Pound Sterling Steadies vs. Euro & Dollar as Tenacious Theresa looks to Sell her Brexit Deal: The Scenarios to Watch from Here

Image © Number 10 Downing Street

- Sterling consolidates as market believes May can still succeed

- Prospect of a second referendum only grows amidst current chaos

- Why a divided Conservative party could yet pass this deal

Prime Minister Theresa May has clearly stated she intends to stay in her position and deliver the Brexit deal she has fought so hard for and won't be abandoning the country at this highly uncertain time.

In a speech at Downing Street the Prime Minister told her audience the deal "is right for our country."

May showed an extraordinary tenacity following what must have been a challenging day that saw senior members of her cabinet resign while backbenchers on her party lined up to warn her Brexit deal would not be voted through.

One MP described it as "dead on arrival".

May's comments appear to have offered some support to Pound Sterling which suffered its biggest one-day drop against the Euro since the Brexit referendum of 2016 after the resignation of Brexit Secretary Dominic Raab and Works and Pensions Secretary Esther McVey. The Pound saw its biggest one-day drop against the Dollar since October 2016.

But can the support for Sterling last into the weekend?

Markets appear to believe that the Brexit deal announced by the E.U. and U.K. on Wednesday, November 13 still has a shot: if they didn't we believe Sterling would be materially lower than where it is now as markets frantically rush to price in a 'no deal' Brexit.

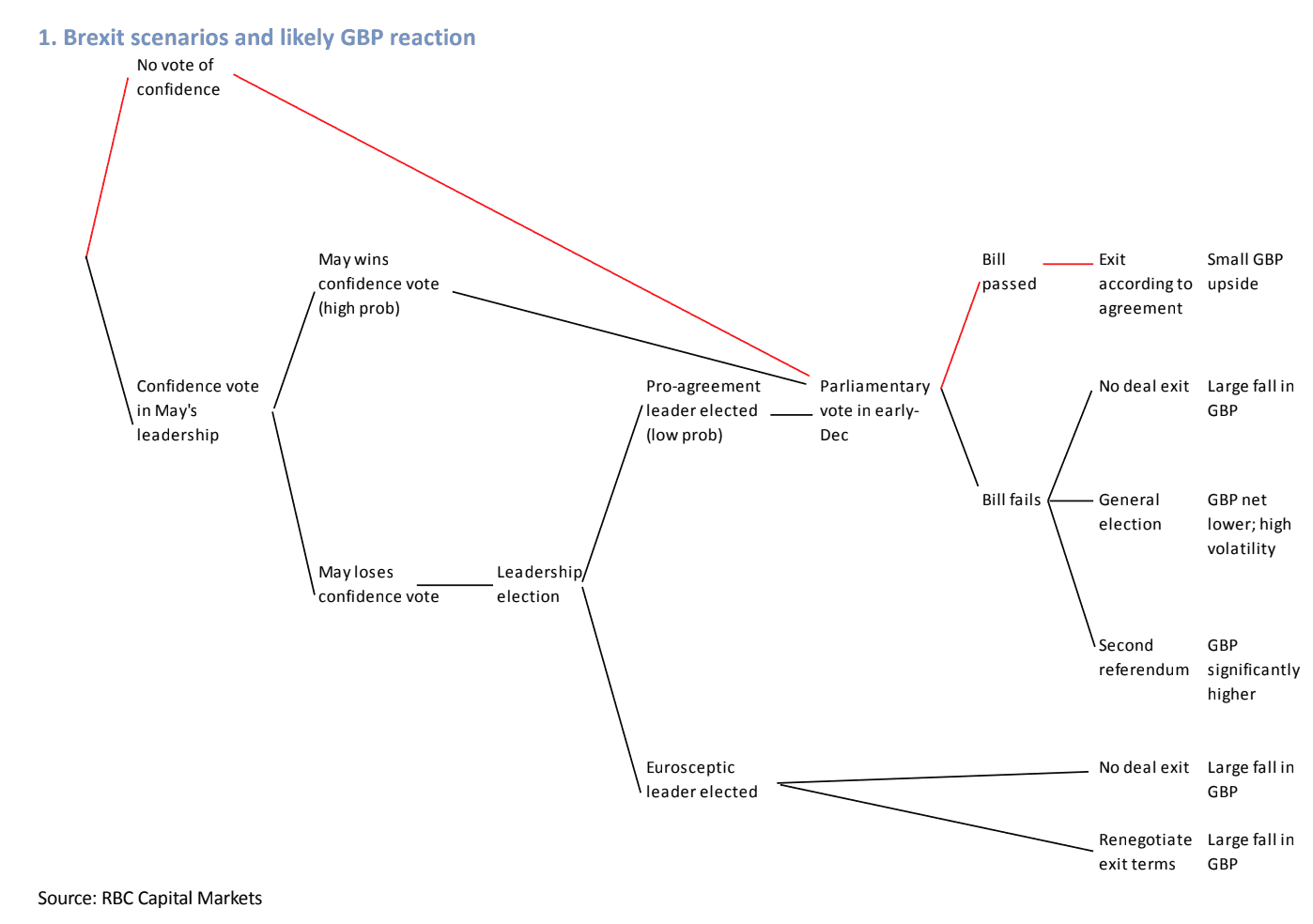

May is likely to face a vote of no confidence from her Conservative party, but we and most commentators believe she will win that vote and secure a year of grace from further challenges in the process.

