GBP/EUR Rate Hits New 2021 High on Hot Inflation Reading

- Written by: Gary Howes

Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

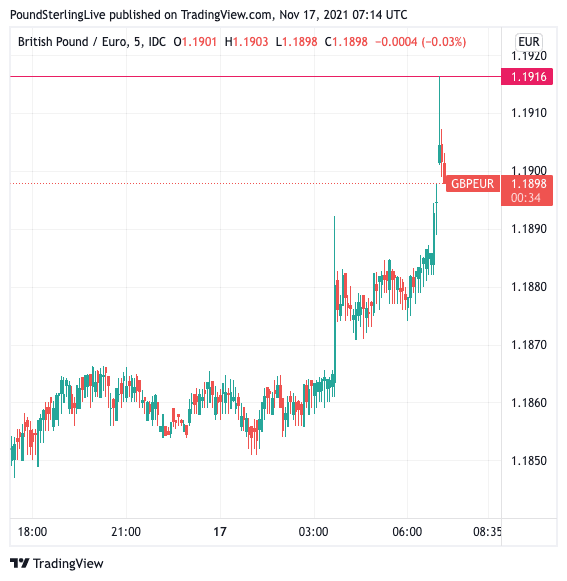

The Pound to Euro exchange rate rose to its highest level in 2021 at 1.1910 after UK inflation beat expectations.

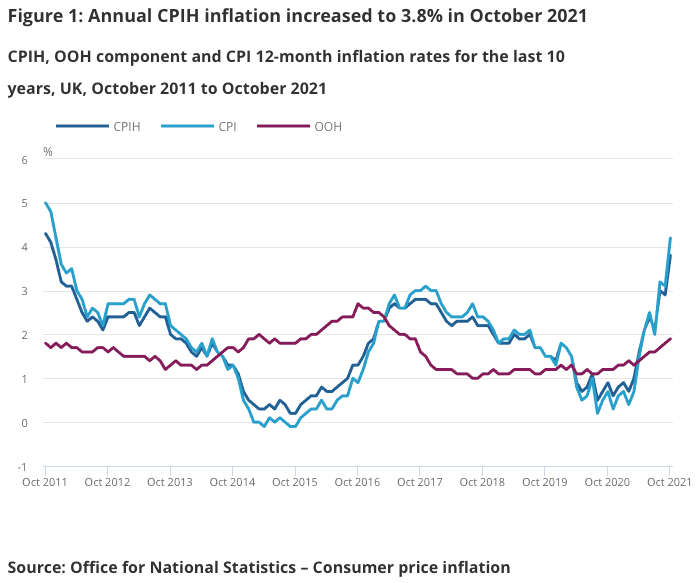

UK headline CPI inflation rose 4.2% year-on-year in October reported the ONS, surpassing the previous month's 3.1% and the market's estimate for 3.9%.

In the immediate release of the inflation data the Pound rose and extended a strong multi-day move higher against the Euro, confirmation that the market is preparing for a December interest rate hike at the Bank of England.

The previous high of 1.19 was set by GBP/EUR on October 26, but back then it marked a turning point for the exchange rate which promptly entered a decline back to 1.1650 by November 05.

Above: Five minute chart showing a spike in GBP/EUR following the release of inflation data.

- GBP/EUR rates at publication:

Spot: 1.1894 - High street bank rates (indicative band): 1.1578-1.1660

- Payment specialist rates (indicative band): 1.1787-1.1835

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

Where the exchange rate ends the day will be instructive: does it perform another about-turn and head back lower or is a rally to the next round number of 1.20% on the cards?

The economic case for a rate rise is certainly building: Tuesday saw official data show there no evidence of a spike in unemployment in October following the ending of the government's job support scheme.

Now, inflation data is running hot: the Bank is running out of reasons to keep interest rate settings at emergency lows.

"Coming after yesterday’s decent labour market release, this makes an interest rate hike in December even more likely," says Paul Dales, Chief UK Economist at Capital Economics.

CPI inflation rose a substantial 1.1% month-on-month in October, surging past the market's expectation for 0.8% and making a notable increase on the previous month's 0.3%.

Core CPI inflation rose 3.4% in October, beating the estimate of 3.1% and the previous month's 2.9%.

Increases in core inflation come off the back of rising VAT, which went from 5.0% to 12.5% on October 01 as tax breaks for the hospitality and tourism sector come to an end.

Input inflation at the country's factories and manufacturers remains acute with PPI input prices rising 13.0% year-on-year in October, above the 12.1% consensus was looking for and the previous month's 11.4%.

The economic settings are set fair for the Pound, particularly against the Euro which will likely feel the impact of slowing economic growth in the final quarter of the year owing to surging covid rates in Europe.

"The pound is surging on the UK inflation data across the board," says Neil Jones, a dealer with Mizuho Bank in London.

Jones says he is fielding some enquiries from clients as to the chances of the Bank of England hiking interest rates by more than 15 bps in December.

Money market pricing - as per the OIS market - suggests the odds placed by investors for such an outcome are set at 65%, with the majority still favouring the first hike in February.

Either way, interest rates are rising in the UK long before they will in the Eurozone.

Jones says he would expect Pound Sterling "to continue appreciating against the euro towards major alarm bell type levels at 0.8 & 1.25".

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}The main driver of October's rise in inflation was the 11.9% month-on-month rise in utility prices, which pushed up utility price inflation from 2.8% to 22.9%.

Food inflation rose from 0.9% to 1.3% as did fuel inflation, going from 17.8% to 21.5%.

"Unfavourable base effects may raise CPI inflation to around 4.7% in November and the surge in wholesale prices may result in it rising to around 5.0% by April next year. That peak would be in line with the Bank’s forecast, which the Bank has said is consistent with interest rates needing to rise," says Dales.

But Capital Economics say they expect CPI inflation to fall back "a bit further and a bit faster in the second half of next year", perhaps closing on the Bank of England's 2.0% target by December 2022.

As such, although interest rates may well rise from 0.10% to 0.25% in December and perhaps to 0.50% in February, Capital Economics don’t think that they will reach the level of 1.00-1.25% currently priced into the market for the end of next year.