ECB 'Dove' Lane Pushes Back on Eager Rate Hike Expectations

- Written by: Gary Howes

Above: Philip Lane. Photo by Bernd Hartung/European Central Bank.

The European Central Bank's Chief Economist Philip Lane has pushed back against market expectations for a number of interest rate rises in 2022, saying the ECB could accommodate a temporary rise in inflation.

In an official ECB blog post Lane reiterated that the overwhelming cause of the Eurozone's current inflationary pressures are related to supply and demand mismatches related to the pandemic.

The findings will ease concerns that the Eurozone's current inflationary pressures are structural in nature and they will therefore ultimately come down.

The intervention comes just days after the ECB signalled it could raise interest rates before 2022 is out, which amounts to a substantive pivot in policy for the central bank.

Currently the market is looking for up to 50 basis points of hikes in 2022, an expectation that has aided Euro exchange rates higher since the February 03 ECB policy event.

"The prevalence of downward nominal rigidities in wages and prices means that surprise relative price movements should mainly be accommodated by tolerating a temporary increase in the inflation rate," said Lane.

Indeed, reacting to the current inflation levels by raising interest rates would only compress economic growth.

He said it would be better to accept current inflation "rather than by seeking to maintain a constant inflation rate that could only be achieved by a substantial reduction in overall demand and activity levels".

"Since bottlenecks will eventually be resolved, price pressures should abate and inflation return to its trend without a need for a significant adjustment in monetary policy," he added.

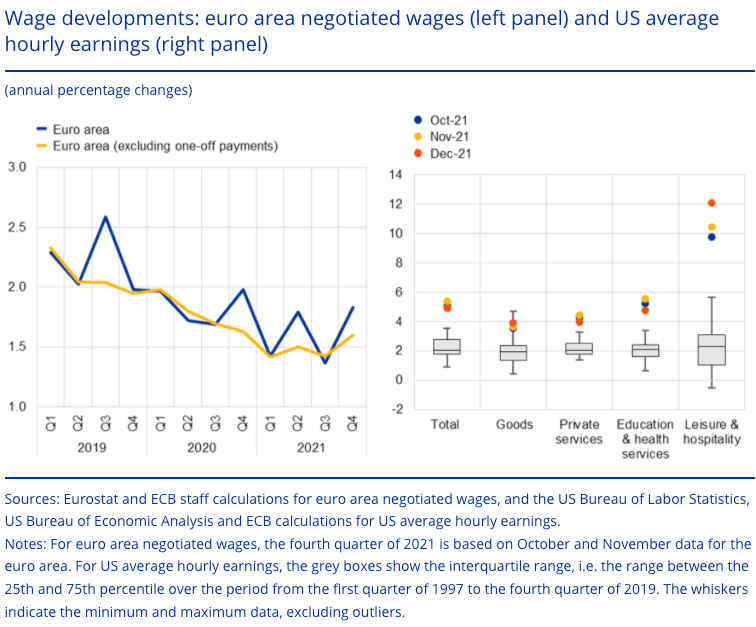

Lane argued in January that the Eurozone was not likely to see sustained inflation at or above 2.0% until such a time as wages were increasing at 3.0% on a sustained basis.

However, any focus on wages by members of the ECB's Governing Council appears to have been lost amidst the discomfort caused by recent surges in inflation readings.

But Lane is clear that inflation is being driven by external factors and there is therefore little the ECB can do with its policy levers to control them.

He says the "logic underpinning a hold-steady approach to monetary policy is reinforced if the bottlenecks are primarily external in nature, caused by global disruptions in supply or a surge in global demand".

"Since monetary policy steers domestic demand, a tightening of monetary policy in reaction to an external supply shock would mean that the economy would be simultaneously confronted with two adverse shocks - a deterioration in the international terms of trade (generated by the increase in import prices) and a reduction in domestic demand," he says.

He does however concede there is a need to be vigilant that external drivers of inflation don't transfer to domestic drivers, in what is known as a second-round effect.

Upward pressure on wages would be such a second-round effect.

Lane notes that while earnings growth in the euro area remains muted so far (as tracked by negotiated wages), there has been a significant increase in average hourly earnings in the United States.

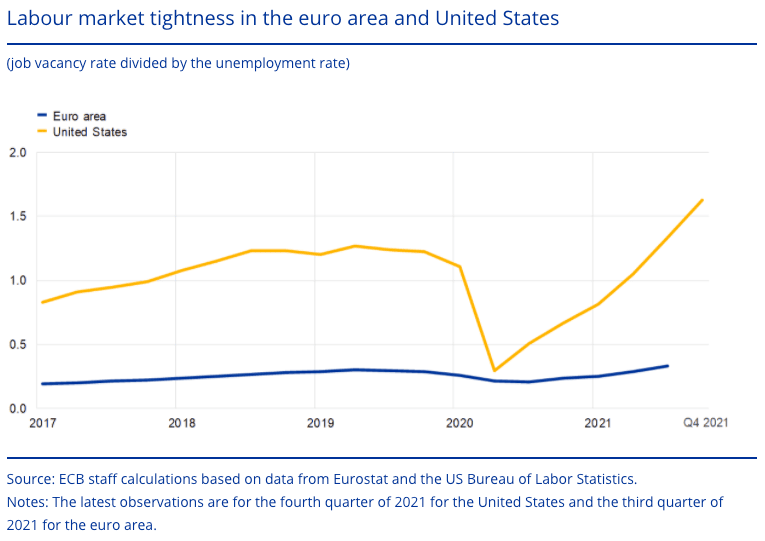

Crucially, he argues the euro area labour market is not experiencing the same degree of labour market 'tightness' as in the United States where the Federal Reserve could potentially up to five rate hikes before 2022 is out.

The ratio of vacancies to unemployment is ticking up in the euro area and is higher than before the pandemic, but the level of this ratio is far higher and its slope has been far steeper in the United States where inflation concerns are far greater.

Lane also finds other indicators suggesting that the labour market has not fully recovered from the pandemic.

For example, hours worked in the euro area are still below the pre-pandemic level and various furlough and wage subsidy schemes remain in place.

"Although there might be some signs of labour market bottlenecks in certain sectors in some euro area countries, the overall profile of the euro area suggests a smooth recovery in overall labour supply," says Lane.

He says he expects a gradual-but-sustained increase in labour demand.

"Such a gradual tightening of the labour market constitutes a key mechanism for inflation to stabilise at our two per cent target over the medium term, whereas there are no indications of aggregate overheating in the euro area labour market," says Lane.