Canadian Dollar Pops after Bank of Canada Eschews Rate Cut, but Winter is Still Coming

- Written by: James Skinner

Image © Bank of Canada

- CAD advances on rivals after BoC holds rates at 1.75%, eschews cut.

- Notes on-target inflation but warns of growth slowdown in second half.

- Ties future rate decisions to developments in the U.S.-China trade war.

- Markets eye 1st cut in October, but some say it may wait until a bit later.

- But the USD/CAD rate is still tipped as a "buy on dips" by BMO and CIBC.

The Canadian Dollar extended gains over rivals Wednesday after the Bank of Canada (BoC) left its cash rate unchanged and neglected to give a strong hint about any cuts that might be likely for the winter months, instead tying future policy decisions to developments in the U.S.-China trade war.

Governor Stephen Poloz noted again Wednesday the recent outperformance of the economy and acknowledged that inflation is contained at the target level when announcing the Bank of Canada's decision to leave the overnight rate unchanged at 1.75% in September. The move was in line with consensus but the tone of the accompanying statement gave off a lesser sense of concern about the outlook than some had anticipated.

Poloz did warn again that economic growth will likely slow in the second half of the year but he clearly tied forthcoming interest rate decisions to developments in the U.S.-China trade war, which might have simply been an attempt to avoid pre committing to interest rate cuts in case of a de-escalation in tensions between the world's two largest economies ahead of the next decision which is scheduled for October 30.

"The Bank of Canada left rates where they were, and drafted a statement designed to give them some time to think about what to do next, rather than dropping a clear hint of an October cut. The final paragraph, where the policy decision is summarized, had an on-the-one-hand, on-the-other-hand tone," says Avery Shenfeld, chief economist at CIBC Capital Markets. "We do think the Bank of Canada will ultimately have to ease, but perhaps December is looking more likely than October for that decision."

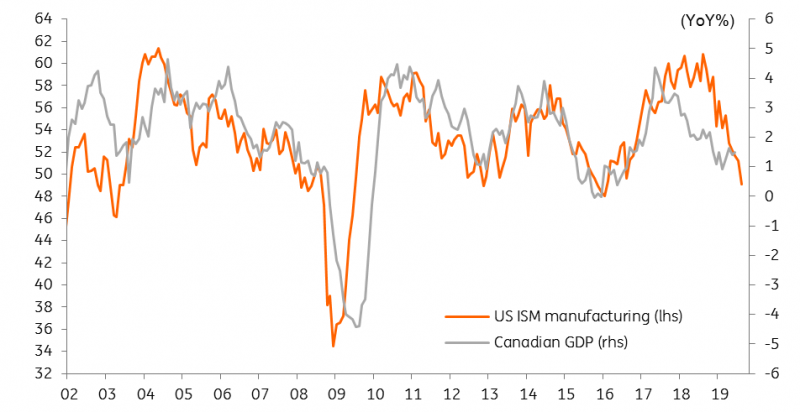

Above: ING chart showing correlation of Canadian GDP growth with U.S. ISM manufacturing PMI.

"The Bank of Canada has left interest rates unchanged as widely expected, but the accompanying statement includes a dovish shift that reinforces our view that they are gearing up for a rate cut," James Knightley, chief international economist at ING. "Given Canada’s trade and commodity exposure and with little prospect of an imminent easing in trade and global growth concerns, we recently changed our view to a 30 October cut and that call remains valid."

The trade conflict between the U.S. and China escalated following publication of the BoC's last decision and its most recent economic forecasts, dealing another blow to the already-troubled global economy. But Canada's "temporary" economic outperformance has led markets to believe the BoC will leave its cash rate unchanged at 1.75% for a while yet despite that almost all other developed world central banks have either cut interest rates already in 2019 or are expected to do so promptly.

This has helped Canada's Dollar retain its position as the second best performing G10 currency for this year, after it ceded the top spot to the safe-haven Japanese Yen back in August when the tariff fight flared again. President Donald Trump went ahead Sunday with a new 15% tariff on $112 bn of goods imported from China each year, although there's still a further $190 bn worth of tariffs scheduled to take effect on December 15. After that point, all of China's exports to the U.S. will have been tariffed.

"The bank’s comments on the global outlook suggest the door is open to a rate cut. Our forecast assumes a move in January. We’ve been flagging growing risk of an earlier cut, which has only been diminished slightly by today’s statement," says Josh Nye, an economist at RBC Capital Markets. "The combined ½ ppt add to growth from business investment and net trade in its 2020 GDP forecast looks vulnerable to a downward revision."

