Pound Sterling "Fairly Valued" against Euro as UK Current Account Deficit Nears Sustainability: Barclays

- Written by: Gary Howes

- FX analysts overexaggerate current account risks

- UK current account back to equilibrium levels

- Leaves GBP fairly priced vs. EUR

- GBP/EUR predicted to trade flat over coming weeks

Image © Adobe Images

New research from one of the UK's largest investment banks suggests the Pound is fairly valued against the Euro and persistent anxiety about the UK's current account deficit is a case of 'much ado about nothing'.

"We estimate that sterling is currently broadly fairly valued versus the UK's current account, the usual bearish narrative notwithstanding," says FX Strategist Lefteris Farmakis at Barclays.

Barclays' analysts acknowledge the UK's current account deficit is a near-permanent feature in bearishness towards the Pound: "It is read as implying large overvaluation, which leaves the pound susceptible to large drawdowns."

The deficit is largely a result of a trade deficit that sees the UK spending more on the import of goods and services than it earns, meaning the Pound requires inward capital flows to remain stable.

The downside risks to the Pound grow when these capital flows are compromised, often due to global downturns in investor sentiment or concerns about the state of UK politics and the economy.

"When a country runs a current account deficit financed by portfolio inflows, its currency is, in theory, more sensitive to a decline in risky assets globally, as cross-border portfolio investment dry up, leaving the currency vulnerable to depreciation," explains Jedrzej Glownia, Emerging Markets Strategist at BNP Paribas.

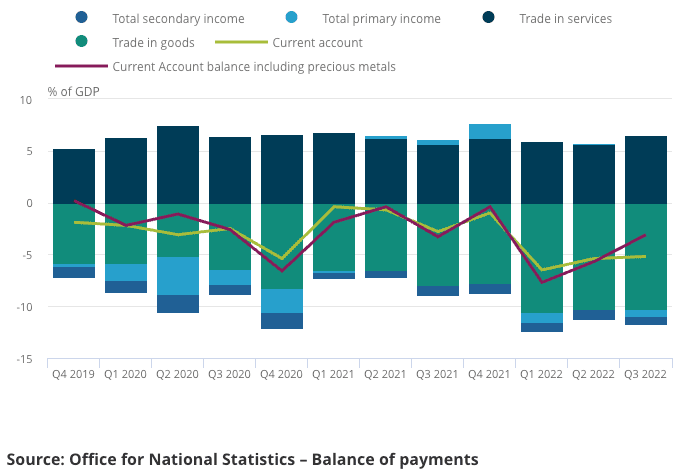

Above: The constituents of the UK's current account position. Source: ONS.

A persistent deficit therefore often accompanies bearish stances on the Pound in the global analyst community.

"Sterling... likely will remain more sensitive than normal to any changes in the willingness of overseas investors to finance the large current account deficit," says Gabriella Dickens, Senior U.K. Economist at Pantheon Macroeconomics following the most recent release of UK trade balance data.

"The UK's weak net international investment position leaves it reliant on foreign money, which should increasingly be demanding higher yields cheaper currency (or both) to fund its current account deficit," says James K Lord, a strategist at Morgan Stanley.

But, researchers at Barclays find the Pound is currently broadly aligned with current account dynamics, which goes against the consensus thinking.

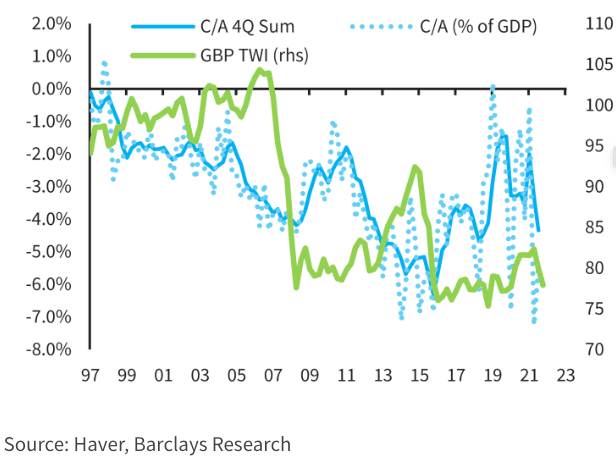

"Adjusting for data volatility/revisions and the output gap, the UK's current account gap is just short of its equilibrium value of the last 25 years," says Farmakis.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Most institutional analysts started 2023 with an expectation the Pound would remain an underperformer relative to its peers, with many citing the persistence of the current account deficit.

"The UK's persistently large current account deficit since the GFC is a key ingredient of the recurring bearish sterling narrative in recent years. The optically wide deficit tends to be interpreted as a sign of currency overvaluation. Assuming that the pound is the main mechanism for current account adjustment, and given a generally small FX pass-through to it, outsized currency moves are required to close the gap," says Farmakis.

Data from the ONS out last week revealed "the trade deficit appears to have returned to more normal levels, having ballooned in the first half of the year," says Dickens.

The overall deficit remained smaller than its 2010s average at £2.2BN for the third consecutive month in November, and well below its January 2022 peak of £13.3BN.

Economists are broadly in agreement that the UK's current account dynamics have become more volatile over recent years owing to the impact of "erratic" items, such as ships, aircraft, precious stones and metals.

Barclays therefore constructs "a smoother series" which is claimed to be a more accurate gauge, "but also much less negative".

The research finds financial flows likely offer a more accurate sense of the order of magnitude of the corresponding current account position.

These are smaller by an amount equivalent to Errors and Omissions in the H1 2022 balance of payment statistics from the ONS, "suggesting a need for financing a much smaller current account deficit," says Farmakis.

The research further finds that the equilibrium current account is not 0% but closer to -3%, implying the assumption that a deficit is a permanent downside risk to the Pound is overexaggerated.

The ONS said the UK current account deficit, when trade in precious metals is included, reduced to £19.4BN, or 3.1% of GDP in the third quarter of 2022.

This implies it is largely at the equilibrium level identified in the research.

Barclays also finds most of the UK current account deterioration since the Great Financial Crisis has been driven by the Primary Income account rather than the trade balance.

"This, in turn, is reflective of the smaller returns for net UK assets in the rest of the world during a period of sub-par global growth and low global interest rates," says Farmakis.

"There is no conceptual reason why the historical fact of a -3% current account equilibrium is an aberration," he adds. "This, in turn, implies a much smaller valuation drag on the currency."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Barclays has calculated the depreciation that must theoretically be undertaken by the British Pound to correct current account misalignments to the -3% of GDP long-term equilibrium.

Their modelling applies an FX pass-through to the current account of -0.2 (the average of the IMF and PIIE estimates) and finds Sterling screens broadly fairly valued versus the current account (between 2.5% and 5.5% overvalued).

"This is hardly meaningful," says Farmakis.

He says the results of the research are consistent with EUR/GBP's strong resistance above 0.90 (Pound to Euro rate's reluctance to fall below 1.11).

It also explains the Pound's "quick snap-back" from the 'mini-budget' lows of September.

The research also underpins Barclays' flat EURGBP forecast of 0.87 throughout the forecast horizon. (GBP/EUR at 1.15).

"In the absence of fundamental misalignments, a common ToT shock and broadly reactive monetary policies across the two regions are likely to keep EURGBP range-bound for the foreseeable future," says Farmakis.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)