The British Pound Extends Leap of Faith on Hope of Brexit Progress as Analysts Eye More Gains

- Written by: Gary Howes

Above: Michel Barnier, Stephen Barclay. Photographer: Lukasz Kobus. © European Union, 2019 Source: EC - Audiovisual Service.

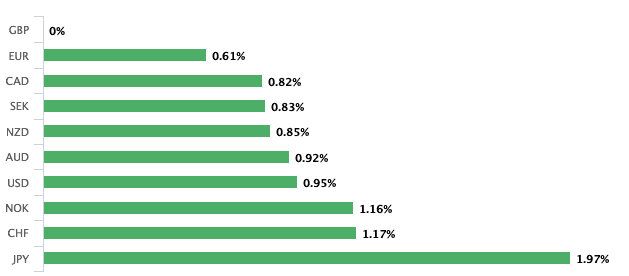

- Pound is best performing major currency of the week

- Gains come on apparent progress in Brexit negotiations

- Lack of detail prompts questions over sustainability of gains

- But some tip further gains amid biggest GBP rally for 25 years.

The British Pound is set to become the best-performing major currency of the week thanks to an ongoing leap off the back of renewed optimism that the EU and the UK are close to striking a Brexit deal.

UK Brexit Secretary Stephen Barclay met his counterpart Michel Barnier in Brussels on Friday morning, and a statement said they had a "constructive" meeting in which details of the UK's latest proposals for the Northern Irish border were discussed. The negotiators agreed to hold intense talks over the next few days in a bid to present a workable deal to EU leaders at the European Council summit to be held on October 17 & 18, however it remains the case that the Irish border remains the key sticking point.

An EU ambassador told The Telegraph EU leaders "are giving the green light" to Barnier to enter 'the tunnel phase' in the hope of agreeing a deal by next week's EU summit.

The 'tunnel phase' will see negotiators strive for a deal in secrecy, going through the proposals line by line.

A further boost for Sterling came as it appears a key piece in any deals puzzle - Northern Ireland's unionist DUP - have not outright rejected the broad outlines of the proposal they believe is cooking.

According to Steven Swinford, Deputy Political Editor, at The Times, "The DUP is not necessarily opposed to a post-Brexit customs partnership with the EU."

"Provided it doesn't mean that NI is excluded from being able to participate in new trade deals we could be supportive," a DUP source said.

Disagreement over how to keep the island of Ireland free of trade barriers while also delivering on the outcome of the June 2016 referendum have so far frustrated the UK's orderly departure from the bloc.

“After continued combative comment from Brussels earlier in the week, the complexities around the workability of the Ireland scenario took a major step in the right direction yesterday. Sterling was immediately bid up on this news, and as it was reported the Barclay/Barnier meeting took a positive step, sterling gained to hit three month highs," says Harry Adams, co-CEO of Argentex, an international payments specialist listed on the London Stock Exchange. "If this breakout gets traction and rhetoric continues to be positive we could easily see a very aggressive rally through major levels at 1.33."

Above: Pound-to-Dollar rate and Pound-to-Euro (orange line, left axis) shown at hourly intervals.

The open border on the island of Ireland that's required by the Good Friday Agreement would amount to a backdoor into both the EU and UK single markets in the absence of matching regulatory regimes, although some in the 'leave' camp insist that such threats can be addressed with technology and adapted versions of systems that are already in place. But the EU has rejected all of the proposals put to it so far and the clock is ticking down to the October 17 EU Council summit and October 31 expiry of the current Article 50 extension.

"The EU and the UK have agreed to intensify discussions over the coming days. The EU's position remains the same: there must be a legally operative solution in the Withdrawal Agreement that avoids a hard border on the island of Ireland, protects the all-island economy and the Good Friday (Belfast) Agreement in all its dimensions, and safeguards the integrity of the Single Market. The Commission will take stock with the European Parliament and Member States again on Monday," says a European Commision spokesperson.

Dublin says @BorisJohnson has made “a big move on customs arrangements” for the island of Ireland. London says @LeoVaradkar has made a “big move to secure a deal”. Are the statements compatible? Maybe. Certainly there is striking degree of optimism that a Brexit deal is possible

— Robert Peston (@Peston) October 11, 2019

Argentex's Adams says that if a deal results from ongoing talks and also happens to appear palatable to parliament, the Pound-to-Dollar rate could advance to 1.40 and beyond, which are levels not seen since the June 2016 referendum. Others are more focused on likely price action in the immediate future, and have one eye on a still-present risk that the talks fail.