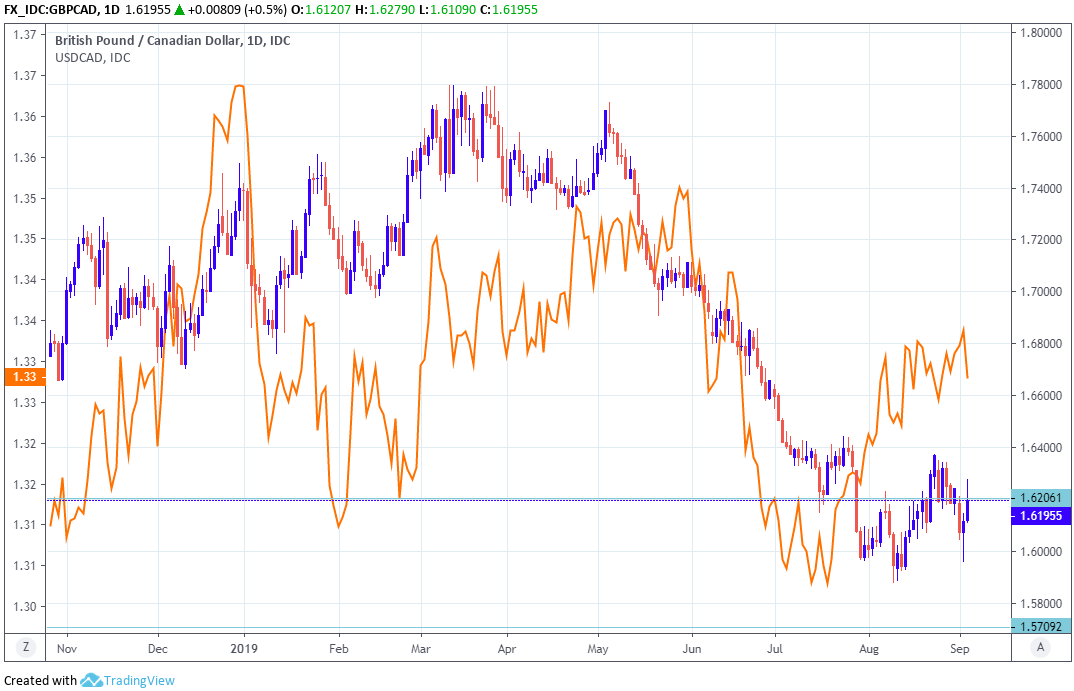

Above: USD/CAD rate shown at 15-minute intervals, alongside EUR/CAD rate (orange line, left axis).

"Our judgement – given the lack of pushback, there’s scope for the CAD to continue outperforming on the crosses as the BoC is on the ‘less dovish’ side of the global central bank spectrum. Still, we can’t ignore that sentiment is at odds with positioning," says Bipan Rai, head of FX strategy at CIBC. "USD/CAD View: We still like buying dips. Particularly if price action gets back toward the 1.3200 handle to target a move to the 1.35-1.36 area in the medium-term."

The BoC lifted its forecast for growth in 2019 to 1.3% in July, from 1.2% previously, owing to a stronger-than-anticipated performance by the economy in the second quarter that the bank has already described as temporary. However it downgraded projections for growth in 2020 and 2021, and by more than it lifted the 2019 forecast. Meanwhile, and despite a recent spike in prices, the BoC also downgraded forecasts for inflation which it now expects to average just less than the 2% target until the end of 2021.

The bank noted that all measures of core inflation, which is the preferred indicator of price pressures for many central banks, are all sitting around the 2% target. It is expected to update its inflation forecsts in October, which could see them downgraded given that Governor Stephen Poloz has already said the BoC expects the economy to slow in the second half. That might encourage markets to speculate that interest rates could eventually be cut more than once.

Changes in rates are normally made in relation to the outlook for inflation, which is sensitive to economic growth, but impact currencies because of the influence they have over capital flows and decisions of short-term speculators. Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

Above: Pound-to-Canadian-Dollar rate at daily intervals, and USD/CAD rate (orange line, left axis).

"Our model is still looking to buy USDCAD on dips down to fair value, which closed at 1.3243 yesterday. We don't always agree with the model, but we do in this instance. Buying USDCAD on a dip to 1.3250 if it happens would be our way of trading the BoC in the FX market," says Greg Anderson, head of FX strategy at BMO Capital Markets.

Central banks the world over have either cut rates in recent months or signalled that they could do so before long, as momentum has ebbed from the global economy and is threatening to undermine inflation pressures that were in some cases already insufficient, but not the BoC.

The BoC's separation from the crowd has boosted the attractiveness of Canadian government bonds and seen investors flock toward the Loonie as a result, but even the BoC governor has said Canada cannot remain immune to the global trend forever, with the implication being it may soon have to cut rates and risk undermining the Loonie's grip on second place in the G10 league table.

Canada's blowout second quarter growth figures were, after all, the result of a strong increase in exports of manufactured goods and oil from the energy sector, both of which are at risk from the trade war. But everything up ahead depends on the BoC's own reading of the economic tea leaves.

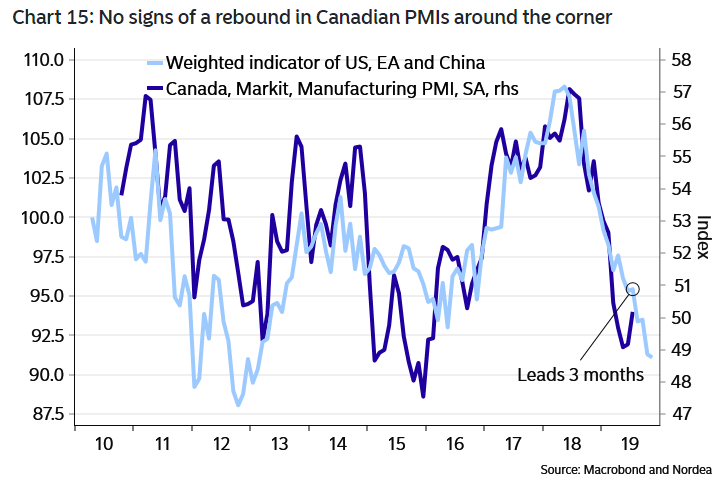

"Why save the easing ammo until markets are already on par with the cut? Our weighted import indicator of Chinese, Euro area and US imports still points to a lukewarm (at best) development in Canada ahead," says Martin Enlund, chief FX strategist at Nordea Markets.

Above: Nordea Markets graph showing correlation of lagging Canadian indicators with global peers.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement