South African Rand: Strength in June

The Rand retains a choppy tone on global foreign exchange markets as it continues to take direction from external drivers.

The Pound to Rand exchange rate (GBP/ZAR) is trading at 17.20 at the start of a new week of trade on global foreign exchange markets.

It is actually now slap-bang in the middle of its May range and the territory remains familiar for those who have been watching this market since April.

The USD/ZAR is meanwhile softer at 13.18 and continues to look heavy.

The immediate outlook for the currency has the US Federal Reserve in view - can the Fed spark a Dollar recovery by indicating it is going to raise interest rates on at least two occassions in 2017?

If so, the Rand might suffer.

Domestically, keep an eye on the South African Reserve Bank mid-week.

“Event risk is concentrated from Wednesday evening through Thursday. Fed minutes are the highlight, with markets looking for signs on how it plans to unwind its asset book. We expect the SARB to be neutral to dovish as it assesses a better inflation outlook, but the scope for cuts remains constrained by the domestic political situation,” says John Cairns, an analyst with RMB.

Seasonality at Play

Concerning the currency's multi-week outlook, it has been flagged to us that seasonality could play a big part in whether or not the South African currency can put some pressure its main counterparts.

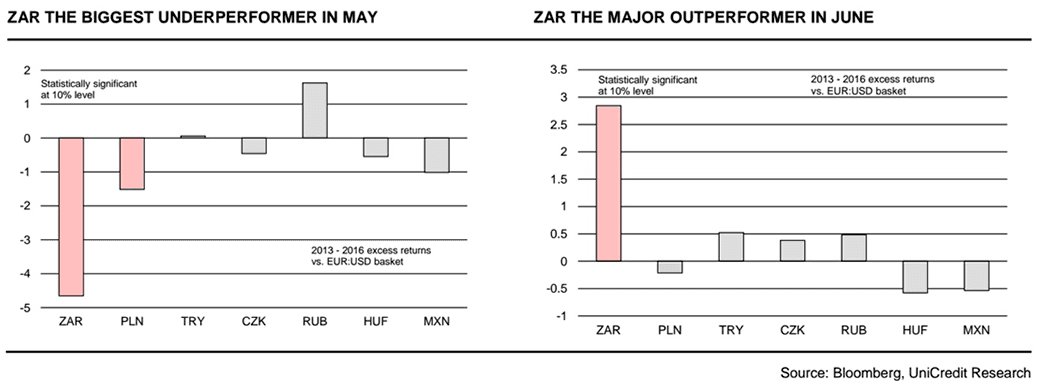

“The ZAR tends to be the biggest under-performer in May and we would expect a repeat performance over the coming fortnight,” says Kathrin Goretzki, an analyst with UniCredit Bank in London.

Update: Retail market rates on GBP/ZAR show banks offering in the region of 16.54-16.66 while the best independent providers are offering towards 17.00. More details here.

S&P will this week provide an update on the sovereign rating and markets will likely become more anxious ahead of the event.

“It is quite possible that the agency might downgrade the local-currency (LC) rating to sub-IG. That said, we think any weakness following the event could provide opportunities to consider long exposure for two reasons,” says Goretzki.

(Long exposure means UniCredit are buyers of the Rand.)

First, South Africa will likely remain in the Citi WGBI local currency bond benchmark as long as it retains its LC IG status with Moody’s.

Hence it may be too early to sell the ZAR on the “rating downgrade” theme in Goretzki's opinion.

Second, while May is consistently a bad month for the ZAR, in recent years the currency has performed well in June.