"Uninspired" Pound Sterling Shrugs at News of Brexit Deal

Above: Prime Minister Boris Johnson confirms a deal in a call with President of the European Commission, Ursula von der Leyen. 10 Downing Street. Picture by Pippa Fowles / No 10 Downing Street.

- Market rates at publication: GBP/EUR: 1.1112 | GBP/USD: 1.3540

- Bank transfer rates: 1.0900 | 1.3260

- Specialist transfer rates: 1.1034 | 1.3445

- More about bank-beating exchange rates, here

The British Pound showed a remarkable lack of enthusiasm to news the UK and EU had finally struck a post-Brexit trade deal, a somewhat counterintuitive reaction to an agreement which brings to an end years of uncertainty for businesses, investors and millions of citizens.

The Pound-to-Euro exchange rate fell back from a high of 1.1168 to quote at 1.1105 in the wake of an agreement being announced, the Pound-to-Dollar exchange rate fell from a high at 1.3619 to quote at 1.3527.

The UK currency pared gains made earlier against the majority of the world's largest currencies.

The Pound's reaction suggests the market had been anticipating the deal to be done, and now that the actual news has come traders are taking some profit off the table.

In short, we have a "buy the rumour, sell the fact" market movement.

"The uninspiring Sterling reaction to today’s confirmation of a trade deal is looking like a classic case of 'buy the rumour, sell the fact'. After weeks, months, and years of back-and-forth, it seems the confirmation of the deal was mostly as expected by markets and as such is not a game changer for sterling. Other factors, most importantly Covid-19, will now once again begin to drive the outlook for the pound," says Ranko Berich, Head of Market Analysis at Monex Europe.

"While GBP is likely to find support on any news that a trade deal has been struck, it remains likely that any relief rally will be cut short," says Jane Foley, Senior FX Strategist at Rabobank.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"Any deal is set to leave many sectors, particular in services, out in the cold. In addition, the likelihood that larger swathes of the UK will be entering higher ‘tier 4’ restriction to prevent the transmission of the virus will significant dampen recovery prospects," adds the strategist.

Numerous foreign exchange analysts we follow are of the view that the outlook for the UK economy will remain challenged given a combination of covid-19 restrictions and adjustments that will inevitably be required from January 01.

"Let’s be very clear: this is not the end of Brexit," says Nigel Green, CEO of deVere Group. "Now there will need to be a period of major readjustment as the world’s sixth-largest economy diverges from the world’s largest trading bloc after being an integral part of it for almost half a century."

Economist Kallum Pickering at Berenberg Bank says exiting the EU Single Market and Customs Union will lower UK potential growth by harming its export prospects and reducing inflows of foreign direct investment and qualified labour from the EU.

A deal can limit some of the damage, says Pickering: relative to potential growth of ~2.0% as an EU member and less than 1.5% in case of a hard exit, Berenberg estimate that UK potential growth will be around ~1.7% in the years ahead.

"Near-term, some disruptions at the UK-EU border are inevitable in January as traders will be subject to additional paperwork and checks once the UK has left the EU Single Market and Customs Union. However, such disruption will be much less than in a no-deal scenario," says Pickering.

David Alexander Meier, an Economist at Julius Baer holds a short-term forecast for the Pound-to-Euro exchange rate at 1.1364 now that a deal is agreed.

Meier describes the accord agreed between the EU and UK as a "fig leaf deal, one too small to achieve much beyond avoiding embarrassment."

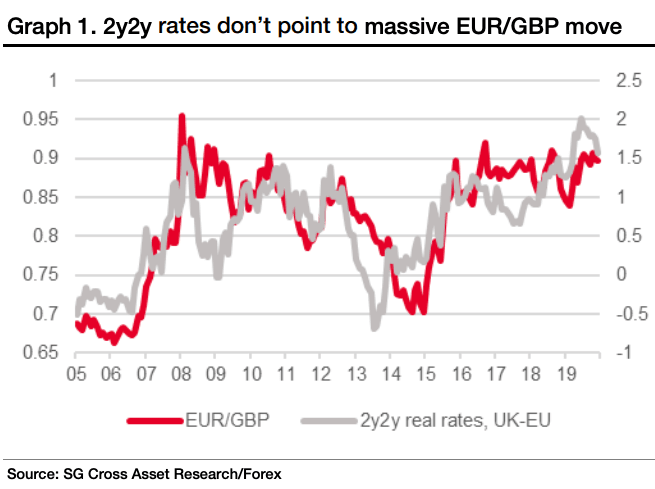

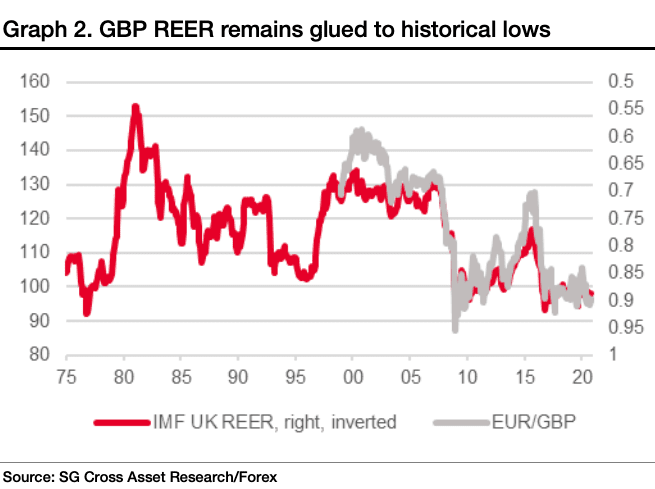

"Trade frictions will inevitably increase, just as vaccine optimism boosts growth prospects globally. The UK will lag others, interest rates will remain anchored, and sterling will remain in its range," says Kit Juckes, analyst at Société Générale.

Juckes says the Pound-Euro exchange rate has traded in a 1.0526-1.2050 range since the EU referendum of 2016 and he now sees the exchange rate setting a new range around 1.16.

But, longer-term gains might be on the cards from 2022: "In the long run, if history is a guide, the next big move for the pound’s real effective rate will be a rally. From here, that’s the path of mean reversion. A good deal could have unlocked such a move," says Juckes.

"Absent that and facing further economic under-performance, a bounce will have to wait until 2022 at the earliest," says Juckes.

Economists at UBS forecast a steady recovery in Pound exchange rates in 2021, "on account of attractive valuations and the global cyclical rebound to follow in 2022," says Farmakis.

Rabobank's Foley says that the Pound-Euro exchange rate will struggle to move beyond 1.1235/1.1363 now that a deal has been agreed.

Hinesh Patel, portfolio manager at Quilter Investors says there is good news for the UK in that a deal should help unblock the backlog of international investment that has been waiting for some sort of outcome before institutions begin investing in UK plc once again.

"Indeed, the market appears to be enjoying the news despite the usual quiet Christmas period. The overall mood though appears to be one of relief and this news should benefit the small and mid-cap businesses of the FTSE 250 who should now be able to plan with a bit more confidence and adapt to the new environment," says Patel.

"However, this does not mean the UK is out of the woods. The response to Covid-19 still matters far greater as this is the key to bringing back consumer demand. Without a successful vaccine roll out we may just continue to witness scenes like we have in Dover of late as businesses struggle to cope with disrupted supply chains,” adds Patel.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.