"GBP has outperformed on Brexit deal optimism and GBPUSD appears headed toward 1.26 after various other European leaders expressed optimism that a Brexit deal could be reached. The one G10 currency that has fallen against the USD overnight is the Japanese yen, which has been hit by improving risk appetite with Brexit and US-China trade deals appearing more likely," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Above: Pound-to-Euro rate and Pound-to-Dollar (orange line, left axis) shown at daily intervals.

Speculation over a deal, and gains for Sterling, come after talks between Ireland's Taoiseach Leo Varadkar and UK Prime Minister Boris Johnson saw "both continue to believe a deal is in everybody’s interest. They agreed that they could see a pathway to a possible deal."

Sterling endured similar optimism back earlier this year when Theresa May reached an agreement with the EU, only for the rug to be pulled from beneath her by a Parliament that rejected the proposal three times. Johnson's attempts to secure a deal could yet meet the same fate as May's if the concessions he offers the EU whittle away his Parliamentary support.

It's back:

— Steven Swinford (@Steven_Swinford) October 11, 2019

Boris Johnson has 'resurrected' Theresa May's customs partnership, source familiar with plans says

'NI effectively stays in the EU customs union but for the purposes of trade it's in UK customs union,' source says. 'It's a fudge'

Will ERG be able to stomach it?

Given the GBP/EUR rate was as high as 1.18 back in March, while it is only at 1.14 now, markets are still more pessimistic of a deal this time around despite Thursday and Friday's jump.

Gains appear to be something of a relief rally as the currency had been under pressure for much of the week owing to a distinct breakdown in the tone and optimism surrounding the negotiations. Indeed, Pound Sterling Live previously reported the talks were on the brink of failure.

"We are witnessing a massive short squeeze. The stops have come out with GBPUSD shooting north of 1.26 and blowing out resistance levels along the way," says Mark Wilson at Markets.com. "A move to the June closing peaks around 1.2740 and intra-day highs of that month at 1.2780 looks entirely feasible given the momentum shift...it's on course for one of its best two-day rallies in about 25 years."

Above: Sterling is the best performing major currency of the week on the back of recent Brexit developments.

"Michel Barnier has the go-ahead from member states and, vitally, Ireland on the final stage of negotiations to take place behind closed doors. It does not, however, mean a final deal will be presented, nor that MPs will back the deal that may be presented to them in due course. There are yet some considerable barriers to clear," Wilson adds. "This rally is built on shaky foundations and is susceptible to a crash if the negotiations don't produce a deal for MPs."

Little detail of either meetings is known, making it difficult to gauge the prospects of any agreement passing through a divided and highly partisan Parliament. But there are some tidbits of information that might mean caution is in order.

The Times is reporting progress has come off a "substantial" offer from the UK on customs checks on the island of Ireland, and a consent mechanism to give the Northern Ireland assembly a say on how long a new backstop should last.

"Critically, he is understood to have dropped his insistence that the Tories' DUP allies be given a veto on new arrangements coming into effect," says Oliver Wright at The Times, who claims Johnson spoke to DUP leader Arlene Foster before the meeting. Last night, party sources did not dismiss out of hand reports of what had been agreed.

Recall Theresa May's government would court and brief the DUP on developments in the negotiations, yet the Northern Ireland unionists rejected her plans. If the DUP are unable to sign up to any agreement, we would suspect Johnson will lose a good chunk of support from members of his own party who would prefer a 'cleaner' Brexit.

This is a big statement from Julian Smith. Explains why Varadkar was so upbeat yesterday. Really does look like Boris has decided to throw the DUP from the balloon. Or at a minimum, has persuaded Arlene Foster to jump out of the balloon. https://t.co/CM0zEAiVo6

— (((Dan Hodges))) (@DPJHodges) October 11, 2019

"The problem is that PM Johnson's potential majority in the House of Commons is also very fragile and he cannot afford to lose support from DUP and the group of hard Brexiteers within his own party. This means that one should not get hopes too high yet," says Jens Peter Sørensen, Senior Analyst with Danske Bank. "Details on what such a compromise would entail remains sparse, as does the reality of such a compromise in getting through parliament. For now, we prefer to fade the move in Sterling."

Further solid signs of progress based on some real details would be required for Pound Sterling to make a material and sustained breach to the upside.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement