The Pound-to-Euro Exchange Rate 5-Day Forecast: Weakness Expected, Tuesday's Brexit Vote a Key Moment

Image © Lee Goddard / Number 10 Downing Street

- Short-term bearish trend to continue

- Major events could mean volatile conditions

- Brexit vote to dictate Sterling; ECB meeting the Euro

The Pound-to-Euro rate could see a lot of volatility in the week ahead due to major political and economic events.

For the Pound the meaningful vote by Parliament on the government’s Brexit deal has the potential to rock markets; for the Euro the same can be said of the last meeting of the year of the European Central Bank (ECB) governing council.

From a purely technical perspective, we note that the market is compressing with tighter and tighter ranges forming which suggests a more explosive move is brewing.

Think of an uncoiling sprin.

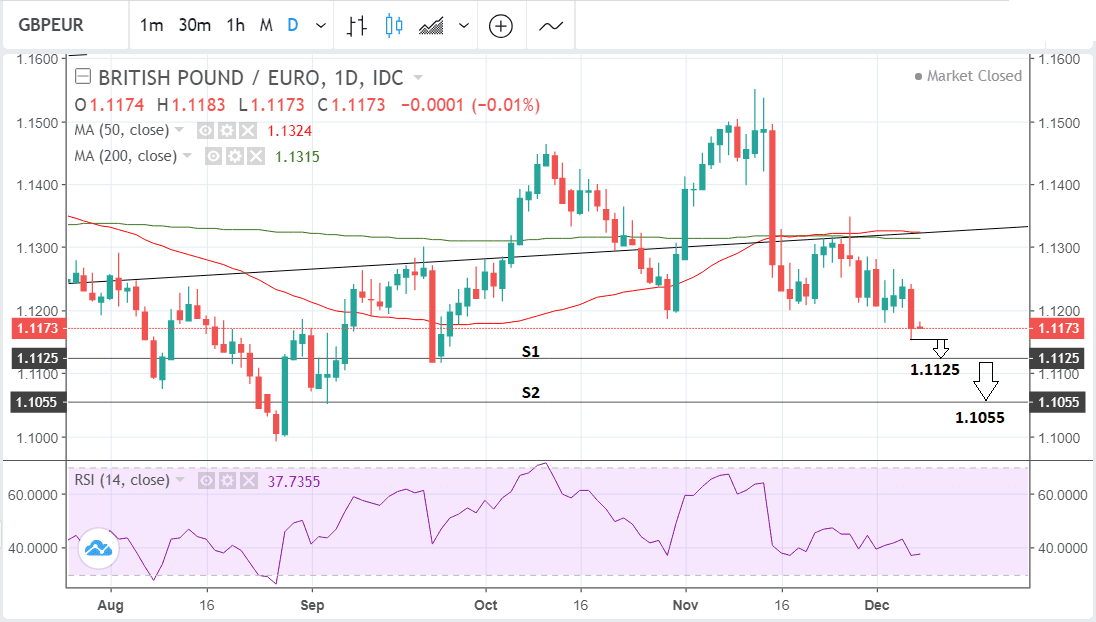

This big move might or might not happen in the coming week, but in the absence of a major direcitonal move we can identify the short-term trend remains bearish and Sterling-Euro will likely to continue falling.

The break below the October lows was a negative sign which suggests more downside on the cards.

A break below the recent 1.1152 lows will probably reinvigorate the downtrend and lead to a continuation down to a target at 1.1125. After that, we see risks of a further move down to a target at 1.1055 where the S2 monthly pivot is situated.

Pivots, as the name suggests, are levels where there is a higher probability the trend could reverse or ‘pivot’ thus they lend themselves to adoption as targets on charts.

The sluggish downside momentum, as indicated by the RSI indicator in the lower pane, raises some alarm bells and suggests bearish pressure is waning, however, on balance, we remain bearish given the direction of the short-term trend. Nevertheless, traders should beware that these are ‘choppy seas’ and anything is possible, so caution is recommended at every turn.

