Australian Dollar a 'Short' Target at Morgan Stanley

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar is expected to extend lower by foreign exchange strategists at international investment bank Morgan Stanley.

Strategists have looked at currency value "holistically" and evaluated currency attractiveness across a variety of metrics.

These metrics include:

- positioning and momentum

- monetary policy and rate hikes

- economic data

- commodities and terms of trade

- sensitivities to key market variables.

"Our results suggest that AUD and NZD are the currencies most likely to sell off, affirming our core short AUD and NZD positions," says David S. Adams, an analyst at Morgan Stanley.

Regarding central bank policy intentions; monetary policy tightening is most clearly priced in the antipodeans (Australian Dollar and New Zealand Dollar) and the U.S. Dollar finds Morgan Stanley.

Analysts at the bank think that the more that is priced in, the greater the chance that central banks disappoint, potentially weighing on the currency going forward.

Conversely, there's very little priced in from the Bank of Japan, suggesting that a hawkish shift would raise the Yen says Adams.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Australia's international trade position is meanwhile seen as vulnerable to the ongoing Covid outbreak in China that has been met with a harsh zero-Covid policy response.

It is reported activity in China - Australia's most important export market - has fallen to its lowest level in two years as restrictions dampen consumer demand.

The Caixin China services purchasing managers’ index, which asks companies whether they experienced an increase or decrease in business activity compared with the previous month, fell to 36.2 in April from 42 in March, the second-sharpest fall since the survey was launched in 2005.

"China's COVID zero policy weighs on export demand and snarls supply chains, we expect a continued deterioration in regional AxJ growth expectations, including for commodity exporters like Australia," says Adams.

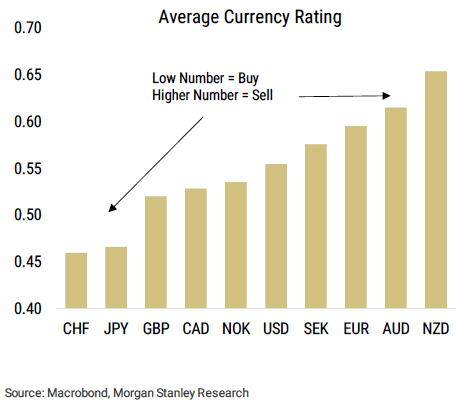

Assessing these and other input factors, Morgan Stanley arrive at the below outcome:

Above: "Our subjective assessment of relative currency attractiveness suggests selling antipodean currencies against low yielding safe havens" - Morgan Stanley.

The chart shows what the average rating for each currency is based on its relative ranking in each of these subcategories.

"A rating of 1 would imply it would be the best currency to sell in every category, and the lower the number, the more attractive the currency is to buy all else equal," says Adams.

The findings help inform Morgan Stanley's decision to extend their sell recommendations on the Australian and New Zealand Dollars.

Specifically, they extend an existing short AUD/USD target to 0.67 (from 0.70).