EUR/USD Forecast to Fall to Parity as Deutsche Revisit Euroglut Theory

Talk of the Euro hitting a par against the US Dollar is back in fashion courtesy of the shared currency's recent poor run.

The Dollar has been on a tear since the election that has powered it to its strongest level in 11 months on a trade-weighted basis.

The Euro has shown it is unwilling to go below 1.06 for any extended period of time - any forays below this level are typically met with increased buying interest and a rally towards the top of a multi-year range towards 1.15 then takes place.

Understandably, forecasts for EUR/USD parity typically become louder when the pair tests towards the bottom of the range.

The EUR/USD currency pair will probably now fall to parity, says analyst George Saravelos at Deutsche Bank who has been long-time bears of the Euro.

We have been reporting for some time about Saravelos' Euroglut theory - the idea that Eurozone portfolio outflows keep the Euro suppressed.

Core Europe’s (mostly Germany’s) vast savings are expected to be deployed overseas thanks to record-low interest rates at the European Central Bank, while American and Asian investors retreat from European assets.

Deutsche believe central bank policy divergence that sees currency flow from Europe to the US is likely to remain in play and stimulate a lower Euro.

The pair is likely to break out of its current range between 1.05-1.15 and then move down to parity, and possibly even lower, says Saravelos.

The big game-changer for EUR/USD has been Donald Trump’s presidential election win, was followed by a surprising strengthening of the dollar as Trump’s initially dollar-negative policies were reinterpreted as dollar-positive.

Trump’s preference for loose regulation and greater fiscal spending could be positive for the currency, as it would increase the chances of the Federal Resederve making more rapid interest rate rises.

“More fiscal and regulatory easing would add further upside risk to the growth and Fed outlook.”

This contrasts with Saravelos’ analysis of the outlook for the Eurozone:

“Meantime European risks are tilted to the downside given a deteriorating credit impulse and political outlook.

“The recent rise in European real rates increases the odds of a more dovish ECB,” he adds.

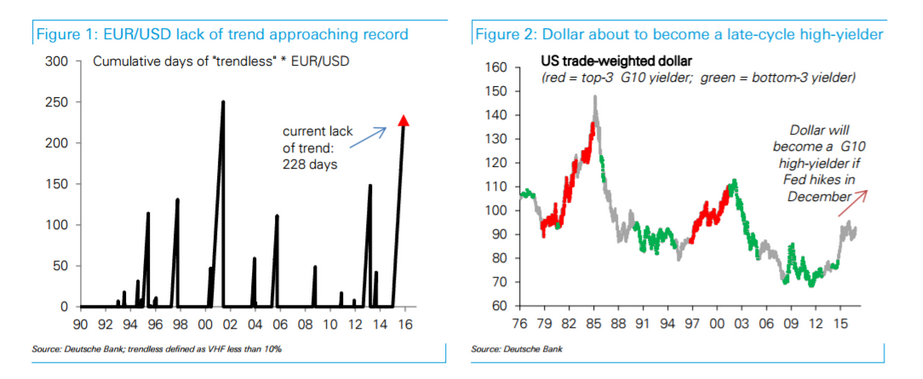

If the Fed hikes rates in December it will lead to an increase in lending rates, which will attract more international capital, further supporting the dollar.

“A Fed rate hike this December will make the dollar the third highest yielding currency in the world, a strong dollar positive,” said Saravelos.

The exceptionally long period in which EUR/USD has been meandering sideways is now increasingly likely to end and for there to be a period of directional movement.

“It is high time EURUSD started to move again.

“The duration of the current lack of trend is approaching a record high.

“When EURUSD last broke out of such a prolonged range corporate hedgers and asset allocators were caught off guard and the EUR moved 10% within the following few weeks,” remarks the Deutsche analyst.