Canadian Dollar's Strong Run against the Pound Stalls, Can GBP/CAD Head Higher from Here?

Image © Adobe Images

- GBP/CAD decline has stalled

- Pair remains in strong downtrend

- Formation of ‘morning star’ candle a bullish sign

The Pound-to-Canadian Dollar exchange rate's downtrend is stalling, and there is now a risk the pair could reverse higher, according to technical studies.

The pair’s “prevailing downtrend came to halt on July 16, as price printed a morning star pattern,” says Anthony Charalanmbous, an analyst at XM.com, referring to a pattern from the time-old art of Japanese candlestick analysis.

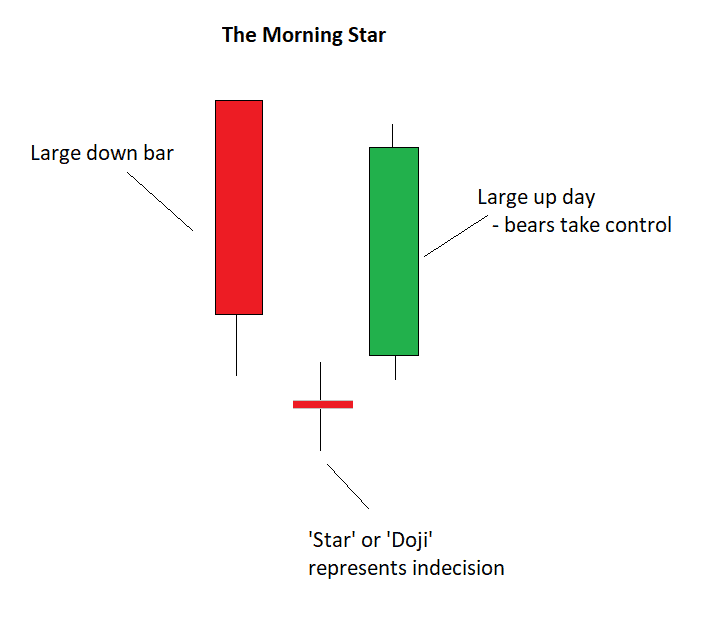

When found at the end of long bear trends the ‘morning star’ is a bullish reversal pattern. It is composed of a long down day followed by a day which looks like a star (in which the range and the distance between open and close are both narrow), and then finally a long up day.

The pattern shows bearish pressure waning and bulls ‘taking control’. Candlestick patterns are often short-term indicators of trend change but their longer-term forecasting potential is limited, so despite the signal, it is not enough to herald a full-blown reversal.

The call developments nevertheless come a day after we reported a major institutional bank sees value in backing the Pound to rise against the Canadian Dollar over coming days.

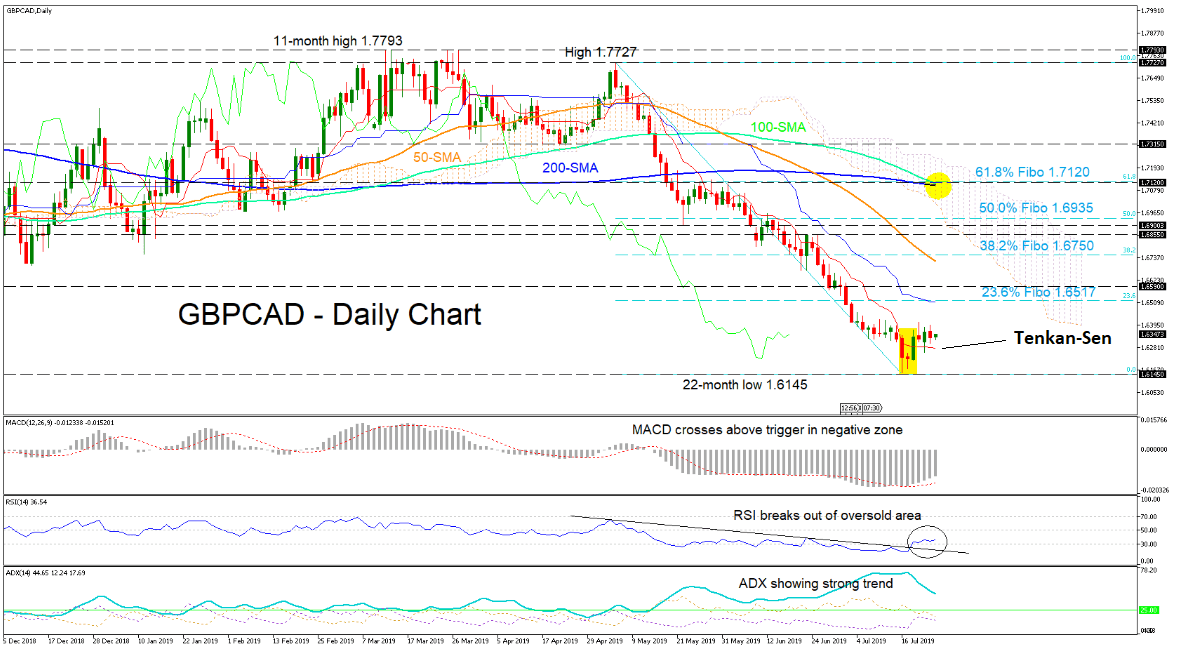

Another technical indicator called the ‘tenkan-sen’ is corroborating the morning star, adding evidence the downtrend may be fading, but not yet supporting major reversal yet either.

