Euro / Dollar Outlook Still Challenged after ECB Policy Stance Offers Little Help

- Written by: James Skinner

- EUR/USD aided by poor U.S. GDP after ECB decision

- ECB pours cold water over market’s rate expectations

- Sees inflation fading with temporary factors in 2022

- EUR/USD faces chart resistances at 1.1671 & above

Image © European Central Bank, reproduced under CC licensing

- EUR/USD reference rates at publication:

- Spot: 1.1640

- High street bank rates (indicative band): 1.1233-1.1314

- Payment specialist rates (indicative band): 1.1535-1.1582

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The Euro rate got little help from October’s European Central Bank (ECB) monetary policy decisions and struggled to compete with a Dollar that has benefited from the prospect of a further shift in stance at an almost-hawkish Federal Reserve (Fed).

Europe’s single currency attempted to lift off from the 1.16 handle on Thursday as the Dollar fell broadly in the wake of a third quarter U.S. GDP report that came in below market expectations, which emerged around the same time as the ECB’s monthly press conference.

ECB President Christine Lagarde was quick to note in her opening statement that recent increases in Eurozone inflation will persist for longer than previously anticipated by the bank, although this acknowledgement was followed quickly by reiterated concerns about the medium-term outlook.

“We did a lot of soul searching and asked a lot of questions to test our analysis and we are confident that this analysis of the two categories is actually correct,” Lagarde said, before pouring cold water on recent market expectations for the ECB’s interest rates.

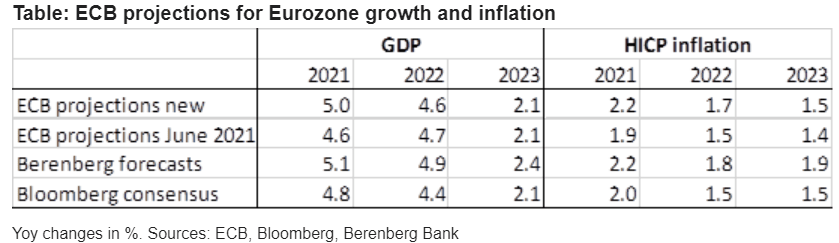

Above: ECB’s September economic forecasts. Source: Berenberg Bank.

President Lagarde told reporters from Frankfurt that Eurozone inflation rates are expected to fall back to the ECB’s target and below next year as the temporary factors lifting price pressures lose their potency as an influence on the consumer price index.

Financial markets have recently come to anticipate a 2022 interest rate rise from the ECB as a result of 2021’s pandemic-related surge in inflation, but Lagarde pushed back against this idea on Thursday while ECB policymakers are sceptical of the idea that current inflation rates could be sustained.

“Markets are now convinced global monetary policy will soon have to tighten significantly to quell higher inflation. We are confident pushing back against this idea in the Eurozone, but we concede that the economic data likely will continue to fuel markets’ apprehension of sustained higher inflation in the next few months,” says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

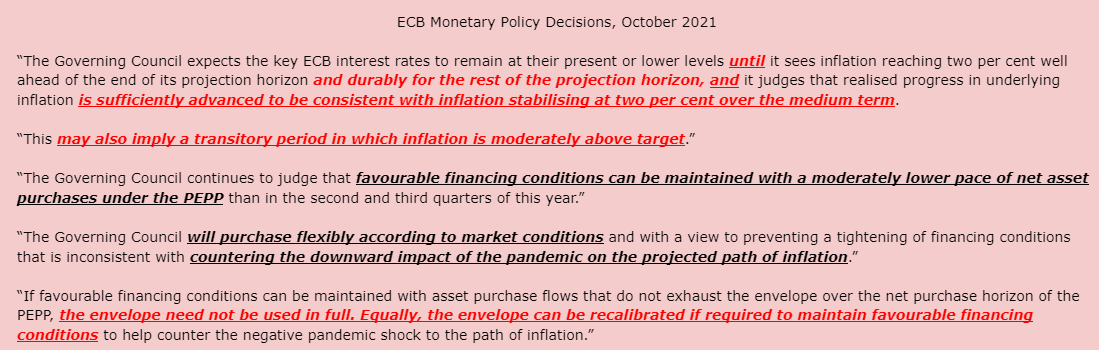

Above: Key excerpts from ECB’s October policy decision.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

President Lagarde’s comments followed the ECB’s October decision to leave rates charged or paid on its main refinancing operations, marginal lending facility and bank deposit facility left unchanged at 0.00%, 0.25% and -0.50% respectively, with the original Asset Purchase Programme also set to continue at a pace of €20BN per month.

