Pound Sterling Forecast 2021 from Commerzbank

- Commerzbank pessimistic on GBP outlook

- Brexit reality, threat of -ve interest rates to weigh

- But Credit Suisse say GBP can outperform

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1230 | GBP/USD: 1.3536

- Bank transfer rates: 1.1015 | 1.3280

- Specialist transfer rates: 1.1150 | 1.3468

- More about bank-beating exchange rates, here

Foreign exchange analysts at Germany's Commerzbank say they have turned more pessimistic on the outlook for the British Pound and have released forecasts that indicate little further upside in the UK currency over coming months.

In a research briefing out on Jan 15., analysts say the currency remains overvalued against the Euro and Brexit will continue to weigh on UK economic performance.

As such, 2021 is likely to see the currency depreciate in value against both the Dollar and Euro.

"The outlook for the currency is unlikely to improve much in the coming quarters, which is why we have turned slightly more pessimistic on Sterling," says Thu Lan Nguyen, FX and EM Analyst at Commerzbank.

The British Pound was tipped by the majority of analysts we follow to rally in the event of the EU and UK striking a post-Brexit trade agreement, however the lacklustre response by Sterling that materialised following the December 24 agreement suggests markets had long expected this outcome.

"The market has apparently quickly come to the realisation that, even with an orderly Brexit, the economic outlook for the UK remains bleak," says Nguyen.

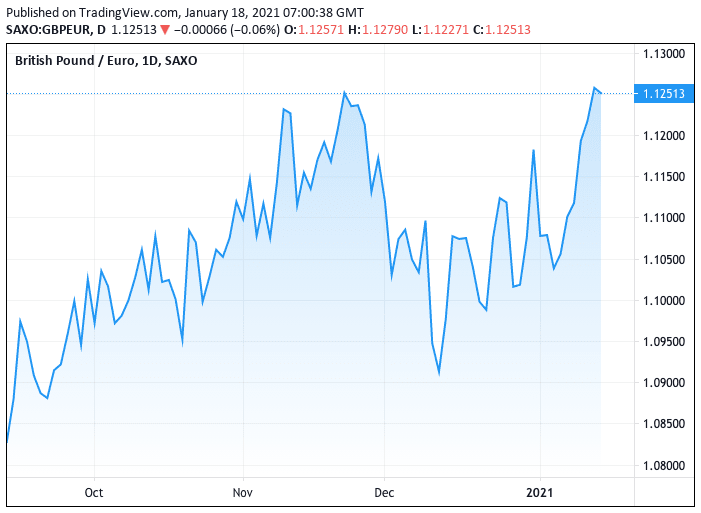

Nevertheless, the Pound has nevertheless progressed higher over recent days, putting a soft start to 2021 behind it. The Pound-to-Euro exchange rate is now 0.63% up in 2021 at 1.1230, meanwhile the Pound-to-Dollar exchange rate is flat on the year at 1.3570.

The Pound picked up in value this past week after Bank of England Governor Andrew Bailey suggested cutting interest rates again was unlikely in the future, pushing back the market's expectations for such a move until later in the year.

The rally in the Pound confirms that interest rate expectations do matter, and should the expectation for a rate cut recede further, then further gains are possible.

But Nguyen is not convinced this will be the case, saying: "the market continues to price in an interest rate cut by the end of this year, which should limit the appreciation potential of the GBP for the time being."

Furthermore the long-term outlook for the UK economy remains uncertain says the analyst.

"The GBP outlook continues to be clouded by the ongoing ambiguities in the relationship between the EU and the UK - especially in the area of trade in services. This is because the free trade agreement only covers trade in goods. However, it is here - and specifically in the financial services sector - that the strength of the British economy lies," says Nguyen.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Commerzbank say any agreement on equivalence, as is currently being sought by UK and EU negotiators will not offer a long-term framework for services orientated business, and as such there will be a further migration of firms out of London and into the EU.

From a valuation perspective Commmerzbank's long-term valuation models say the Pound is overvalued against the Euro, albeit less so in the wake of the EU referendum.

"The pound will lose ground again against the euro in the coming quarters and at least stop its appreciation trend against the U.S. dollar, which should do much better this year than last thanks to positive growth prospects," says Nguyen.

Commerzbank is forecasting the Pound-Dollar exchange rate to trade at 1.38 by the end of March 2021, 1.36 by the end of June, 1.38 by the end of September and 1.37 at the end of March.

The Pound-Euro exchange rate is forecast at 1.15, 1.1360, 1.1360 and 1.11 at these respective dates.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

While Commerzbank communicate a pessimistic view on Sterling upside in 2021, others are more constructive.

In a monthly currency briefing strategists at Credit Suisse say there is a chance of Sterling appreciation in coming months should the UK execute a successful vaccination programme.

"GBP looks increasingly like a notable “Covid goes away” play in G10 space," says Shahab Jalinoos, Trading Strategist with Credit Suisse.

The market currently expects the Bank of England to cut interest rates by June 2021, but Jalinoos says if this pricing is pushed back, Sterling can rise. But, this will require the market to believe the vaccination process is proceeding at a pace to allow for the country to reach herd immunity.

"With the market still pricing in high odds of negative rates, if the UK actually manages to reach herd immunity relatively quickly due to a successful vaccination program, GDP and rate expectations could bounce, leaving room for general GBP outperformance," says Jalinoos.

Credit Suisse forecasts show the GBP/USD exchange rate could attain 1.40 this year, while the GBP/EUR exchange rate could achieve 1.15.