Australian Dollar Rises on Trump Tariff Exemption

- Written by: Gary Howes

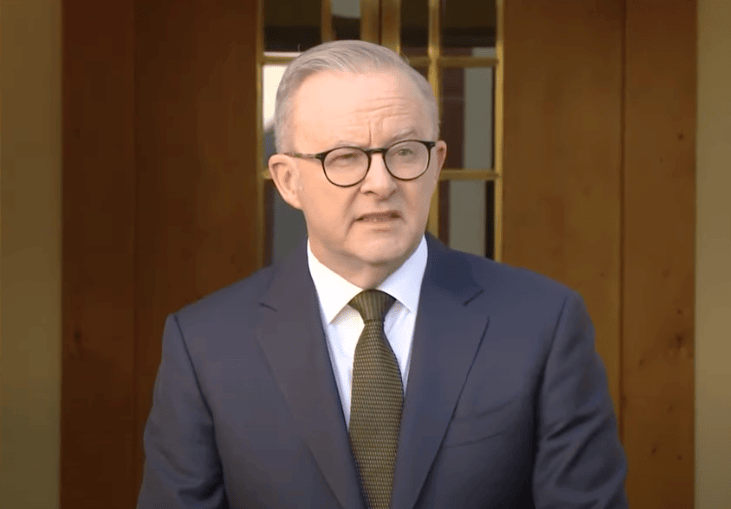

Above: President Albanese says he managed to carve out an exemption for Australia from a universal U.S. steel tariff.

Australia has managed to duck a universal tariff placed on U.S. imports of iron and steel.

The Australian Dollar firmed following news Australia would not be subject to a U.S. import tariff on steel and aluminium.

The relief follows a phone call between U.S. President Donald Trump and his counterpart Anthony Albanese.

Trump announced a 25% tariff on steel and aluminium imports from all countries on Monday, but Albanese says he successfully made the case for an Australian exemption.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

After telling reporters there would be no exemptions, Trump noted Australia was one of the few countries with which the United States ran a trade surplus.

"We have a surplus with Australia. One of the few. And the reason is they buy a lot of airplanes. They're rather far away and they need lots of airplanes," Trump said.

"I told him that that's something that we'll give great consideration to," the Republican president told reporters in the Oval Office, adding that Albanese was a "very fine man".

The GBP/AUD exchange rate spiked to 1.9853 in early Monday trade as markets reacted to news Trump would announce the tariff on metal imports, but has since slid to 1.9675. The AUD/USD exchange rate has recovered to 0.6275 from Monday's low at 0.6232.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

More broadly, it becomes clear to investors that Trump's tariff bark is far worse than his bite, which will allow tariff-sensitive currencies to recover.

"The shock factor is beginning to fade," says Karl Schamotta, Chief Market Strategist at Corpay. "At this point, it’s clear that it is deeply unwise to place large bets on market outcomes contingent upon the president following through on his tariff pronouncements."

Although Australia has never been in Trump's line of fire, it remains a major trading nation that will be highly sensitive to any slowdown in global trade owing to tariff wars.

Trump is not yet done and will announce further tariffs later this week, which will maintain risk for global FX.

"The bigger news this week could be details on a plan for country-by-country reciprocal tariffs. If the administration pursues that strategy rather than a 10% universal tariff, then it could result in a smaller rise in the overall effective tariff rate than we have assumed," says Stephen Brown, Deputy Chief North America Economist at Capital Economics.

But the bigger message is that there are always exit routes, which Australia's Albanese has provided the latest confirmation.