UK Trade Deficits Widen in March but Annual Data Shows Longer-term Improvement in Import-Export Balance

- Written by: James Skinner

-UK trade deficits widen further than expected in March.

-Quarterly and annual data show longer-term improvement.

-UK trade deficit was just 1.3% of GDP in year to end March.

© Winterbilder, Adobe Stock

The UK's trade deficits widened during the March month, according to Office for National Statistics data released Thursday, although comparisons with figures from one year ago show export growth driving a strong improvement in the nation's international trade position.

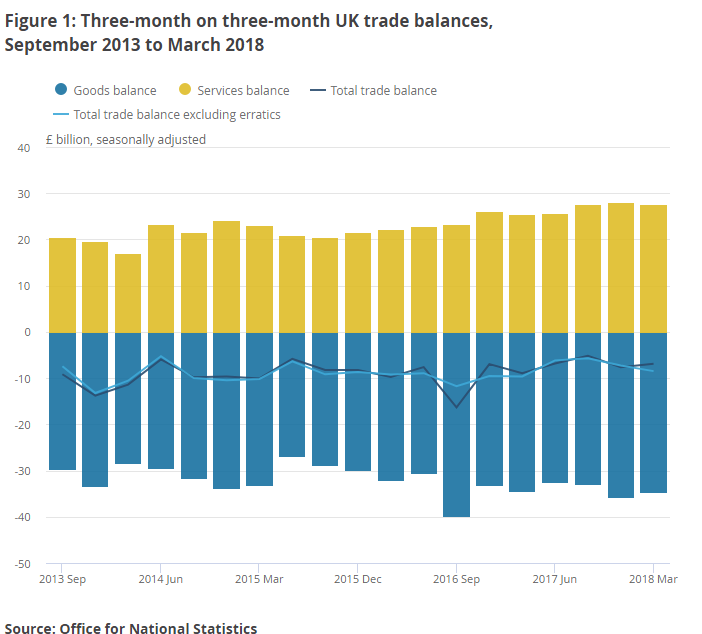

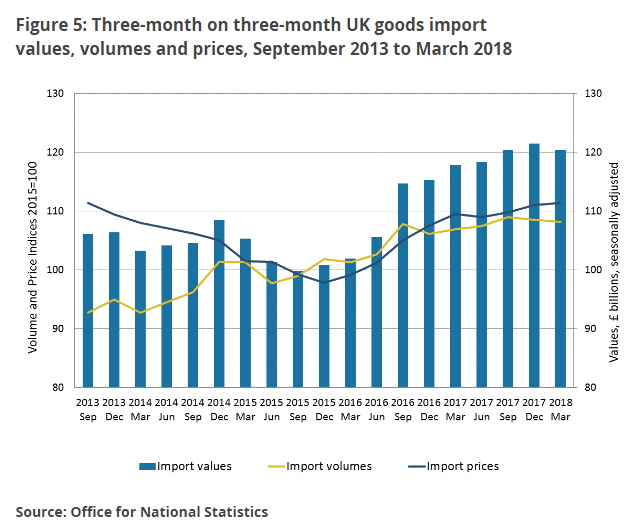

The trade in goods deficit rose to from -£10.41 billion to -£12.28 billion during the March month, according to the ONS, as growth in the value of goods imported into the United Kingdom was larger than the rise in export values. Meanwhile the total trade deficit, which takes account of both goods and services trade, rose from -£1.17 billion to -£3.09 billion during the month.

This March-focused deterioration garnered much of the market's attention Thursday and captured most of the column inches decicated to UK trade however, separate measures of the UK's international trade position showed a marked improvement in the first quarter and in the year to end-March 2018.

The annual trade in goods and services deficit falling to -£26.6 billion over the 12 months to March 2018, which is equivalent to just 1.3% of GDP. This was the result of Britain's trade surplus in services rising by £1.1 billion to £109.2 billion during the period while the trade in goods deficit narrowed £2.2 billion to -£135.7 billion. A similar improvement was also recorded in the quarterly figures.

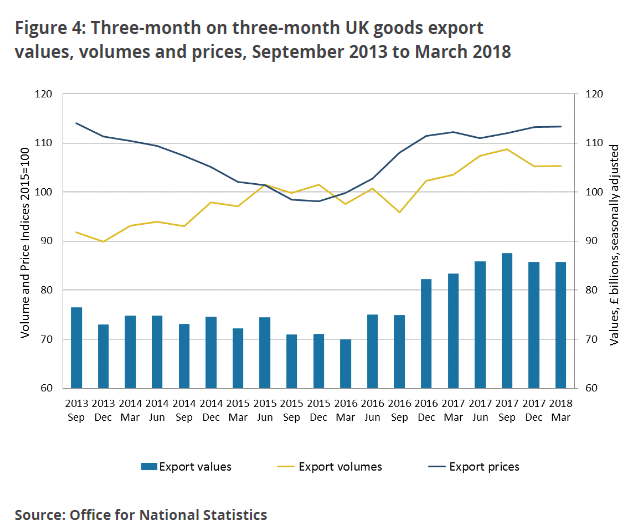

Office for National Statistics staff attribute the lower goods deficit to exports having grown at a much faster pace than the increase in imported goods during the period, with exports up 9.2% while imports rose only 6.4%.

Thursday's data comes closely on the heels of another report by the ONS showing the 2016 UK trade deficit was just -£30.9BN or 1.6% of GDP, which is almost £10BN lower than previously thought. Earlier estimates suggested the deficit was in fact 2.1% of GDP.

Markets care about trade deficits because they provide valuable insight into real-world demand for a currency. A rising trade deficit suggests either that exports and their associated demand for a currency are falling, or that imports and their associated supply of a currency on global markets are rising. Both are typically bad for a currency while a steadily narrowing trade deficit is a positive influence.

The size and trajectory of a trade deficit is also important for economic growth and therefore, inflation and interest rates. This is because imports are a substraction in the calculation of GDP while exports represent a credit to the value of economic output. As a result, rising exports and, or, falling imports can help to boost the economy.

However, an ONS breakdown of the different statistics took some of the shine off of the three month and 12 month numbers as it shows much of the improvement in the UK's goods trade position over the last year coming as a result of trade in volatile commodity items such as gold and oil.

Excluding these, the goods trade balance registered a minor deterioration over the last 12 months, althought the total trade balance after the services sector is taken into account still improved from £-4.48 billion in March 2017 to -£3.72 billion in March 2018.

International trade statistics for both goods and services have been of increased importance for the UK economy ever since the Brexit referendum of June 2016 given near-universal forecasts that an exit from the EU would be bad for the economy and after the referendum itself produced a double-digit devaluation in the value of Pound Sterling.

The more optimistic pundits participating in the Brexit conversation had hoped the lower value of Sterling would help stimulate UK exports by making British goods cheaper for overseas companies and consumers to buy, while encouraging producers to substitute foreign raw materials for those produced at home.

To some extent this has happened, with exports enjoying a broad upturn in the almost two-years since the vote while the UK's manufacturing sector enjoyed its longest run of growth since the 1980's during the eight quarters to the end of 2017.

However, the value of imports is still rising and as has been observed above, much of the increase in goods exports over the last year appears to have been the result of trade in volatile commodity items rather than manufactured goods.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.