Japanese Yen Towers Over Euro, Swiss Franc after Bank of Japan Lifts Yields

- Written by: James Skinner

- JPY lifts as BoJ appears to covet higher bond yields.

- With March interest rate/bond yield hike in disguise.

- Wider permissable range to cultivate room for a cut.

- May lessen JPY's appeal as 'funder' Vs EUR & CHF.

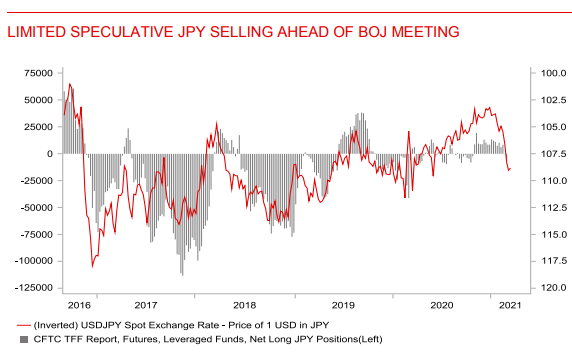

- Bodes well for JPY while most bearish for EUR/JPY.

Image © Leonid Andronov, Adobe Stock

- GBP/JPY spot rate at time of writing: 151.61

- Bank transfer rate (indicative guide): 146.29-147.36

- FX specialist providers (indicative guide): 149.33-150.54

- More information on FX specialist rates here

- Set an exchange rate alert, here

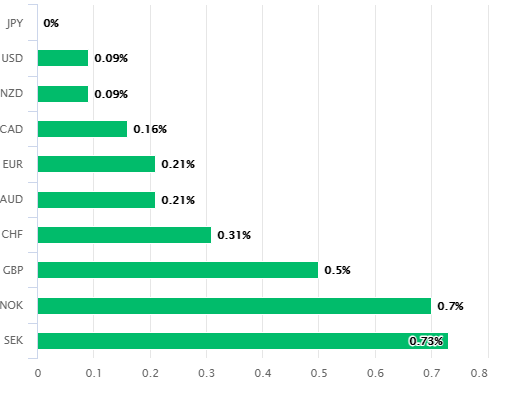

The Japanese Yen outperformed on Friday, rising against all major currencies but especially those within its 'funding currency' peer group, after the Bank of Japan (BoJ) appeared to covet higher bond yields through what may be eligible for description as an interest rate rise in diguise.

Japan's Yen pipped even high yield commodity currencies like the Canadian Dollar to a proverbial post when claiming the top spot among major currencies in the final session of the week and following the BoJ's March policy decision.

Billed as a "clarification" of existing policy, the BoJ's March decision begged more questions than it answered in some parts. The main decision was to leave the benchmark interest rate at -0.1% and yield-curve-control target for the 10-year bond unchanged at 0.10%, as was expected by the market.

The BoJ also retained upper limits to the amount of stock market assets it purchases as part of its monetary easing programme but scrapped earlier targets for actual amounts accumulated. These were the anticipated, clear and otherwise uncontroversial outcomes from the meeting that ended on Thursday.

But these 'dovish' policy decisions belied the implications of an eagerly-awaited "assessment for further effective and sustainable monetary easing," that was announced in December, with results unveiled on Friday.

"Ummmm… it’s totally a widening," says Freya Beamish, chief Asia economist at Pantheon Macroeconomics. "Mr. Kuroda was eager to drive home that this was not a widening but a clarification. We beg to differ."

Above: Japanese Yen performances against major currencies on Friday (left) and for 2021 year-to-date (right).

"If everyone thought the band was 0.20pp, and you didn’t clarify it until now, then it was 0.20pp. And now it’s 0.25pp. So we are going to continue calling it a widening. The point is that the BoJ will allow 10-year yields to rise further than people thought it would yesterday," Beamish adds

The BoJ said after the last major shake-up of its policy programme in July 2018 that the 10-year yield - for which the official target is still 0.10% - would be allowed "to move upward and downward in about double the range, which was previously between around plus and minus 0.1% from the target level."

However, the BoJ and Governor Haruhiko Kuroda said on Friday that it's "appropriate to make clear that the range of 10-year JGB yield fluctuations would be between around plus and minus 0.25 percent," in what was effectively a widening of the band and increase in the upper limit for the 10-year yield.

A yield rise in disguise, which also came alongside a rate hike in disguise.

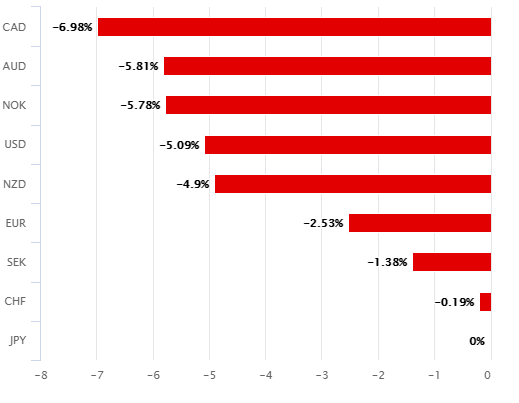

"That the yen should do well on a week when US 10-year yields rose by 10bp, makes a mess of lots of correlations, and says a lot about positioning," says Kit Juckes, chief FX strategist at Societe Generale.