Frankfurt also pledged to continue buying bonds under the €1.85 trillion PEPP programme “until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over,” albeit at a pace reduced from that seen in the first and second quarters of 2021.

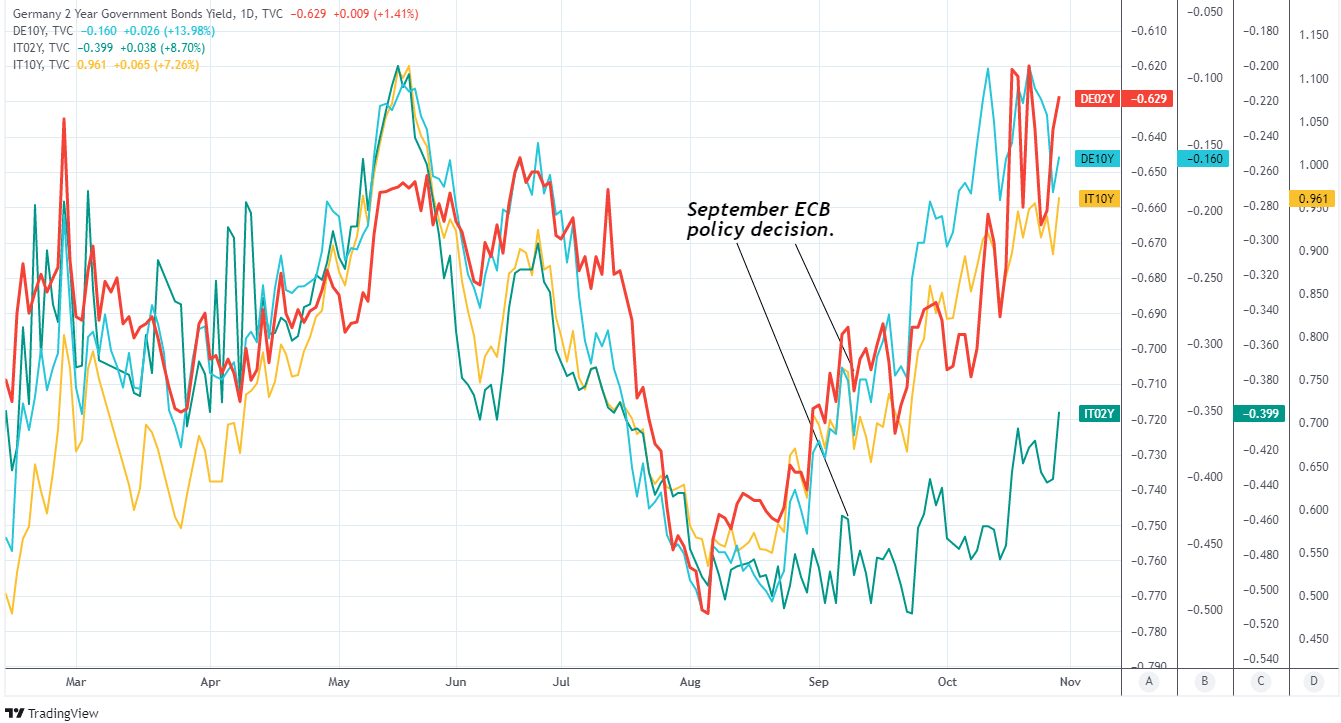

The ECB said in October’s decision that it thinks the recently reduced pace of quantitative easing purchases can be maintained without leading to an economically stifling shift in financial conditions, which are sensitive to changes in the level of government bond yields, among other things.

