Week-Ahead Pound vs. Australian Dollar Forecast: A Breakout is Coming

Image © Adobe Stock

- GBP/AUD has formed a right-angled triangle

- Possibility of a break in either direction depending on confirmation

- Pound to be moved by Brexit news; Aussie by RBA meeting

The GBP/AUD exchange rate is trading at around 1.8084 at the start of the new week having fallen 0.75% in the week before, and we note the pair to be trading in an increasingly narrow sideways range, with a decisive break higher or lower required to define the trend.

With a politically-charged week of UK politics lying ahead, we could see some fresh direction injected into this exchange rate over coming days: the question is what are the levels readers should be watching?

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair forming a triangle pattern which could either break higher or lower:

A break higher might seem more likely as this would be in line with the short-term trend which is bullish after climbing steadily since the July 30 lows, however, the nature of the triangle pattern brings this into doubt.

This is because the triangle is of the right-angle variety which tends to give a clue as to the direction of the breakout, which in this case is down, in the direction of the flat-edge.

There is evidence both to support a break up or down so we remain neutral until price dictates which.

A break above the 1.8236 highs would provide bullish confirmation for a move up to a target at 1.8425 whilst a break below 1.8000 would provide bearish confirmation for a move down to a target at 1.7800.

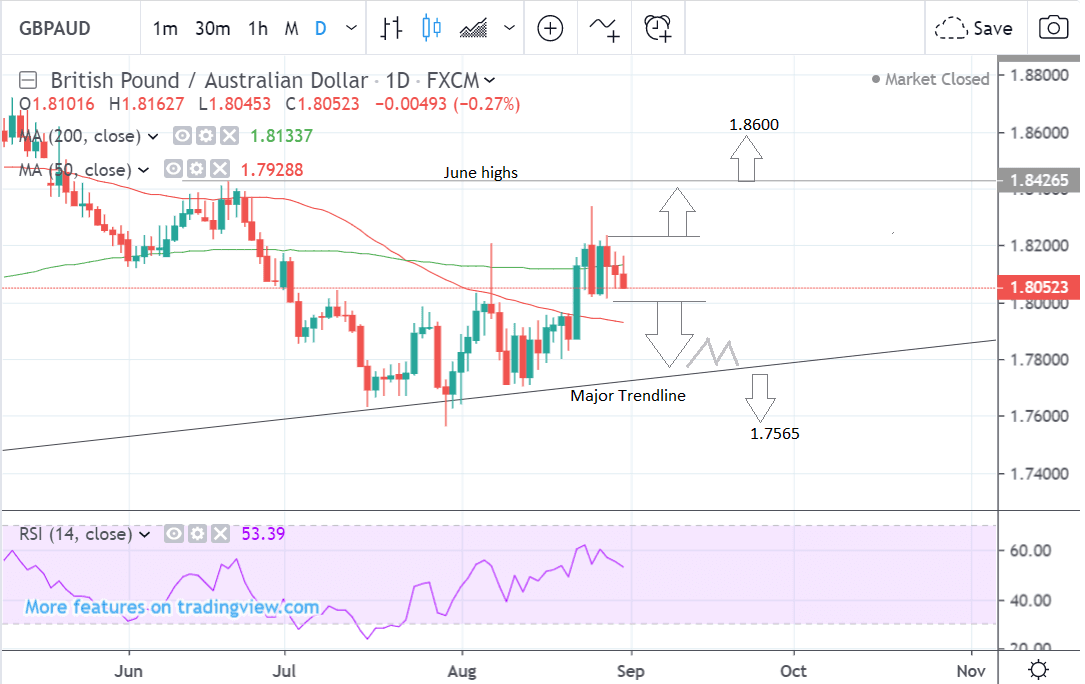

The daily chart shows how the pair fell to the July lows at a major trendline and then bounced and has been climbing through most of August.

Despite the recovery, the previous downtrend was very strong and there remains a risk it could resume. A break below the trendline would be a very bearish sign and probably lead to a move down to the 1.7565 lows.

A break higher will probably initially reach the June highs and then possibly an even higher upside target at 1.8600.

The daily chart is used to give us an indication of the outlook for the medium-term, defined as the next week to a month ahead.