The percentages in question are literally fractional and may seem to readers like small beer or short change, but they do matter in financial markets, while the underlying signal that BoJ is permitting if-not seeking to covet higher bond yields couldn't be overstated for its short-term importance.

Source: MUFG.

"With a view to being able to cut rates, the BoJ established the Interest Scheme to Promote Lending which will involve changes to tiering on current account balances to better protect banks and promote lending," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

The eagerly-awaited outcome of the BoJ's policy review saw the bank announce that it will now pay out to commercial lenders an interest rate of up to 0.2% on certain loans made to companies and households, despite having said as part of its main policy decision that the benchmark interest rate would remain at -0.1%.

This is in every sense an interest rate hike and yield rise in disguise from the BoJ, which is typically found ever in the running alongside the European Central Bank (ECB) as a candidate for the currency market's biggest or most prolific 'easer' in terms of monetary policy. However, and at the sime time, it isn't at all to suggest the BoJ is turning 'hawkish' due to any outperformance by Japan's economy because the reality is quite the opposite in some respects.

"The Bank has long wanted to wheel back the damage done to financial institutions by negative rates, and to steepen the curve. Today’s moves are a baby step in that direction. They are dressed up as a way of making a further rate cut credible, and that’s great, if necessary. But the main aim here was to help out financial institutions," says Pantheon's Beamish. "The terms loosening and tightening are no longer useful with the BoJ. Raising rates is seen as helpful to protect the financial system and the real economy thereby. The same applies to a steeper yield curve. Today’s moves allow the Bank to bend the rules further, just as space-time distorts around a blackhole."

Source: TD Securities.

"This could provide a further tailwind to inflows. The yen could benefit near-term as our dashboard signals. But, with USTs on the move, we find more appeal in the relative value space vs JPY's funding peers," says Mazen Issa, a senior FX strategist at TD Securities in a note ahead of the decision. "With the ECB pledging to up its asset purchases, EURJPY downside could begin to emerge. The cross has reached a multi-year downtrend (from 2008 highs)."

The BoJ said that its yield-curve-control policy has been effective in lifting economic activity and cultivating the stronger inflation pressures necessary for a return to its long-lost 2% target, but that this was only effective by having brought about "a decline in funding costs." The rub for the BoJ and reason for the rate hike in disguise was that years of policy easing or downward pressure on rates and yields had already taken funding costs to a point where they could no longer fall further without causing trouble.

Declines at some maturities were not possible without leading to "anxiety about the future sustainability and functioning of financial activities", the BoJ said while referring to commercial bank profitability, as well as "a negative impact on economic activity by, for example, undermining people's sentiment. "

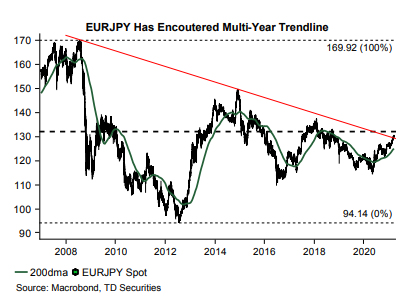

Above: Euro-Yen and USD/JPY (orange) at daily intervals. EUR/JPY falls as USD/JPY holds steady. Meanwhile, Japanese 10-year bond yield (red) rises even as U.S. 10-year bond yield (black) corrects lower.

In other words, if the BoJ didn't perceive itself as already having met the so-called reversal rate then it may have been worrying that it could soon meet it.

For the BoJ to admit this would be for a central bank to reveal its hand while sat at a poker table, but lifting funding costs simply in order to reduce funding costs again was clearly the intention behind the decisions which resulted from the eagerly-awaited review, and this does rather imply a 'reversal rate' is nearby.

MUFG, Japan's largest lender and world's fifth largest institution when size is measured by the scale of balance sheet, disagrees with some of this.

But irrespective of if there's a reversal rate near, the BoJ is offering somewhat higher returns to investors who buy or hold the Yen, which is an incentive for a bearish market to lighten up on the Japanese currency at least in the short-term and notably against other yow-yielders like the Euro and Swiss Franc.

"The takeaway today will be that there appears to be still a degree of reluctance to further cut rates," MUFG's Halpenny writes in a note Friday. "There has certainly not been a message of any change in view over the so-called “reversal rate” being close by that may have helped encourage more speculation on cuts to rates. Very recently, while there have been some days where it looked like there was some speculative selling of the yen in anticipation of something more dramatic today in regard to negative rate prospects, the key driver for USD/JPY remains UST bond yields. But taken in isolation, the BoJ announcements certainly do not in our view provide reason for yen selling."

Above: Euro-Yen and USD/JPY (orange) at weekly intervals. Japanese 10-yr bond yield (red), U.S. 10-yr bond yield (black).