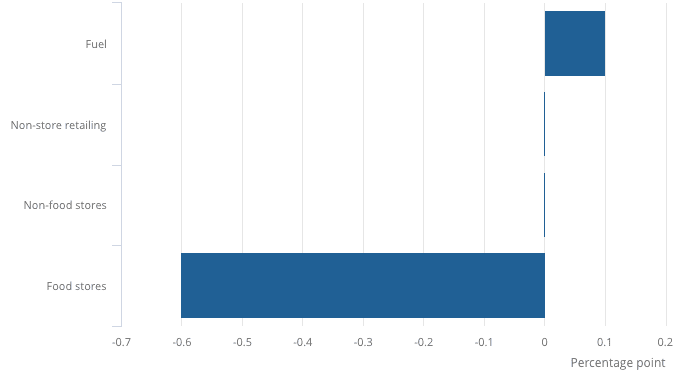

The ONS said the fall in sales volumes over the month was because of a fall in sales at food stores where a decline of 1.6% was recorded in May.

Above: Contribution to monthly growth, volume seasonally adjusted, Great Britain, May 2022 compared with April 2022. "Retail sales in May 2022 were impacted by sales in food stores" - ONS.

The ONS said "reduced spending in food stores seems to be linked to the impact of rising food prices and the cost of living".

This week it was reported UK inflation rose to a new high at 9.1% year-on-year in May with further rises expected by economists.

"Unsurprisingly, consumers are increasingly making purchase decisions based on cost. We've seen a significant dip in sales. With large retailers offering huge discounts, it’s impossible for small independent businesses to compete. We have had a few returning customers asking for favourable rates, which is difficult. We want to help our customers, but we honestly can’t afford to," says Elizabeth McQuillan, an artisan jeweller at Boho Silver.

In the wake of the retail sales data release the Pound will look to hold onto its recent gains made after Thursday's PMI data came in stronger than the market was anticipating.

The Pound to Euro exchange rate is quoted at 1.1644, unchanged on the day's open, the Pound to Dollar exchange rate is quoted at 1.2271, also largely unchanged.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"We remain bearish on sterling given the deterioration of the UK economy and because we expect much less tightening than is still priced in by the UK forward curve. Repricing risk is still a cloud hanging over sterling," says Roberto Mialich, a currency strategist with UniCredit in Milan.

Markets currently expect the UK to experience a significant economic slowdown, and the Pound to come under pressure in response, as rising prices curb consumer activity.

"Affordability may explain some of the falls in recent months," says the ONS.

The ONS' Opinions and Lifestyle Survey, covering the period 11 to 22 May 2022, found that 88% of adults reported that their cost of living had increased over the last month, up from 62% when this question was first asked (3 to 14 November 2021).

The most common reason reported by adults who said their cost of living had increased was an increase in the price of food shopping (93%).

When asked about their shopping habits in the past two weeks, 44% of adults reported that they were buying less food when food shopping.

The ONS says this proportion appears to be increasing, having been 41% in the previous period (27 April to 8 May 2022) and 18% at the beginning of 2022.

"Higher inflation is starting to hit consumer spending harder. More pain probably lies in store for the retail sector over the coming months, but that won’t stop the Bank of England from raising interest rates further," says Nicholas Farr, Assistant Economist at Capital Economics.

Capital Economics continue to expect the Bank of England to raise Bank Rate from 1.25% now to 3.00% next year, higher than the peak of 2.00% expected by the consensus of analysts.

"The new path could now include a 25 bps rate hike at each of the next four meetings between now and the end of the year, with risks of a larger hike, by 50 bps in August or September," says Asmara Jamaleh, economist at Intesa Sanpaolo, referencing the potential outlook for Bank of England action.

"The prospect of a steeper BoE rate hike path should aid a gradual recovery of the pound against the dollar, albeit moderate," says Jamaleh.

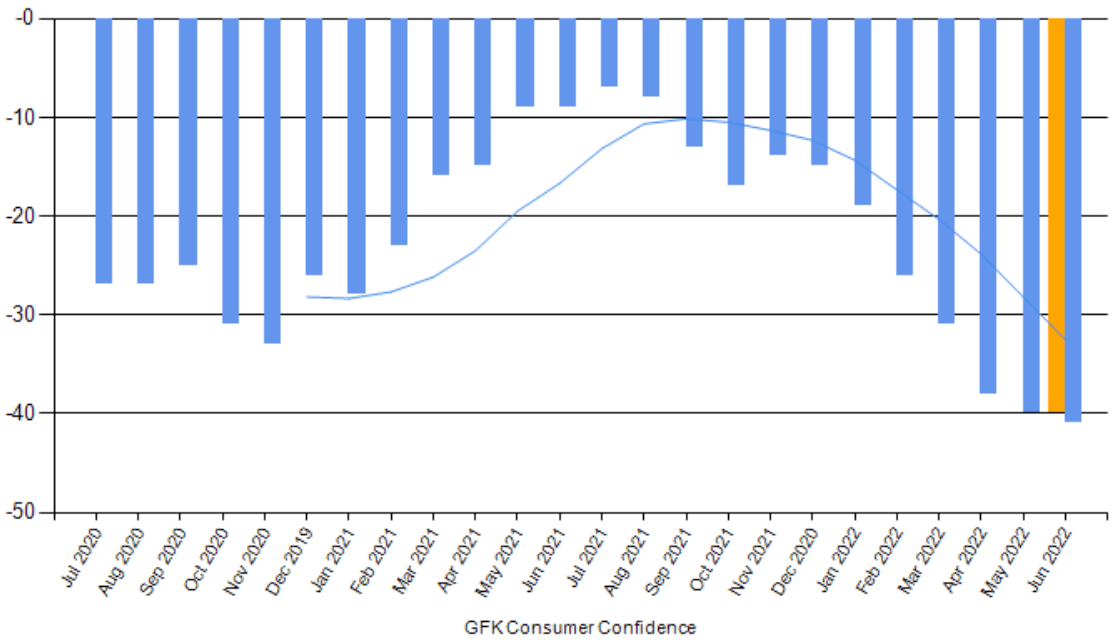

A much watched gauge of consumer confidence meanwhile showed on Friday UK consumer confidence had sank to a new record low this month.

GfK said its consumer confidence index fell to -41 in June from -40 in May, below levels that have previously preceded recessions.

This is the lowest reading recored since the survey was initiated 48 years ago.

Image courtesy of @spreadex. Yellow bar = expected, blue = actual.