Looking Beyond the Election UK Confidence is Fading

Whatever the end result in Thursday’s general election the economy won’t change, only the personnel running the country.

And looking beyond the politics, UK Economic Confidence is fading fast, says UBS Strategist John Wraith.

If the economy is in for a bumpy ride it is safe to assume that the Pound will suffer too, regardless of the election result.

Weaker consumer spending will reduce GDP which will hamper interest rate expectations, the principle drivers of currency appreciation.

“At both the consumer and business level, confidence in the UK is on the wane, with surveys suggesting a gradual but persistent loss of momentum,” said Wraith.

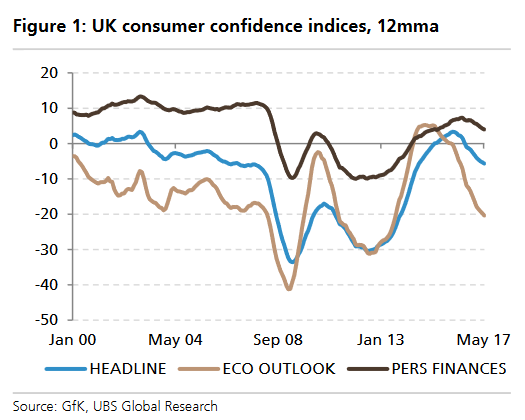

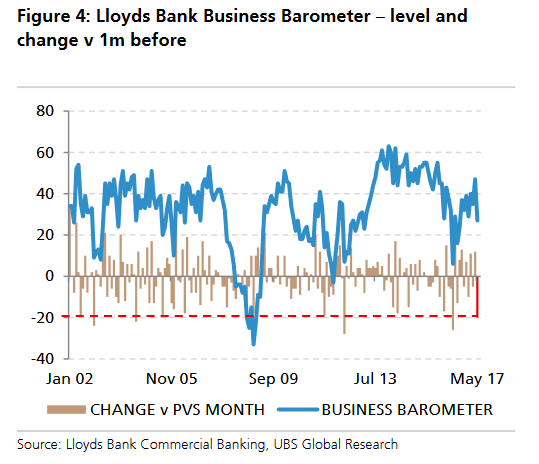

The loss of confidence is already showing in various indicators such as the GfK consumer confidence gauge, which has dropped to its lowest level since mid-2014, and the Lloyds Bank Business Barometer which registered a very large fall in May.

The European Commission has also warned of weakening economic sentiment and consumer confidence in the UK.

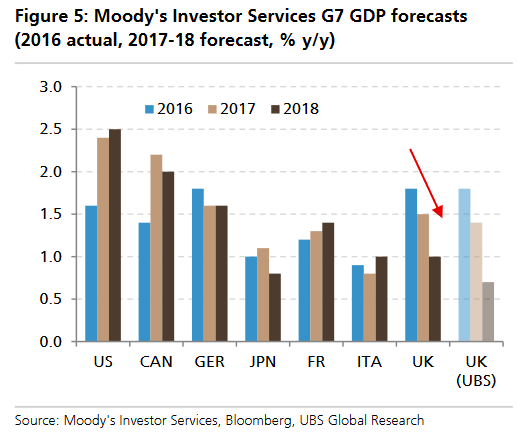

Moody’s investor service has downgraded GDP projections for the UK and anticipates that the UK will be the only G7 economy where growth slows both this year and next, with growth slowing to 1.5% in 2017 and 1.0% in 2018.

Squeeze on Real Earnings

Confidence remains high for private finances if not so high for the economy, however, this divergence is unlikely to last, says Wraith.

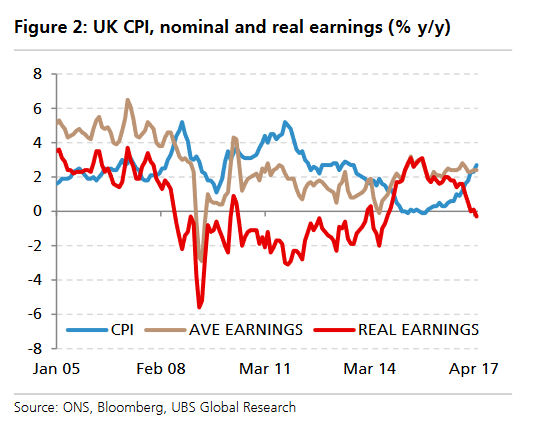

The weak economy will begin to impact on earnings, and rising inflation will lower real earnings, replacing confidence with fear.

Going forward it will be the squeeze on real earnings which will be the most important factor limiting consumption.

“The intensifying squeeze on real earnings is not likely to relent and will, in our view, exert mounting pressure on private sector consumption,” said Wraith.

Corporate Confidence

Corporate confidence remains relatively high as the weak pound has helped support exports which has offset concerns about declining consumption and the uncertain impact of Brexit negotiations.

The FTSE is negatively correlated to the Pound which means it tends to rise as Sterling weakens.

This is due to the unusually high international element in the companies which make up the index.

Wraith, however, thinks that the boost enjoyed by corporates from the weak Pound is coming to an end.

“The tailwinds provided by the fall in the currency are starting to blow less strongly, and from July onwards the currency will no longer be lower on a year-on-year comparison, assuming it stays around current levels.”

This assumption seems less credible following Sterling’s deep -2.0% fall after the election.

It may also be overoptimistic given the weakening economy.

After all, a decline in consumption will negatively impact GDP which is a key component in the valuation of the currency.

“Concerns about the strength of domestic consumption may intensify as consumers' spending power diminishes. Lloyds Bank reported a sharp drop in its Business Barometer gauge from 47 to 27 in May. This is the largest monthly decline since the outcome of the EU referendum rocked sentiment in June 2016, and has only been exceeded four times in the past 15 years,” said Wraith.

Feedback Loop: Lower for the Pound

Given the dark clouds on the horizon noted by Wraith it may even be possible that Sterling starts to trend lower again as a result of a negative feedback loop caused by the erosion of real earnings.

Such a scenario could play out if the weaker Pound kept inflation stubbornly high by increasing the price of imports.

If the economy stagnates then earnings are unlikely to rise strongly and real earnings will continue falling.

The Bank of England (BOE) could normally put up interest rates to combat higher inflation, but normally prefer to do so if the inflation is home grown from economic growth and increased spending.

They will be much more reluctant to lift interest rates if inflation is imported due to the weak Pound and growth is subdued.

This is because higher interest rates without robust growth can tip the economy into a recession.

The lack of rate increases from the BOE is likely to lead to even further devaluations for Sterling as its counterparts pursue comparatively more aggressive monetary policies.

This will in turn make the Pound even weaker and exacerbate imported inflation even further, thus completing the negative feedback loop.

This is an example of what legendary investor George Soros calls reflexivity – a process by which a currency moves outside the bounds of statistically normal distribution and extends.

It explains why markets trend and are prone to a higher than expected number of incidents which fall well beyond the normal range.