Pound-Euro Week Ahead Forecast: Eyeing 1.14+ as GBP Shines, ECB and Vaccine Woe Halt EUR

- Written by: James Skinner

- GBP/EUR set to break higher, with scope for 1.14+ this week.

- Vaccine success & valuation aid GBP in a FX-concerned world.

- ECB's EUR/USD fears, EU’s vaccine crisis put brakes on EUR.

- BoE decision on negative rates the highlight for GBP this week.

Image © Adobe Stock

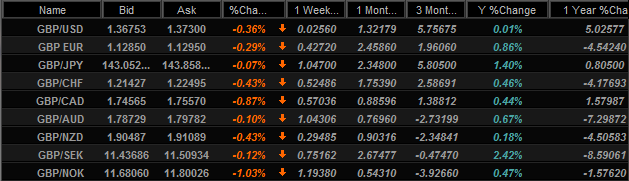

- GBP/EUR: spot rate at time of writing: 1.1285

- Bank transfer rate (indicative guide): 1.1004-1.1083

- FX specialist providers (indicative guide): 1.1130-1.1220

- More information on FX specialist rates here

The Pound-to-Euro rate extended its tentative 2021 advance last week and could rise further in the coming days, breaking above resistance on the charts and opening the door to fresh milestone highs, as Sterling enjoys fundamental tailwinds while the Euro is handicapped by homegrown vulnerabilities.

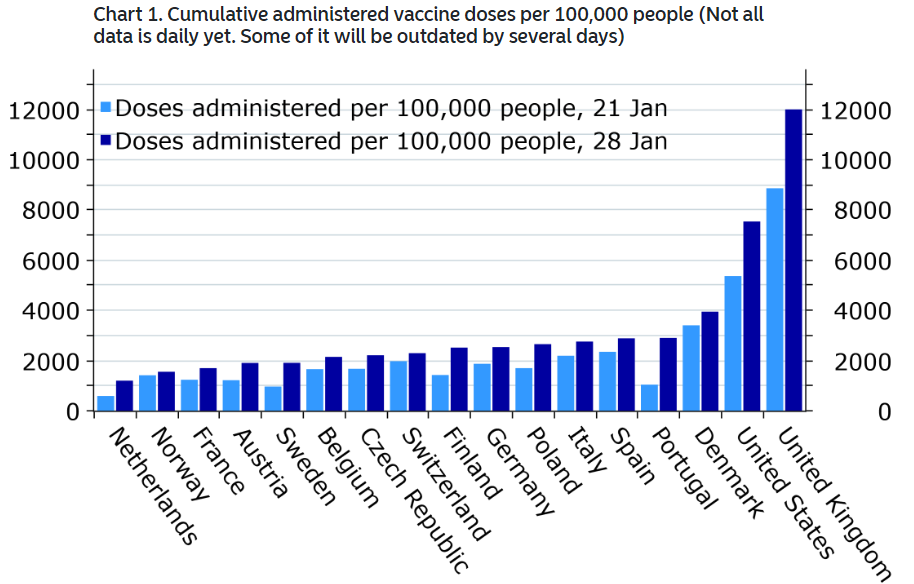

Pound Sterling pulled ahead of all other major currencies for 2021 last week and could further outperform the Euro in the short-term as the UK remains in pole position on coronavirus vaccinations while the European Central Bank (ECB) and an escalating vaccine crisis in Brussels handicap the single currency.

The Pound stumbled with risk assets on Friday but had otherwise outperformed for the week despite earlier widespread losses in stock and commodity markets, enabling it to overtake both a resurgent U.S. Dollar as well as the now-flagging commodity Dollars of New Zealand, Australia and Canada for 2021.

"Sterling continues to reap the benefits of the fast vaccination process which puts it ahead of its major peers. With the currency being undervalued based on our medium-term BEER fair value model (around 7% against both USD and EUR), the valuation gap should continue closing throughout the year," says Petr Krpata, chief EMEA strategist for currencies and interest rates at ING. "The big focus next week is on the BoE meeting (Thursday)."

Above: Sterling Vs the majors over selected timeframes. Source: Netdania Markets. Click for closer inspection.