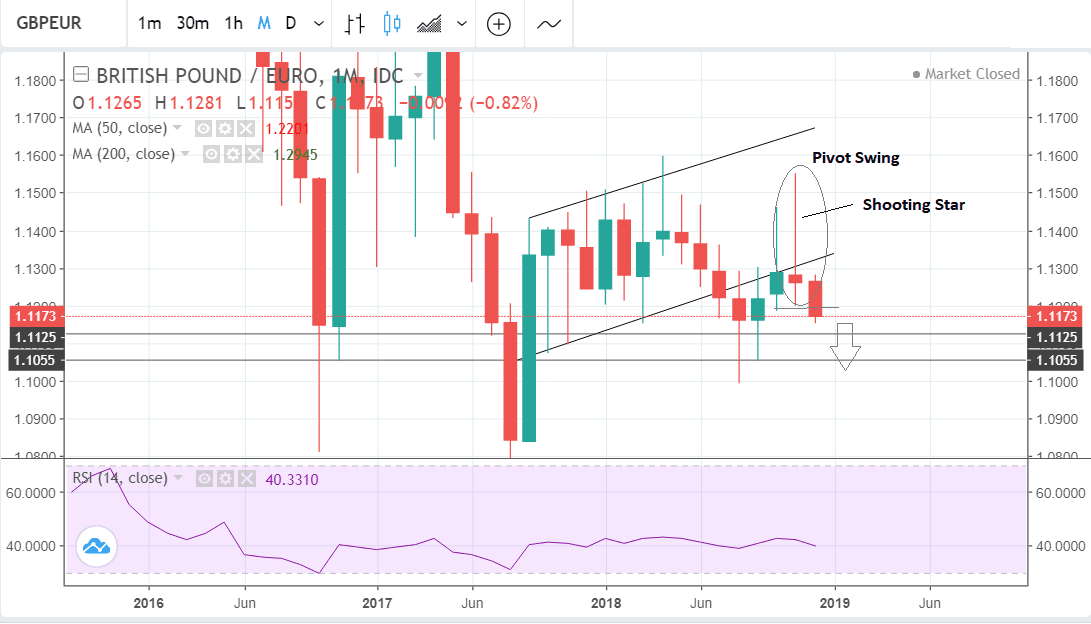

The longer-term monthly chart of GBP/EUR is also bearish.

The pair has potentially reversed the longer-term uptrend by forming a ‘pivot swing’ pattern around the November highs. These are highly bearish longer-term signals. They occur when the exchange rate reverses over a three-month period: peaking in the middle month and then falling in the third month. A pierce below the first month’s lows provides confirmation. The break below the October lows was the defining signal for the pattern.

The fact the pair formed a bearish shooting star candlestick in November is a further sign the exchange rate is vulnerable.

Advertisement

Bank-beating GBP/EUR exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Pound: What to Watch

Despite rumours the vote may be postponed, the coming week promises to be busy for Sterling if the crucial Brexit vote in Parliament goes ahead.

It is an event which has the potential to start a new era for the Brexit story and Theresa May’s future in her role as Prime Minister and leader of the Conservative party.

Parliament’s meaningful vote on the government’s Brexit deal is scheduled for Tuesday 11, at 19.00 GMT. The government is currently expected to lose the vote and this could cause some short-term weakness for the Pound.

Rumours have surfaced over the weekend that the vote could be delayed whilst Theresa May attempts to draw more concessions from Brussels, but further clarification from Downing Street confirm the vote will indeed progress as planned.

For Sterling, the extent of the loss is key. If the loss is smaller than expected, May will take heart that some further concessions on the political declaration from European leaders can help the deal go through.

"We would not expect Sterling to slump if she loses by a narrow margin," says Thomas Pugh with Capital Economics.

If the government loses by 200 or more votes Theresa May could resign. She could also simply head back to Brussels and insist talks are reopened telling the European Union if they do not a 'hard Brexit' becomes inevitable.