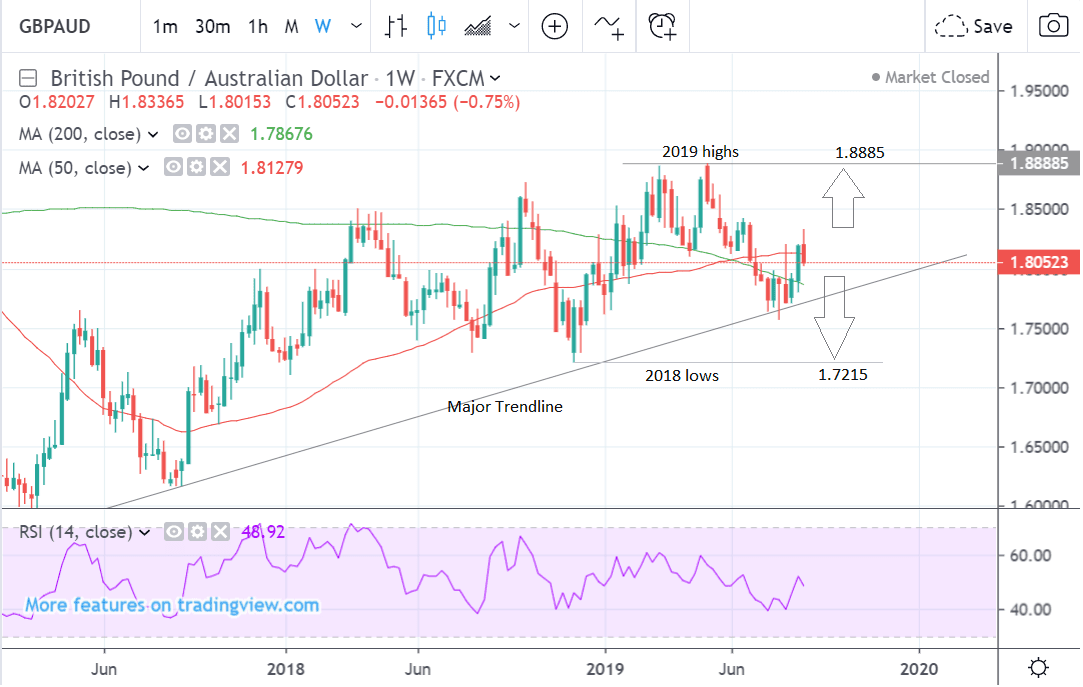

The weekly chart - used to give us an idea of the longer-term outlook, which includes the next few months - shows the pair in a long-term rising channel with even wider, longer-term targets higher or lower depending on which side the breakout occurs.

The long-term bullish target is probably at the level of the 2019 highs at 1.8885 whilst the long-term bearish target is probably at the 2018 lows at 1.7215.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Australian Dollar: What to Watch

The Australian Dollar remains a proxy for investor sentiment towards China, and specifically the U.S.-China trade war.

The Australian Dollar extended lower on Friday as 'risk assets' fell from favour with investors ahead of a weekend that is expected to yield a further escalation of the U.S.-China trade war although the Antipodean unit is tipped by multiple analysts to remain under pressure for a while to come.

President Donald Trump moved ahead Sunday with a new tariff of 15% aimed at the remaining balance of Chinese exports to the U.S. not yet covered by punitive levies, although it will be December 15 before all of the country's trade with the U.S. is fully tariffed.

Those exports waiting to be tariffed are worth around $300 bn each year, while the U.S. has $75 bn of exports to China that are set to be targeted in retaliation.

"While weaker iron ore and equity prices and greater China risk all help explain AUD/USD losses, the overwhelming driver was simply broad USD strength, which pulled AUD/USD down, despite rate spreads moving against USD," says RBC Capital's Elsa Lignos. referring to the August period. "Combined with our relatively constructive view on USD, this raises the hurdle for equity or commodity prices or China risk dragging AUD/USD off post‐crisis lows. Our forecasts continue to have AUD/USD drifting lower."

The main domestic event for the Australian Dollar in the week ahead are the Reserve Bank of Australia (RBA) interest rate decision on Tuesday, Q2 GDP on Wednesday, the trade balance on Thursday, and retail sales on Tuesday.

The RBA, which has its meeting on Tuesday at 5.30 BST, is expected to leave interest rates unchanged after making two 0.25% cuts so far this year, as it is likely to want to gauge the impact of these cuts first before deciding whether the economy needs more stimulus.

The level of interest rates heavily impacts on the Australian Dollar which tends to rise and fall in line with rates. This is because higher interest rates tend to increase net foreign capital inflows because of the higher interest return on offer.

The Australian Dollar has weakened considerably since the interest rate cuts and this may suggest enough has been done to support economic conditions. In theory a weaker Aussie helps raise exports and inflation.

"The AUD has been short on luck. A weak external environment pushed it lower in 2018, but that recovery was not enough to lift it in 2019, as the domestic policy environment turned dovish. We have now broken support. How low the AUD falls will be defined by how aggressively the RBA eases and the success of Chinese stimulus efforts," says Daniel Been, a strategist with ANZ Research.

Q2 GDP data out at 2.30 on Wednesday could also impact on interest rate expectations and the Aussie. If GDP comes out lower-than-expected that should increase the chances the RBA will have to cut rates again later in 2019; if higher-than-expected the RBA will probably leave interest rates alone.