The Tenkan-sen is the midpoint of the highest high and highest low over the last 9 days, it is the thin red line hugging price action on the chart below. Charalanmbous says that it is supporting a more neutral view of the market because it has gone horizontal.

Evaporating momentum is another sign the downtrend is stalling. The MACD indicator has moved above its dotted moving average ‘signal line’ giving a mild bullish signal.

The RSI momentum indicator has broken above a trendline and out of the oversold zone which is a buy signal according to the inventor of the indicator Welles Wilder.

The ADX which measures the strength of the trend (not its direction, it's a subtle difference) is neutral now after rolling over.

The major moving averages, which are generally slow to react to daily changes, are still painting a bearish picture.

“The 50-, 100- and 200-day simple moving averages (SMAs) still confirm bearish bias,” says Charalambous.

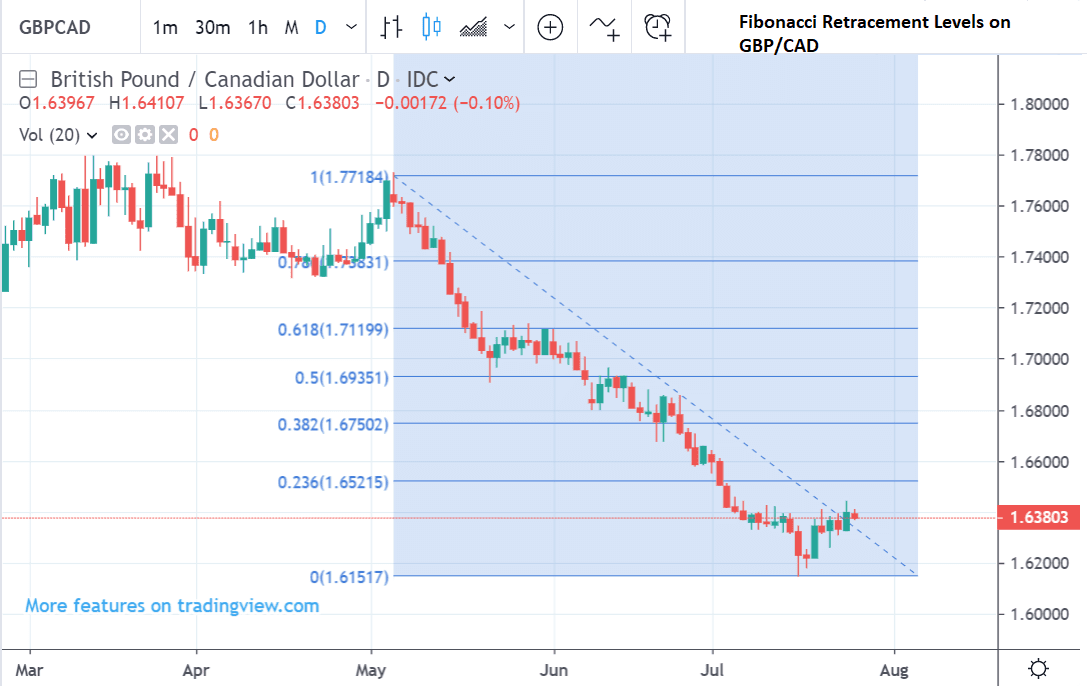

If the pull-back evolves into something bigger, the next target higher would be the 26.3% Fibonacci retracement level of the previous downtrend at 1.6517. This is an important retracement level of the move down from the late April highs. Certain retracements such as 26.3%, 38.2%, 50%, 61.8% and 100% have a special value for chart analysts. They exert a stronger-than-usual pull on charts and often keep prices pinned at their level. Sometimes then can even fully repulse a trend in play.

A “violation” of the most important retracement, the 61.8%, at 1.7120 would signal a shift in the broader trend to ‘up’, says the analyst.

From a bearish perspective, the main game-changer would be if the 100 simple moving average (SMA) crossed below the 200 SMA. They are close at the moment but still not touching.

Such a cross, however, could “have price penetrate the recently formed 22-month low of 1.6145. If the bearish bias dominates again, the seven-and-a-half-month low of 1.5830 would be the next target,” says the analyst.

Ultimately for bulls to build on their early success, the pair needs to cross the 61.8% Fibonacci retracement ‘rubicon’ at 1.7120. At that point, they will have their bigger trend change signal.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement