Eurozone Recession Avoided says Goldman Sachs, But UK Will Still Contract

- Written by: Gary Howes

Image © Adobe Stock

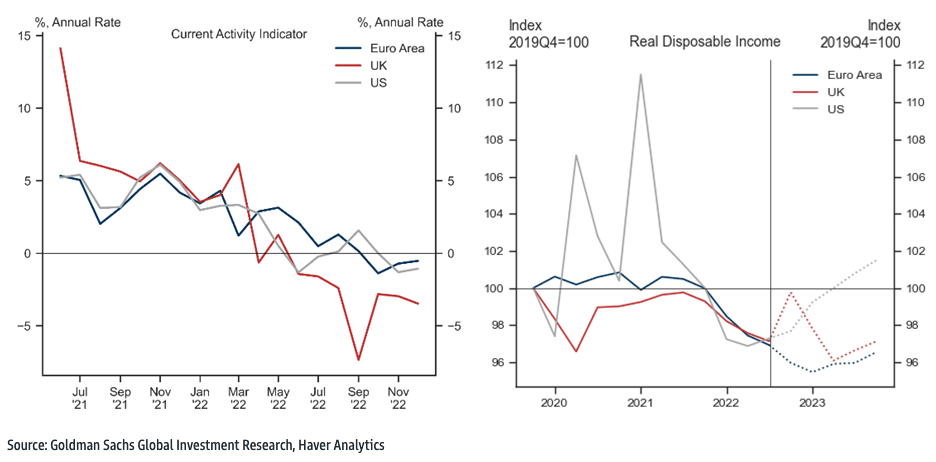

The Eurozone economy won't contract in 2023 says Goldman Sachs following a review of its forecasts, however, the UK economy is still expected to suffer a technical recession.

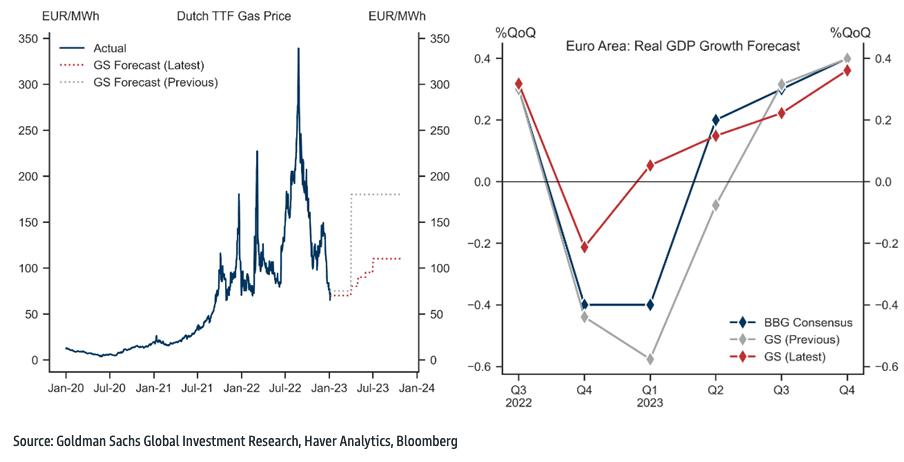

The Wall Street bank has revised its forecasts for the Eurozone and UK following recent developments in natural gas markets that have seen prices fall below levels seen just ahead of Russia's invasion of Ukraine.

"Inflation has moved past the peak and, following the sharp decline in wholesale energy prices," says Sven Jari Stehn, chief European economist at Goldman Sachs.

Eurozone headline inflation is now forecast to end the year around 3.25%, a downgrade on previous forecasts of 4.25%, with core inflation sliding back to 3.3%.

The reopening of China's economy as authorities abandon the zero-Covid policy is also expected to underscore a better-than-expected year for Europe's major industrial exporters.

Above: "Past the inflation peak" - Goldman Sachs.

"We maintain our view that Euro area growth will be weak over the winter months given the energy crisis but no longer look for a technical recession. This reflects more resilient growth momentum at the end of last year, sharply lower natural gas prices and earlier China reopening," says Stehn.

Goldman Sachs upgrades its Eurozone GDP forecast to +0.6% for 2023 (from -0.1%), which places it now meaningfully above the consensus expectation of -0.1%.

The European Central Bank (ECB) is expected to maintain its hawkish stance in light of "sticky core inflation" and is expected to "tighten significantly more in coming months".

Goldman Sachs looks for 50bp hikes in both February and March, before slowing to 25bp for a terminal rate of 3.25% in May.

"The firmer growth outlook reinforces our view that the ECB is unlikely to cut soon after that and we do not see the first cut until 2024Q4," says Stehn.

Goldman Sachs meanwhile upgrades its UK growth forecasts in light of easing pressures in European gas markets but a recession is still expected.

UK GDP growth forecasts are raised to -0.7% in 2023 from -1% previously.

The Bank of England will raise interest rates a further 100 basis points in this cycle says Goldman Sachs, despite the recession and the Bank's trademark 'dovish' rhetoric.

"The main reason is that the UK labour market remains overheated with low unemployment, high vacancy rates and strong wage growth. Although we see core inflation past the peak, we expect sticky UK inflation pressures in H1 and look for a 50bp Bank Rate hike in February, followed by 25bp hikes in March and May for a terminal rate of 4.5%," says Stehn.