Pound Sterling Holds Key Levels Against Euro and Dollar in Wake of Better than Expected Jobs Data, but Economists Warn Storm Clouds are Gathering

- UK jobs data better than expected

- GBP in mixed reaction, but broadly supported

- Key to outlook is ending of furlough scheme in Oct.

- "calm before the storm" warns one economist

Image © Adobe Images

- GBP/EUR spot: 1.1134 | GBP/USD spot: 1.3066

- GBP/EUR bank rates: 1.0920 | GBP/USD bank rates: 1.2800

- GBP/EUR specialist rates: 1.1033 | GBP/USD specialist rates: 1.2948

Find out more about specialist rates here

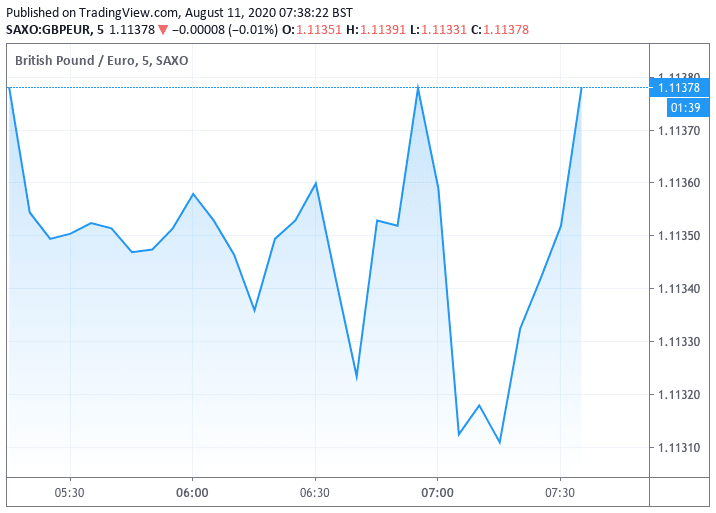

The British Pound saw some volatility in the wake of the release of keenly awaited UK employment statistics, but ultimately the currency remains well supported above the key 1.11 area against the Euro and 1.30 against the U.S. Dollar after data showed the country's unemployment rate reached 3.9% in June, which is better than the 4.2% markets were expecting.

The ONS reports 220K people fell out of employment in the three months to June as the covid-19 crisis bit into the real economy, however this was less than the -288K foreign exchange markets were expecting and is therefore on balance supportive of the currency even as anticipation of a deterioration in the data from October onwards is anticipated.

Analysts say data out of the UK will become increasingly important for Sterling exchange rates over coming weeks as foreign exchange markets are likely to pay more attention to how economies are recovering from the covid-19 pandemic relative to each other, with those that recover in a faster and more robust fashion likely to see their currencies outperform.

"The near-term drivers for GBP now revert back to tracing the path of the economic re-opening against scattered COVID-hotspots and associated localised restrictions," says Paul Meggyesi, FX Strategist at JPMorgan.

Following the release of the employment data we saw a dip in Sterling followed by a recovery as traders and automated trading programmes made sense of the data: the Pound-to-Euro exchange rate is now seen trading at 1.1130, up half a percent this week, while the Pound-to-Dollar exchange rate is trading at 1.3075, unchanged for the week.

The headine figures were broadly supportive of Sterling, however the claimant count and wage data was less so and might explain some of the volatility in Sterling following the release.

Those seeking out of work benefits rose by 94.4K in July, which was greater than the 10K markets were expecting.

Average earnings, with a bonus included, fell 1.2% in June which is sharper than the 1.1% fall the market was looking for, while average earnings fell 0.2% which is worse than the 0.1% fall markets were looking for.

The employment data is the first of two major economic releases due out this week with further interest likely to fall on the release of GDP statistics mid-week. For Sterling, news that the employment rate remains

However, the foreign exchange market's reaction to the latest release of employment data might be more muted than might be expected given the importance of economic data in the current climate, given that the UK's labour market outlook will ultimately depend on what happens to the UK government's furlough scheme.

The scheme that sees the government subsidise wages is due to end in October, and there are concerns that a sharp rise in unemployment might occur at this point. However, a continuation of the programme might soften the blow although this will create further substantial demands on the country's finances while also potentially retarding any post-covid recovery as employers maintain a state of stasis.

