Pound Sterling: Delta Wave Shows Signs of Cresting

- Written by: Gary Howes

- Global market recovery aids GBP

- Signs UK's 3rd wave cresting

- But Brexit tensions on the rise

Image © Adobe Images

The British Pound is in the process of recovering ground lost over recent days aided by improving global markets and a slowing in the rate of acceleration in UK covid-19 case growth, although the potential for renewed Brexit tensions could cap sentiment towards the UK currency.

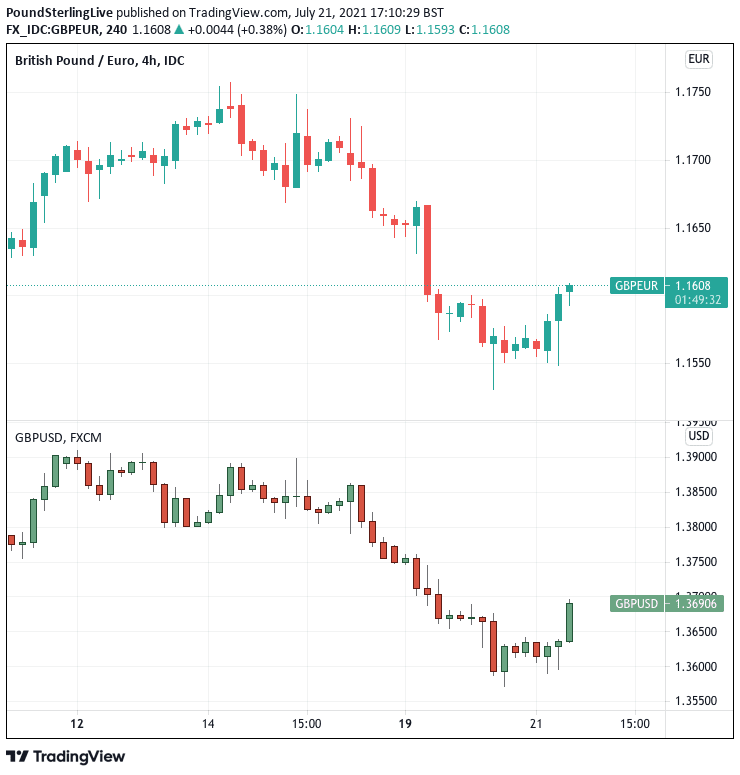

The Pound recovered 1.16 against the Euro and 1.37 against the Dollar thanks to an improving global investor backdrop and amidst tentative signs that the UK's third wave of covid-19 infections is starting to peak.

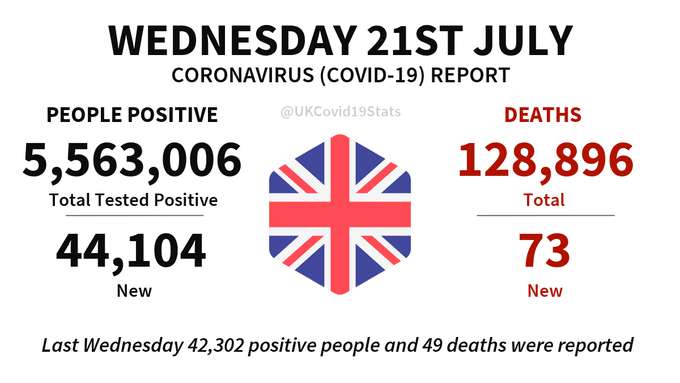

The government reported 44104 new cases of Covid-19 on Wednesday, which is just slightly more than the 42302 reported the previous week and represents a deceleration in the week-on-week case growth. A deceleration in week-on-week cases has been reported over recent days and optimists are hoping a pattern is starting to emerge.

Before cases begin to fall the pandemic will need to see a plateau in case rises and the negligible week-on-week rise suggests exponential growth might just be starting to fade.

Image courtesy of @UKCovid19Stats

Hopes for a turning in the pandemic come amidst a combination of favourable factors: 1) the Euros football tournament is over, 2) the weather is significantly hotter (ventilation is critical to stemming transmission) and 3) school holidays across England commence on Friday.

Furthermore, those areas where the third wave outbreak took off - notably Scotland and parts of north west of England - are now seeing cases fall, suggesting the rest of the country will follow suit over coming days and weeks.