"Given that a large majority of Conservative MPs are pro-remain, it is highly unlikely a majority would vote her out, with the likely consequence that a hard Brexit leader replaced her," says Adam Cole, a foreign exchange strategist with RBC Capital Markets.

A Survation poll in the Daily Mail will make for interesting reading today for Conservative party MPs.

It revealed that only 34% of Conservative voters surveyed supported calling for a leadership contest, and only 30% believed PM May should resign.

The poll suggests that Tory voters want her to “just get on with it”.

"Any negative reaction of GBP to headlines that the 48 member threshold has been crossed, should be faded, as it should become clear May would likely survive," adds Cole.

The Pound-to-Euro exchange rate is currently seen at 1.1290 on the interbank markets with international payment quotes being at around 1.1211. The Pound-to-Dollar exchange rate is quoted at 1.2809 on the interbank market and international payment quotes coming in at 1.2719. (Harry Wills, a dealer at Horizon Currency has made himself available to update on the latest retail market quotes for currency payments at

Undeniably, the biggest anxiety for the British Pound over coming weeks will be May's ability to get parliament behind her deal.

In a nod to her tenacity May looks set to now embark on a publicity blitz for the Brexit deal and will try to sell it to the public: after spending three hours in the House of Commons answering questions, she is going to be answering questions from the people.

Her first engagement is with LBC radio on Friday morning.

"I believe with every fibre of my being that the course I have set out is the right one for our country and all our people," May told reporters at Downing Street.

John Hardy, a foreign exchange analyst with Saxobank sees a scenario where a "May miracle" transpires:

"Theresa May survives the confidence vote and engineers a miracle, perhaps ramming through a key few changes to the deal at the Brexit summit on the 25th to keep the language sufficiently vague on future negotiations to keep most of her party on board, meaning only a few Labour Leave votes are needed to deliver the Brexit under this deal."

"The threat of chaos could move the EU on key points if it is clear that the deal won’t pass as currently written," adds Hardy.

Indeed, we know from May's appearance in the House of Commons Thursday that there are still some parts of the agreement that are yet to be settled, providing the slightest of windows in which to get some movement from European leaders at the November 25 Council meeting.

It could be that May will make a calculation as to what minimal change will be required to bring the DUP back onside. Northern Ireland's DUP have said they will outright oppose the current deal but if May can get Brussels to shift enough to get the DUP back on board then pressure will fall on Conservative party backbenchers to do the same.

Separately - I hear a wider group of Cabinet ministers discussing whether to act together to try to force Number 10 to make some changes to the deal - this group is different to those on resignation list - don't forget tho, a majority of them just want to get on with it

— Laura Kuenssberg (@bbclaurak) November 15, 2018

European leaders watching the ongoing reaction in the U.K. will surely know they will need to offer something to save their deal and could therefore be open to further proposals.

"If May were to succeed through the series of problems, it will be an extraordinary Houdini-like escape from a series of seemingly intractable impasses. The path then would then be clear for withdrawal on the 29th March and a period of transition lasting at least 21 months," says Tim Riddell, an analyst with Westpac.

Westpac believe the British Pound, UK equities and rates are likely to remain under downside pressure whilst uncertainty persists.

Advertisement

Bank-beating GBP exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Second Referendum

RBC Capital's Cole makes the point that if Parliament were to fail to pass May's Brexit plan the chance of a second referendum rapidly rises.

This threat could convince Brexiteer backbenchers that it's May's Brexit, or no Brexit. Indeed May herself has said over recent days that its her deal, no deal or the risk of no Brexit at all.

"A Eurosceptic strategy of voting the bill down in order to engineer an exit with no deal runs a risk of backfiring if it results in either a lost election (the polls are too close to call), or a second referendum," says Cole.

At present the Labour Party have said they will not vote for Theresa May's Brexit deal, nor will they allow a 'no deal' Brexit scenario to play out.

When asked how this apparently contradictory stance would be resolved, a number of Labour parliamentarians simply said they are not yet quite sure how they would engineer this outcome.

Make no mistake though, we believe the current uncertainty surrounding Brexit will fire up the 'People's vote' cause which has wide backing in Labour's ranks. It is not inconceivable that Labour leader Jeremy Corbyn comes around to making a second referendum a preferred Labour policy.

If a clear path to a vote is offered, it could well galvanise Conservative party opponents of May's Brexit deal into backing her.

"Proxies suggest that that the risk of a second referendum is creeping into market pricing already (based on prices from Oddschecker), but it is less clear that markets are prepared for how likely that would be to result in a vote to remain. In this scenario, we would therefore see significant upside for GBP," says Cole.

In the near-term the focus will likely stay on the risk of the exit bill failing in the Commons and the associated risk of a default to no deal exit.

"But if that risk continues to grow, expect the pressure for a second referendum – either to force the hand of the Conservative rebels or to resolve the mess that results – to also grow and with it the risk of Brexit not happening at all," says Cole.

Currently RBC Capital are forecasting the Pound-to-Dollar exchange rate to end 2018 at 1.36. They are forecasting the Pound-to-Euro exchange rate to end the year at 1.1235.

To see where consensus are forecasting the Pound to end the year against the Euro and Dollar we recommend downloading the Horizon Currency consensus forecasts which includes targets from Barclays, Goldman Sachs, Morgan Stanley and more. The GBP/USD download is here, the GBP/EUR download here.

Advertisement

Bank-beating GBP exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here