"A key decision for GBP will be whether the Chancellor extends the furlough scheme that is currently due to wind down in October," says Meggyesi. "While facing greater political pressure to extend, fiscal reality may well prevent this and hence expose GBP to a pronounced rise in unemployment that clouds the recovery prospects by comparison with the many countries in Europe whose job-support schemes run to year-end or 2021."

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Bank of England will be watching employment and various other data closely when approaching their next major monetary policy decision in November. A clear deterioration in data, particularly labour market data, could prompt them to boost quantitative easing once more and even consider introducing negative interest rates more seriously.

Such policy moves are on paper considered negative for Sterling valuations, hence foreign exchange markets will be using the current run of data to second-guess the Bank's next moves. Bank of England Deputy Governor Dave Ramsden told The Times newspaper in an interview "we’ve still got significant headroom to do more quantitative easing if we saw a much weaker recovery".

"A key outcome is what happens to the labour market. Some companies are going to go under. Some jobs are going to be lost".

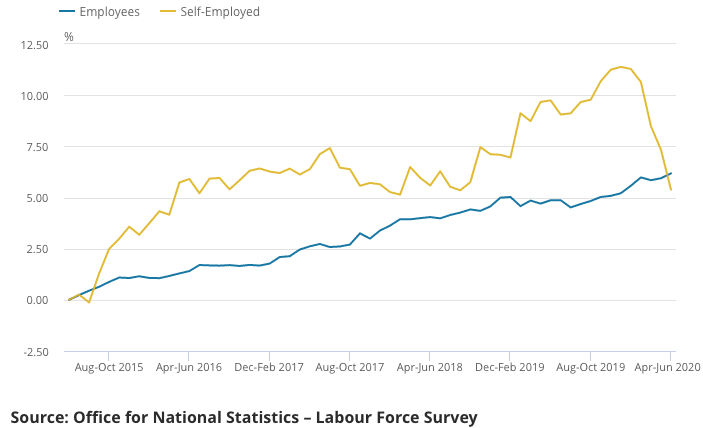

A significant area of concern for the government and Bank of England will be the sharp fall in levels of self-employed, in fact the country has seen a record fall in the numbers of self-employed over the past quarter:

The number of self-employed has shown a sharp fall, which is not reflected in employees owing to the effectiveness of the furlough scheme which was designed specifically for traditional employment roles.

There is a concern that ending the furlough scheme could see a delayed dip in traditional employees from October onwards. Of course, if the economic recovery continues to advance the impact of any late dip in employment levels will be shallower than had the furlough scheme not been employed at all.

“Many of these self-employed workers may not have accumulated the financial track record to qualify for government support, and some will have elected to receive income through dividends rather than salary, meaning they will receive less governmental support or none entirely," says Paul Craig, portfolio manager at Quilter Investors. "While the deterioration in the labour market is disappointing, it is largely in line with expectations that companies will begin to lay-off workers as the effects of the lockdown begin to bite and the furlough schemes starts to wind-down."

"Awful" Data

The headline figures reveal an employment market that has been relatively robust given the record breaking collapse in economic activity, which is no doubt a result of government intervention. However according to a number of economists we follow the outlook looks poor with Ruth Gregory, Senior UK Economist at Capital Economics saying the cracks in the market are likely to turn into a chasm.

"The cracks evident in the latest batch of labour market data are likely to soon turn into a chasm with the unemployment rate rising from 3.9% to around 7% by mid-2021," says Gregory. "The cumulative increase since the trough in February now stands at 1.45m, more than the 1.1m rise seen after the GFC. That pushed the claimant count unemployment rate up from 7.2% in June to 7.5% in July."

"We doubt the apparent stability in the ILO unemployment rate will last long. Indeed, with further rises in unemployment in the coming months all but inevitable as the furlough scheme unwinds, this is just the lull before the storm," adds Gregory.

Quilter's Craig says, "storm clouds are beginning to gather over the labour market, and the forward outlook for jobs is critical to watch. What really counts when it comes to the economy and jobs market is services, and here the recovery momentum has stalled somewhat in the past few weeks, with evidence that for some, the suspended animation of the furlough scheme is over and they are being made redundant."