The UK's major supermarkets Tesco, Sainsbury’s and Waitrose all said they were facing problems, blaming factors including a growing number of staff and delivery drivers being forced to isolate after coming into contact with someone with Covid-19.

Andrew Opie, director of food and sustainability at the British Retail Consortium, which represents supermarkets, told The Times: "The ongoing ‘pingdemic’ is putting increasing pressure on retailers’ ability to maintain opening hours and keep shelves stocked. Government needs to act fast."

Although the UK has jettisoned the majority of remaining Covid restrictions the rising infection rate has nevertheless cast an air of caution over the country as significant numbers being told to self isolate having been in close proximity with someone who has tested positive.

Widespread staff shortages are now being reported and this will impact negatively on activity in July.Tesco, Sainsbury’s and Waitrose all said they were facing problems, blaming factors including a growing number of staff and delivery drivers being forced to isolate after coming into contact with someone with Covid-19.

Short-term economic data has meanwhile revealed an easing in the economic rebound with consumer spending growth easing back and mobility falling from recent peaks.

Only when the trend in cases reverses will consumers become confident to inject a fresh sense of urgency into the economic recovery.

The developments came amidst an improvement in global investor sentiment which was said by analysts to be a positive for Sterling against the Euro and Dollar.

The FTSE 100 recorded its strongest daily gain in five months Wednesday as investor fears over the global spread of the Delta variant of Covid-19 eased.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The improved investor sentiment helped the Pound-to-Euro exchange rate (GBP/EUR) rise to a high of 1.1610, having been as low as 1.1530 the day prior.

The Pound-to-Dollar exchange rate hit a high of 1.3696 having been as low as 1.3571 the day prior.

For the Pound, the near-term outlook rests with how theses Delta variant concerns evolve: if investors have now filly priced in the news further gains in sentiment and the UK currency are possible.

"The apparently sudden explosion of Covid-19 Delta variant risk to the status of “top concern” for global markets is this week’s key story," says Shahab Jalinoos, a foreign exchange trading strategist with Credit Suisse.

"It is still possible that the high rates of Covid-19 infection do not translate into hospitalisation rates that force a reversal of economic re-opening," he adds.

Clouding the outlook for the UK currency are indications that the UK and EU are heading for another significant Brexit showdown, once again centred on the Northern Ireland question.

The UK on Wednesday announced it was seeking a substantial renegotiation of certain points contained in the Northern Ireland protocol, saying that in its existing form it is prevent the trade in goods and medicines between Great Britain and Northern Ireland.

Brexit minister David Frost told the House of Lords that the Government is now proposing a number of major changes to the Protocol, which the EU flat-out rejected.

"Sterling is in focus today as Brexit concerns are starting to make a comeback. With the pound already on its back foot, we think the UK government’s plans to revisit the Northern Ireland protocol could add to sterling’s negative near-term backdrop," says Mark McCormick, Global Head of FX Strategy at TD Securities.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Adam Cole, Chief Currency Strategist at RBC Capital Markets says the move by the UK is highly contentious and could bother the Pound.

"GBP sold off quite sharply on Frost’s comments on Monday and clearly is not indifferent to these developments, though they remain on the back-burner most of the time," says Cole.

The EU and UK have agreed a grace period that allows the passage of goods from Britain to Northern Ireland to go unchecked, but this ends on October 01.

"In the near term, both sides are likely to stand their ground and we should expect a stream of acrimonious exchanges. Only as October 1 draws closer, however, will markets really contemplate the worst-case scenario of the UK unilaterally overwriting the protocol, resulting in a drawn-out legal battle and the threat of EU trade sanctions on the UK," says Cole.

A command paper outlining proposals from the UK Government about how the Protocol should be changed was published on Wednesday, in what amounts to a major challenge to the EU.

The EU have said the Protocol would never be up for renegotiation and the European Commission said as much in a retort to Frost's announcement.

"We are ready to continue to seek creative solutions, within the framework of the Protocol, in the interest of all communities in Northern Ireland. However, we will not agree to a renegotiation of the Protocol," said EU Commission Vice-President Maroš Šefčovič.

Brexit has largely been off the radar for foreign exchange markets since the EU and UK finally parted ways in January 2021, however a spat over the movement of chilled meets arose in June, serving up a reminder that the issue is not fully resolved.

The UK and EU agreed to keep talking but the UK's latest moves suggest they are deeply unhappy with the situation.

Expect the issue to ping on Sterling's radar with greater intensity in the run-up to October 01.