The consensus forecast is for GDP to show a 0.5% rise quarter-on-quarter in Q2 and a 1.4% rise compared to a year ago. This compares to a 0.4% and 1.8% rise in Q1.

The trade balance is expected to show a surplus of A$7.4bn in July from 8.0bn previously when it is released at 2.30 on Thursday. The metric is likely to be a focus for investors as trade is a key concern because of global trade tensions. A bigger-than-expected fall in the surplus could weigh on the Aussie as it might suggest lower demand from China.

The power of the consumer is a key factor in most economies so retail sales is also a major release. Australian retail sales data for July is forecast to show a rise of 0.2% when it is released on Tuesday at 2.30. A miss might weaken the Aussie whilst a higher-than-forecast result could boost it.

The Pound: Political Fireworks

September 03 sees the UK parliament sit once more, and the return of MPs should herald what is potentially going to be the most explosive week of parliamentary politics of our generation.

We fully expect Sterling to react to developments in parliament, and therefore warn readers that volatility is likely to be elevated.

MPs return to a shortened parliamentary session owing to the decision by Prime Minister Boris Johnson to suspend parliament from September 12 to October 14. The move has galvanised those MPs in the House opposed to Brexit into accelerating the passing of legislation designed to frustrate the Prime Minister and remove the option of a 'no deal' Brexit taking place on October 31.

Reports out late last week suggest MPs have agreed the form of legislation they would want to present.

If markets deem the legislation as having the potential to pass, and block a 'no deal' then there is a decent chance Sterling can extend higher.

However, we are of the firm belief that the best possible outcome for those wanting a stronger Pound would be for a Brexit deal to be struck. We believe that removing 'no deal' from the equation lessens the incentive for European negotiators to offer the substantive changes on the Northern Irish border backstop that Johnson is seeking.

It also materially lessens the incentive for MPs in the House to vote for a deal.

Johnson is looking to strike a fresh agreement with the EU and see it passing through the House on the back of the votes of MPs who have no option but to vote for a deal if they want to avoid a 'no deal' outcome.

Keep in mind that it is also possible opposition leader Jeremy Corbyn calls a vote of no-confidence when parliament.

A vote of no confidence has a fairly good chance of being successful given the large number of rebel Conservative MPs who are against a hard Brexit.

Press reports out on the weekend suggests Johnson will look for those MPs who vote against the government to be expelled from the party. This could shrink the scale of the Conservative rebellion against him.

It could however free up a number of MPs to vote against their ex-leader.

We view a no-confidence vote as offering up fresh uncertainty, and therefore potential downside for Sterling.

However, highlighting just how difficult it is to judge the landscape, some analyst believe a no-confidence vote could in fact be good for the Pound.

“If we have that vote of no confidence, whilst it is uncertain what the outcome would be, the Pound would go up on that headline alone. So that is why I think there is a shimmer of hope for a tactical long trade,” says Jordan Rochester, an analyst at Nomura.

There is a risk the Pound could also gain a boost from a legal challenge mounted by the anti-Brexit campaigner Gina Miller, who is attempting to prevent the proroguing of Parliament in the high courts.

Miller's argument is that a proroguing of this length of time is unprecedented. That the Queen was ill-advised and that it is unlawful as it was undertaken precisely to prevent parliament from doing its job of scrutinising the executive.

Opponents claim parliament typically does not sit at this time of year anyway, to allow for party conferences and that it is not within the remit of the courts, as it is a solely political matter.

“The Johnson hijackers are saying that the prorogation of parliament ahead of a Queen’s speech is what always happens – and that it is no more than a normal convention and precedent in our unwritten constitution. But there is no convention or precedent for a five-week prorogation. In the last 40 years, parliament has never been prorogued for longer than three weeks. In most cases it has been prorogued for only a week or less, for example for 3 days in 2015, 5 days in 2016 and 6 days in 2017,” says Miller.

The court hearing for Miller’s case has been set for Thursday, September 5. If she is successful Sterling will almost certainly rally.

On the economic data front, the main releases are manufacturing, construction and services PMI data on Monday, Tuesday and Wednesday respectively.

These could impact the Pound since PMI’s are seen as fairly reliable leading indicators of economic growth, and a better-than-expected result is likely to lead to a rise in Sterling, whilst vice versa for a lower-than-forecast result.

Manufacturing PMI for August is forecast to show a rise to 48.4 from 48.0 when it is released on Monday at 9.30 BST.

Construction PMI is expected to show a rise to 45.5 from 45.3 when it is released on Tuesday at 9.30.

Services PMI is estimated to have fallen to 51.4 in August from 51.0 previously when it is released at the same time on Wednesday.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement