Canadian Dollar Feels the Pull of Sliding Oil Prices

- CAD down 1% against USD

- GBP/CAD tipped to edge higher

- Oil prices are falling once more

Image © Bank of Canada

- GBP/CAD market rate at time of publication: 1.7560

- Bank transfer rates (indicative): 1.6940-1.7067

- FX specialist rates (indicative): 1.7157-1.7401 >> more information

The Canadian Dollar has come under fresh pressure in mid-week trade amidst a souring of investor sentiment, which appears to be sparked by a decline in oil prices which are falling amidst a sharp slump in global economic activity.

Oil prices are falling once more as the overwhelming drop in demand from a shuttered global economy continue to exert a toll, confirming that the supply cuts promised by OPEC+ over the weekend are simply too little to bring equilibrium to the market.

Oil exports are a major source of foreign exchange for the Canadian economy, ensuring the Canadian Dollar tends to underperform when prices are on the wane.

The shift lower in oil prices appears to have sent a signal to stock markets that they might be a little too expensive given the scale of the current economic downturn. Equity markets have been rising for two weeks now as investors take comfort in the gargantuan efforts of global central banks to flood the world with cheap money to stave off economic decline.

Oil prices are however apparently one asset that central banks are unable to manipulate and therefore could be the real gauge of evolving financial conditions; their move lower is asking serious questions about the stock market's willingness to rally into negative economic headwinds.

The WTI benchmark is 2.70% lower on the day at $25.56 a barrel while Brent Crude is lower by 4.0% at $30 a barrel.

The Canadian Dollar has fallen a percent against the U.S. Dollar in line with the softening of oil prices, with the U.S. Dollar-Canadian Dollar quoted up at 1.4026.

The Pound-to-Canadian Dollar is however firmly locked at 1.7533 which places it in the middle of the March-April range, with little movement on the day. This is because while the Canadian Dollar is having a tough day, so too is Sterling which also tends to suffer weakness when market sentiment dips.

In fact, Sterling and the Loonie appear to be evenly weighted on the so-called Risk On / Risk Off equation, suggesting when markets are rising the benefit of the improved investor sentiment offers neither GBP or CAD an advantage. The exact same appears to be true in Risk Off conditions, as is currently the case.

However, we would expect Sterling to retain the upper hand if oil prices continue to fall and the March highs at 1.80 could come into view once more.

"GBP/CAD remains range bound but looks slightly better bid above the 40-day MA (1.7240) which held last week’s dip in the GBP. Trend strength signals are tilting a little more GBP supportive now," says Shaun Osborne, FX strategist at Scotiabank. "We continue to think the GBP is a buy on dips."

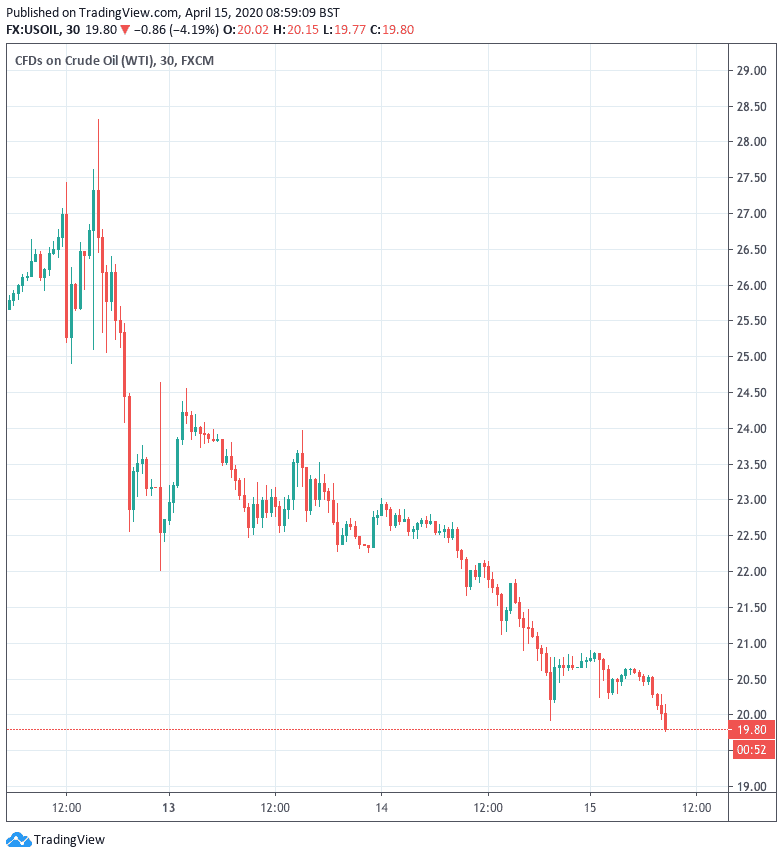

Above: Oil prices provide a reminder that all is not well in the global economy

"The current consensus is that because central banks are flooding the market with liquidity, much of it will push asset prices up and the low-yielding USD down. Apocalyptic economic assessments, even from the IMF, have been shrugged at, but one thing that market participants can't ignore is oil prices – they appear to be headed off a cliff again," says Ewen Chew, an analyst at Thomson Reuters.

Oil demand is predicted to fall by a whopping 29 million barrels per day in April alone, according to then latest IEA data.

"Whether today’s slump in oil prices serves to rally OPEC+ into another cut remains to be seen. However, with the group having difficulty achieving the 9.7 million barrels per day cut, an inability to enact further restrictions would likely lead to further downside for the months ahead," says Joshua Mahony, Senior Market Analyst at IG.

Over the weekend OPEC and Russia agree to cut production by 9.7 million barrels per day over the course of the next two months, which represents the largest margin ever agreed by OPEC.

But it is estimated that global demand has fallen in excess of 30 million barrels per day in the second quarter as the world's largest economies shut down to try and stem the spread of the coronavirus.

The OPEC+ deal remains in place until April 2022, with the quotas increasing by 2 million barrels per day in the second half of 2020, and then another 2 million barrels per day up to April 2022.

The reference point for the cuts was production in October 2018 for most, although both Russia and Saudi agreed to a baseline of 11 million barrels per day.

A significant problem facing oil producers is that simply cutting supply is not as easy as simply turning off a tap as most oil fields and supply lines are designed to keep pumping, which draws question marks on how achievable the agreements inked on paper really are.

For example, while Russia has committed to a 2.5 million barrel per day cut, analysts suggest this is more than 10x its agreed cut under the last OPEC+ deal.

"The demand drop for oil as countries have locked down activity has been unprecedented, with demand in April expected to be down more than 20mb/d. Huge uncertainty remains about the duration of the lockdowns and hence the timing of a demand recovery. In April alone, global inventories could grow by 600m barrels; if there is not a sharp improvement in demand in May then global storage infrastructure risks being overwhelmed, even with the OPEC+ cut," says Henry Tarr, Analyst at Berenberg Bank.

Berenberg's models anticipate a price of USD30/bbl and while the OPEC+ agreement poses a sizeable burden on oil producers Tarr says the moves nevertheless potentially set the stage for a bottoming of crude and a recovery looking into the second half of 2020 and 2021.

Berenberg still expect 2021 oil prices to average above USD50/bbl.

If the Canadian Dollar is to follow the fortunes of crude oil prices, we could therefore be due to see suppressed CAD valuations for the short- and medium-term.