Pound to Euro Week Ahead Forecast: Favouring Resilience

- Written by: Gary Howes

Image © Adobe Images

Pound sterling enters the new week with a constructive tone against the euro after extending its recovery trend.

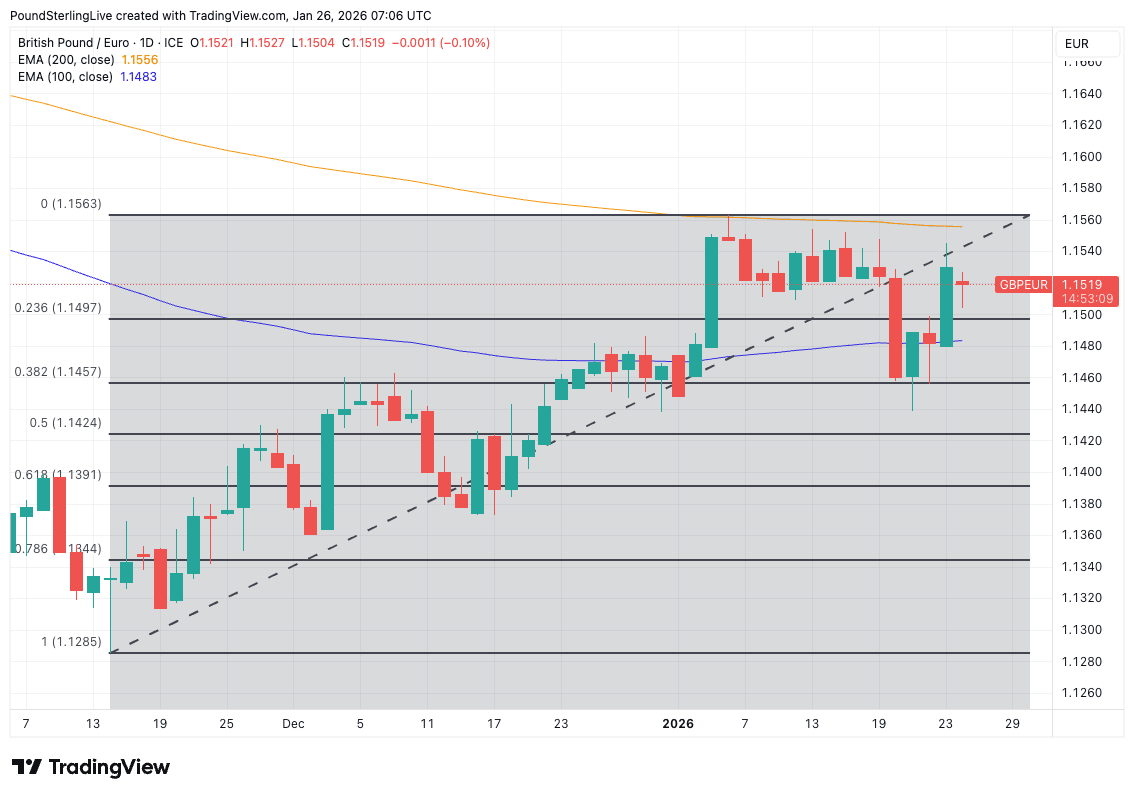

The pound to euro exchange rate (GBP/EUR) trades at 1.1519 on Monday, having clawed back late-week losses to post another weekly gain.

That's a sixth consecutive weekly advance for sterling and the ninth rise in the past ten weeks. The turnaround is notable given the pair was on course for a decisive weekly loss as recently as Friday.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Sterling found renewed support after UK PMI and retail sales data surprised positively, reversing bearish momentum and reinforcing confidence in the near-term growth outlook.

The PMI releases were particularly influential, with markets placing greater weight on the fresher survey data than on backward-looking official statistics from the ONS.

The run of stronger activity data has helped keep the broader uptrend intact, leaving sterling biased to the upside in the near term.

From a technical perspective, GBP/EUR has reclaimed its short-term moving averages, including the 9, 21, 50 and 100-day measures, signalling renewed underlying momentum.

However, the rally continues to face resistance from the 200-day exponential moving average near 1.1556, which has capped advances since early January.

A clear break above this level would be required to confirm a more durable upside extension, while repeated failures here risk another period of consolidation.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

For now, the balance of risks favours further sterling resilience, provided incoming UK data continues to validate the improving momentum signalled by recent surveys.

Calendar-wise, it's a quiet week in the major economies, although there are some inflation numbers due from Germany that tee up expectations for the Eurozone inflation series next week.

The euro could find a bid if German data prints on the hotter side of expectations. However, expectations for European Central Bank interest rates are remarkably stable, meaning the German inflation figures will unlikely have a lasting impact on the market.