Euro-Dollar Exchange Rate Could be on its way to 1.23 says Morgan Stanley

- U.S. outperformance of 'Rest of World' now in question

- EU a safer bet thanks to Next Generation EU fund

- EUR/USD could be on the cusp of a new up-cycle

Above: File image of ECB President Lagarde. Image Copyrights: Angela Morant/ European Central Bank

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Euro-to-Dollar exchange rate is being tipped to head higher by analysts at Wall Street investment bank Morgan Stanley, who say the covid-19 economic crisis has reset the global economy and leaves investors at the start of a new cycle.

The previous economic cycle saw the Dollar outperform its peers, largely thanks to the superior returns being offered by a host of U.S. assets, including bonds and stocks while the Euro underperformed thanks to lingering fears of break-up and ultra-low returns on assets thanks to the European Central Bank's gargantuan efforts to prop up the economy.

The Dollar benefited as the U.S. has over recent years attracted investment flows thanks to its outperformance against the Rest of the World. However, the covid-19 crisis will reset this cycle and the U.S. suddenly does not look as attractive when compared to the Rest of the World.

"In short, the U.S. appears to be losing its competitive advantage in the competition for capital – and this tends to be USD-negative," says Graham Secker, Chief European Equity Strategist at Morgan Stanley.

Interest rates have fallen sharply in the U.S. as the Federal Reserve seeks to mitigate the economic damage posed by the covid-19 crisis, while a massive increase in quantitative easing has forced lower the yield paid on U.S. debt, bringing yields closer in line with other developed economies.

Coming months and years will see investors likely focus on the recovery from the crisis, and money is likely to go where returns are expected to be greater.

But, where could the trillions of dollars worth of global capital turn if the U.S. is no longer expected to be the outperformer and obvious destination for investors it once was?

One destination could well be the Eurozone, where EU states are making progress towards the pooling of debt to fund the economic recovery from the covid-19 crisis; progress that suddenly makes the area more attractive.

Indeed, Morgan Stanley says 'Next Generation EU' recovery fund is a potentially permanent step towards fiscal union, something investors judge to be positive for European assets as it implies improved stability and growth prospects.

"We think that some of the risk premium for EU break-up risk which has been embedded in European assets since the eurozone debt crisis will abate," says Matthew Hornbach, Global Head of Macro Strategy at Morgan Stanley.

The Euro has over recent years been an underperformer thanks to persistent concerns over the future of the Eurozone owing to periodic bouts of fears that the integration project was reversing.

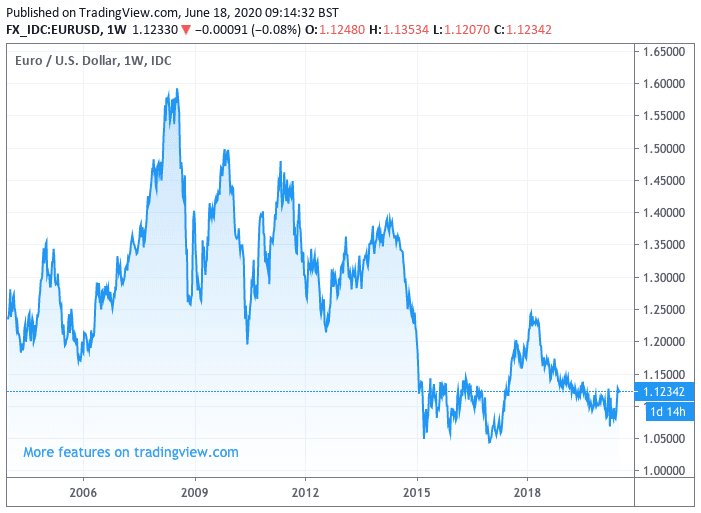

The EUR/USD exchange rate has fallen from highs at 1.39 in 2014 down to a cycle low of 1.0340 in 2017, an attempted recovery from 2017 to early-2019 ultimately failed, resulting in the pair trading back down below 1.10 in 2020.

However, another recovery appears to be shaping up with the exchange rate back at 1.12: the question is, can it push higher?

Above: The recent cycle of EUR weakness and USD strength shown on a weekly graph.

Secker says the EU recovery fund a ‘game changer’ for EU equities, which if correct would surely see the Eurozone draw in substantial amounts of global capital which would in turn aid the Euro.

"The creation of a new large and liquid (likely), higher-yielding AAA asset will attract inflows from real money investors and reserve managers alike and support EUR higher," says Secker.

According to a new report from Fitch Ratings, the proposed 'Next Generation EU' recovery fund could be a net supportive factor for EU sovereign ratings, depending on its final design.

According to the ratings agency, if the fund evolved into a permanent structure with some fiscal risk-sharing that enhanced the capacity for counter-cyclical policy and central debt issuance, "this would help to strengthen the single currency".

The fund, designed by the European Commission to help member states respond to the coronavirus pandemic, will consist of EUR750 billion (5.4% of EU GDP) borrowed by the Commission using the EU budget as a guarantee.

Most of this would finance grants and loans to member states to support recovery and resilience measures.

Funds would be allocated according to the size of a member state's economy, population, unemployment rate, and caps would aim "to avoid excessive concentration of resources", using a formula that aims to make countries hit hardest by the coronavirus the main beneficiaries.

Should the fund proceed as is currently being proposed by Germany and France, the Euro would likely remain supported.

"The EUR/USD rally is driven by both more positive sentiment around the currency union as the EU recovery fund and joint debt issuance become more active and global growth momentum weakens USD," says Hornbach.

Morgan Stanley expects the Euro's rally to come in stages – initially positioning and sentiment adjustment (no longer bearish) followed by active allocation to the eurozone assets via equities as growth picks up.

"The new EU debt issuance in 2021 could over the longer run attract inflows from reserve managers too, if yields are higher," says Hornbach.

Morgan Stanley target 1.16 for the end of this year and 1.23 by end-2021.

However, the bull case for the Euro might be questioned as soon as Friday when EU leaders are due to convene for a scheduled EU Council meeting, where the details of the Next Generation EU fund will be thrashed out.

Reports suggest a group of countries known as the 'frugal four' will push back against France and Germany's plan.

The Financial Times reports Dutch prime minister Mark Rutte, who has long relied on Germany to champion EU fiscal discipline, will push back on integrationist attempts to mutualise debt or relax deficit rules. "On Friday, he will face off against German chancellor Angela Merkel in resisting a Berlin-backed spending plan to help the EU recover from its gravest recession," reads the report.

Rutte and the leaders of Austria, Denmark and Sweden are expected to call for a "realistic level of spending" and for all the money to be paid back.

The resistance confirms that the Euro-supportive funding plan is unlikely to be passed in its current format. For markets, the question then becomes whether the final deal will offer what is needed for investors to take a fundamental relook at EU assets and the Euro.