Britain's vaccination outperformance is increasingly recognised as an ongoing tailwind for the Pound, although Thursday's Bank of England (BoE) policy decision will be crucial in determining if GBP/EUR can sustain a pending move above nearby technical resistances between 1.13 and 1.1318.

Constructive conversation with @VDombrovskis this afternoon. I was reassured the EU has no desire to block suppliers fulfilling contracts for vaccine distribution to the UK. The world is watching and it is only through international collaboration that we will beat this pandemic.

— Dominic Raab (@DominicRaab) January 30, 2021

The vaccine rollout is, according to official pronouncements, unaffected by a recent European Union rule that threatens to block vaccine exports after Prime Minister Boris Johnson and EU Commission chief Ursula von der Leyen agreed that no measures should affect fulfillment of existing contractual obligations.

Constructive talks with Prime Minister @BorisJohnson tonight.

— Ursula von der Leyen (@vonderleyen) January 29, 2021

We agreed on the principle that there should not be restrictions on the export of vaccines by companies where they are fulfilling contractual responsibilities.

"The ask-for-permit proposal will mean that authorities are able to hold back any exports until a set of pre-defined criteria has been met, including that the companies have delivered sufficient vaccine supplies to EU member states as per existing agreements," says Daniel Brødsgaard, an analyst at Danske Bank.

Newly implemented vaccine export restrictions are a direct reminder to the market of Europe's lacklustre progress on vaccinations, which has potentially set its economy back months in comparison to the UK and U.S., and comes just as the ECB makes a more concerted effort to reign in the Euro-Dollar rate.

Above: Pound-to-Euro rate at 4-hour intervals, alongside S&P 500 futures. Shows resilience to risk-aversion in New Year.

"Although AstraZeneca has been facing strong EU criticism as the delivery schedule has been drawn into question, the inclusion of AstraZeneca vaccines will be hugely important for the wider roll-out of vaccines in the EU," says Jesper Rasmussen, an analyst at Nordea Markets.

Europe is lagging on vaccinations after problems at Belgium-based facilities impeded production of both Pfizer and Astrazeneca jabs, although if early misfortune on vaccinations hadn't gotten the attention of the Euro so far, it could be likely to in the week ahead in light of controversy over export restrictions.

{wbamp-hide start}

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

"Remember that a lot of countries are importing Pfizer vaccines made in Belgium (including Canada)," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets. "The EU/AstraZeneca dispute has repercussions for the market if it continues to fester and leads to the EU implementing export controls on all vaccines made in the region."

Meanwhile, 11% of the UK population had received their first dose of a vaccine by Friday, placing the government on course to meet its target of 15 million by mid-February and something like herd immunity around mid-year or soon after. The government is supported in its effort by orders for more than 350 million jabs, which is more than five for every person in the country, albeit that the bulk of them aren't expected to be delivered before the second half of the year.

Source: Nordea Markets.

"Intriguingly, FX price action in recent weeks loosely fits the growing disparity in vaccine rollout. The USD and GBP have been outperformers, fitting their relatively faster vaccine rollout profile, while EUR has lagged," says Richard Franulovich, head of FX strategy at Westpac. "If the recent divergence in vaccine rollout continues there may be a tradeable story for rates and FX. With the UK set to return to some form of “normalcy” sooner than Europe there’s a case for more EUR/GBP downside."

The EU has suffered multiple setbacks in its vaccination effort and as a result faces a slower reopening and later start to its economic recovery although the single currency is also now being handicapped by a European Central Bank, whose exchange rate concerns became more palpable last week.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"We sense that there has been a clear shift in the ECB's thinking on the exchange rate," says Stephen Gallo, European head of FX strategy at BMO Capital Markets. "The recent developments make us more confident that key EUR cross rates are likely to drift lower over the course of H1 (EURCAD, EURGBP, EURNOK, EURAUD, EURCNH, and EURINR)."