The Labour party may also force a vote of no-confidence which could lead to a general election if the government loses, however this would require some Conservative party MPs to vote with the opposition, which is unlikely.

"A decisive defeat could have a more significant market impact though. Theresa May might have to face down a vote of no confidence in the government and a leadership challenge, which would rattle markets," says Pugh.

A second referendum is also said to be a further possible outcome, however we doubt there is a majority in the House of Commons for this.

The bottom line? No one quite knows what will happen next.

"Political uncertainty is likely to continue to hang over the economy for at least the next few months," says Pugh.

Beyond Brexit, a major release for the Pound is GDP data, which is forecast to show a slowdown in October when it is released at 9.30 on Monday. The average over the previous 3 month period was 0.6% but this is expected to slow to 0.4% in the most recent period.

Industrial and Manufacturing production are also released at the same time and forecast to show a slowdown.

Industrial production is expected to show a -0.1% decline in October, and Manufacturing a 0.0% change.

Labour market data is forecast to show little change in November with the unemployment rate stuck at 4.1% and pay excluding bonuses at 3.2% whilst pay including bonuses continues to show a 3.0% rise. Overall employment change is expected to show a 20k rise.

"We expect to see another robust, if unspectacular, rise in employment in the three months to October. Meanwhile, wage growth probably edged up further," say Capital Economics.

Finally, balance of trade data is out on Monday at 9.30. The deficit in the previous month of September was a very marginal -£0.03bn.

"We think the trade balance slipped back in to deficit in October, as imports rebounded and the recent strength of exports came to a halt," says Capital Economics in a note covering the coming week. "Surveys also suggest that exports, which performed well in recent months, fell back in October."

The Euro: What to Watch

The main event for the Euro is the ECB policy meeting out at 12.45 GMT, on Thursday, December 13, with the press conference at 13.30.

The ECB is expected to plough on with its roadmap to reducing monetary stimulus and announce an end to quantitative easing (QE) at the meeting. This is still expected by most analysts despite the growth rate falling to the lower band of 2018 forecasts and only hitting 0.2% in Q3.

“Although Mario Draghi could strike a more cautious tone at his post-meeting press conference on Thursday, he is unlikely to signal any change of path in the ECB’s policy normalisation plans just yet,” says a note from brokers XM.com. "Still, even if the ECB keeps policy and its forward guidance unchanged, the euro is at risk of coming under selling pressure from any dovish remarks by the ECB chief, as well as from downward revisions to the ECB’s quarterly staff projections.”

One key early indicator of growth in the Eurozone is the IHS Markit Composite PMI indicator. This is a gauge of activity in manufacturing and services sectors.

The PMI fell in both October and November, suggesting Q4 growth could still be low. Friday sees the release of the December Composite PMI at 9.00, which is currently forecast to show a slight recovery to 52.0 in December.

"While we have been alarmed by the lacklustre growth in the Euro-area, and if growth weakens further the ECB might be in dire straits, it could be that we will get some relief in December. After warning of downside risks to Euro-area PMI for a long, long time, our models are now inconclusive. It might be that Euro-area PMI surprises positively. If it does, current ECB pricing will be too depressed," says Martin Enlund, an analyst with Nordea Markets.

The ZEW survey is released on Tuesday at 10.00 GMT and is forecast to show sentiment falling by -25.0 from -24.1 in Germany, in November. The ZEW is sometimes seen as a reliable leading indicator for the economy. German data has been weak recently so the ZEW may gain more attention than usual.

Another key release for the Euro is Industrial Production on Wednesday at 10.00, which is forecast to show a 0.3% rise month-on-month compared to September.

Also given Germany slow-down fears, German trade balance data, out on Monday at 9.30, could come into focus.

There is a chance of a more positive surplus because exports are forecast to rise by a stronger 0.5% compared to imports which are only expected to rise 0.4%.

Germany has to import all its fuel so the recent sharp fall in oil should help increase the surplus.

Advertisement

Bank-beating GBP/EUR exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here