Eurozone's Bumpy Expansion Continued in May But ECB Won't Like Signs of Strong Services Inflation: PMI Report

- Written by: Gary Howes

Image © European Commission Audiovisual Services

The Eurozone's economy continued to expand in May although a sharp deterioration in manufacturing activity and still-elevated price pressures are of concern, say economists.

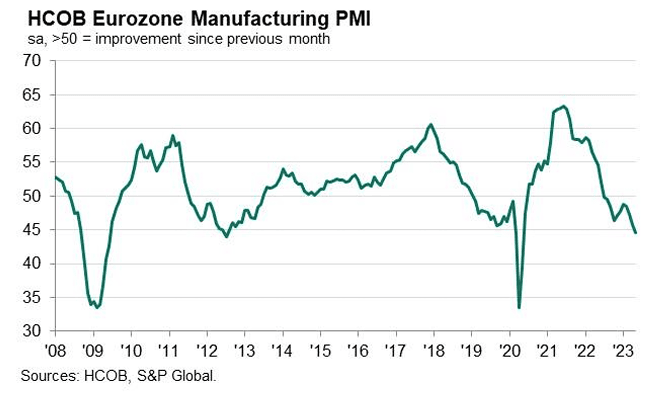

Eurozone Manufacturing PMI read at 44.6 in May, undershooting expectations for 46.2 and representing a slowdown on April's 45.8, confirming this sector remained deep in contractionary territory.

But the Services PMI was at a growth-generating 55.9 in May, stronger than the consensus expectation for 55.6, albeit lower on April's 56.2.

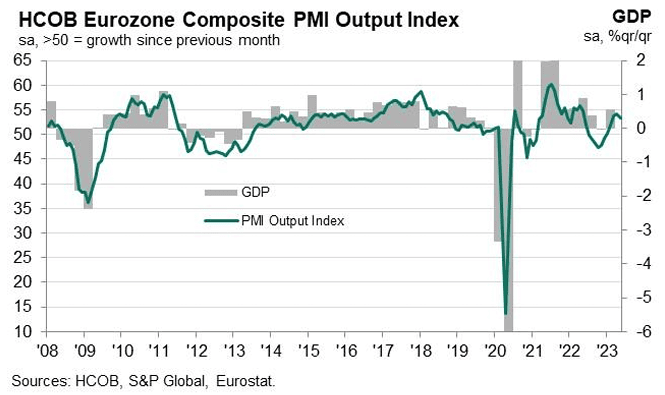

The Composite PMI - which rebalances the data to give a better assessment of broader economic performance - read at 53.3 in May, below consensus expectations for 53.7 and below April's 54.1.

S&P Global said the rate of expansion across the Eurozone moderated in response to the near-stalling of new business inflows.

The surveys also revealed an increasingly uneven recovery with services shining but factory output extending its slide:

S&P Global also reported business confidence in the outlook sank to a five-month low as businesses fretted over the economic outlook.

There was some good news for the European Central Bank - which is expected to continue raising interest rates in the face of hot inflation - as the average price charged for goods and services rose at the slowest pace in 25 months.

Nevertheless, price increases remain elevated by historical standards.

"May’s PMI release confirms that concerns about elevated core inflation should centre around services, while goods inflation is set to ease markedly from here on. The economy continues in a 'muddling through' phase, as the stagnation seen around the turn of the year has not given way to a strong recovery. The strong services performance and subsequent inflation pressures will likely keep the ECB on its toes heading into the summer as any impact on overall inflation unfolds," says Bert Colijn, Senior Economist for the Eurozone at ING Bank.

Input costs fell for a third successive month, and at the sharpest rate since February 2016, suggesting goods inflation is to come in lower.

Looking at the major economies, Germany's Manufacturing PMI disappointed at 42.9 in May, which is below the expected 45.0 and April's reading of 44.5.

But Europe's largest economy was kept afloat by its services sector where the PMI read at 57.8, higher than the anticipated 55.5 and up on April's 56.0.

This meant Germany's Composite PMI stood at a healthy 54.3 in May, up on April's 54.2 and beating expectations for 53.5.

But France slowed down notably with a Composite PMI of 51.4 in May, which is softer than April's 52.4 and below the consensus estimate for 52.3.

Analysing the data, Hamburg Commercial Bank says the data is consistent with ongoing Eurozone economic growth and the ECB will be inclined to respond with further rate hikes.

"The European Central Bank will have a headache with the PMI price data," says Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank. "This is because selling prices in the services sector actually rose more than in the previous month. It is precisely price developments in this sector that the ECB is watching with a wary eye."