Bloomberg News reported Wednesday that the ECB sees investors underestimating the odds of a rate cut up ahead and that its policymakers have agreed to stress one is a viable option after future meetings. The same outlet also reported earlier that the ECB is investigating if U.S. monetary policy could explain the 10% EUR/USD gain for the year to late January, which lifted the trade-weighted Euro exchange rate. The idea the ECB might cut interest rates further is not new but the fact that it's attempting to repackage it as news speaks volumes about the true extent of Frankfurt's currency concerns.

Above: Pound-to-Euro rate at daily intervals, with Fibonacci retracements of 2020 fall and alongside EUR/USD (black).

"The row about vaccine distribution, a plethora of covid-related restrictions in the region and the approach of the end of the Merkel era are all factors which may make investors reluctant to extend long EUR positions – even without the addition of ECB jawboning," says Jane Foley, a senior FX strategist at Rabobank. "While we see scope for EUR/USD to pullback towards the 1.20 area this quarter as investors reassess the change in fundamentals, we expect to see 1.22/1.23 again later on in the year."

Meanwhile, a rising Pound-Euro rate is one of only two viable pathways through which an elevated trade-weighted Euro could be reduced without declines in the Euro-to-Dollar rate, which is widely expected to rise further in 2021. This, the UK's vaccine success and an anticipated favourable turn in rhetoric as well as stance from the Bank of England this Thursday at 12:00 London time all advocate for continued Pound-to-Euro gains in the short and medium-term.

"The argument in favour of another imminent easing of monetary policy has been dampened," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "The most bullish potential outcome for the GBP would be if the BoE leaves the key policy rate unchanged, and the consultation with lenders further dampens speculation over negative rates in the near-term. It could open the door to further GBP gains lifting cable closer to 1.4000 and EUR/GBP towards the mid-0.8000’s [GBP/EUR: 1.1764]. Long GBP positioning amongst Leveraged Funds is still relatively light."

Consensus sees the BoE holding Bank Rate at 0.10% and, ahead of the March budget, offering only assurances of its further monetary support in the event that the economy requires it so Sterling may be more interested in the bank's review of negative rates as a policy tool instead.

Governor Bailey indicated earlier in January that the BoE isn't keen on the idea of negative rates, prompting a rally in Sterling as investors priced-out the prospect of any rate cut at all in the short-term, so the Pound will be sensitive on Thursday to the bank's determination.

Above: GBP/USD at weekly intervals, needs to lift GBP/EUR (black) to ease pressure on EUR/USD (yellow).

Ultimately, the BoE could put a stop on Sterling's rally this week if it does anything to persuade investors into reconsidering their recent pricing-out of further interest rate cuts, which would risk pulling the rug from under Sterling. That would only exacerbate upward pressure on the trade-weighted Euro, however, and in turn threaten to undermine EUR/USD, a consensus market view and an integral part of the so-called reflation trade.

The BoE arguably has less reason than others to want to stand in the way of a currency appreciation, with Sterling still near to long-term lows against many majors including the Euro and given the MPC has not lost sight of its inflation target in the same way that policymakers elsewhere have.

If the Bank steps aside for the Pound on Thursday then GBP/EUR would be in with a shot at sustaining itself above a nearby Fibonacci retracement and its 200-week moving average at 1.1318 through Friday's close.

That would mark the weekly close necessary for a technical breakout toward new milestone highs to be confirmed. Once past there the Pound would have scope to rise as far as 1.1532, which would see EUR/GBP at 0.8671, according to technical analysts at Commerzbank.

"EUR/GBP has eroded the 200 week ma at .8835 (but NOT on a closing basis)," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "A CLOSE below .8835/25 would imply another leg lower to the .8671 April low."

GBP/EUR would find support around 1.1280 if last week's lows in GBP/USD and EUR/USD, around 1.3620 and 1.2070 respectively, held in response to any further risk-aversion over the coming days. The former always closely reflects relative price action in the latter two exchange rates. On the other hand, GBP/EUR would rally if EUR/USD failed to leave intact last week's low.

Meanwhile, Sterling would probe 1.14 in a market where EUR/USD slipped back to 1.2070 as GBP/USD made another attempt to push above the 1.3760 resistance that's so-far blocked its path higher for weeks now.

Above: Pound-to-Euro rate at weekly intervals, with 200-week moving-average in red and EUR/USD in black.