Above: German and Italian government bond yields for 2-year and 10-year maturities.

President Lagarde noted on Thursday that she expects the ECB’s pandemic-related programme of quantitative easing to end in March 2022, although many economists and analysts expect this end to be followed by an increase in size of the original QE programme known as the APP.

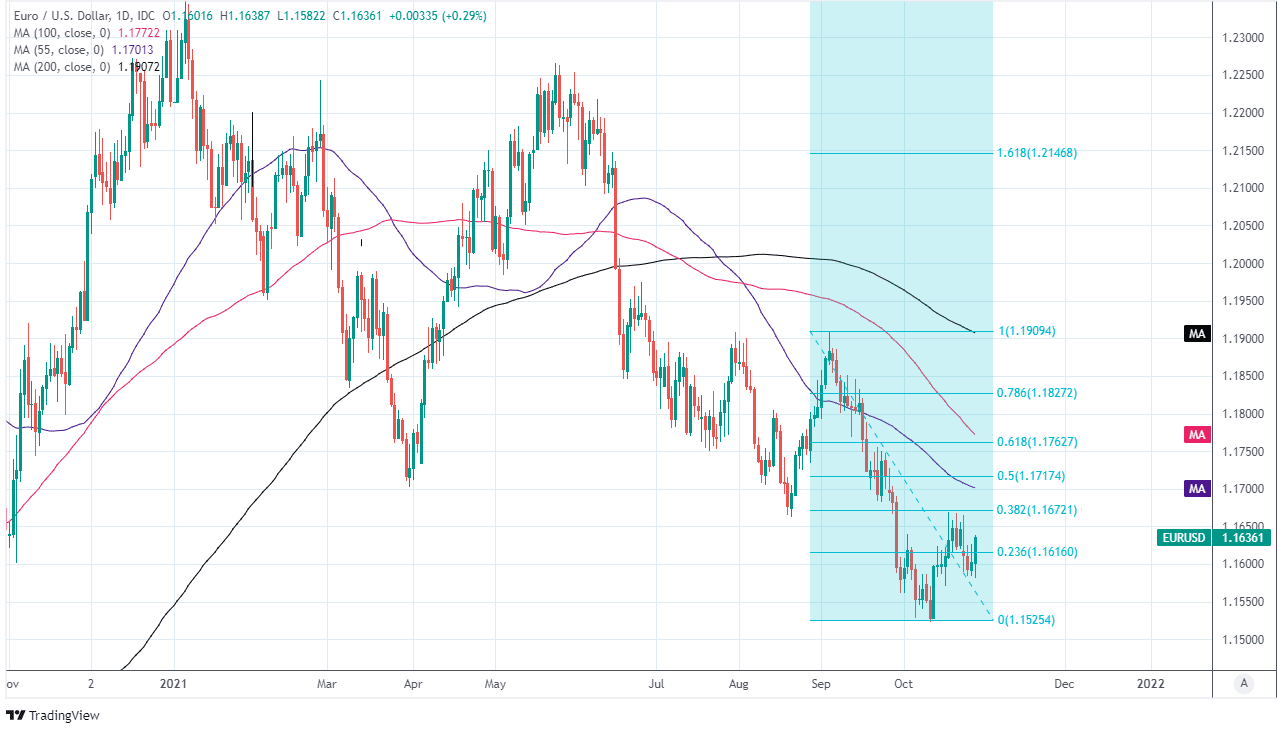

That would be a potential headwind for the Euro-Dollar rate in early 2022, although in the interim the single currency faces a series of technial resistance barriers overhead of its Thursday level that some analysts expect to bar the path higher over the coming days and weeks.

“EURUSD maintains a bearish “reversal day” after its rejection of the 38.2% retracement of the September/October decline at 1.1671 and we maintain our core bearish outlook for our 1.1495/93 first objective,” says David Sneddon, head of technical analysis at Credit Suisse, in a Thursday note.

Above: Euro-Dollar rate shown at daily intervals with key moving-averages and Fibonacci retracements of September/October decline indicating possible areas of technical resistance.